Within the final week, Bitcoin (BTC) secured an all-time excessive above $109,000 as Billionaire Republican Donald Trump grew to become the forty sixth US President. Nevertheless, the premier crypto asset has since declined, with its present market worth now beneath $105,000. Apparently, present information on Bitcoin holders’ profitability backs the bullish construction of the market indicating little potential for bearish sentiment.

Bitcoin Holders Reap Large Earnings: Lengthy-Time period Buyers Up 70%

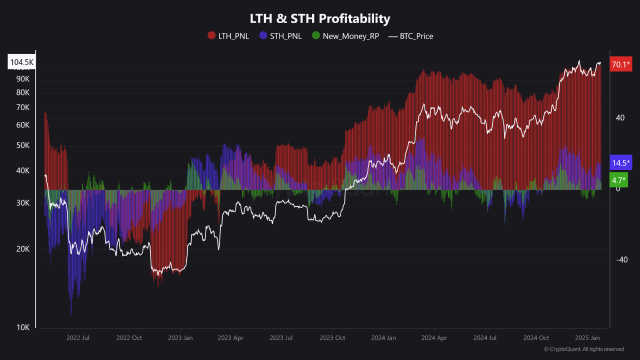

Within the crypto market, an asset’s holders’ profitability primarily based on their realized worth i.e. common value of acquisition, is a vital metric in predicting buyers’ sentiments. In a Quicktake post on CryptoQuant, an analyst with the username Crazzyblockk has supplied perception on Bitcoin holders’ profitability throughout three main tiers.

The analyst states that information from CryptoQuant reveals that BTC long-term holders i.e. buyers of greater than 6 months are presently experiencing a mean revenue of 70%. In the meantime, short-term holders i.e. holding lower than six months are seeing a average 14.5% revenue, reflecting their skill to precisely navigate latest market situations.

Lastly, regardless of restricted publicity, new buyers i.e. holders of Bitcoin for lower than 1 month are experiencing a small revenue of 4.7%. Going by this information, no tier of BTC holders are at present dealing with important losses lowering the potential for a widescale market sell-off.

Importantly, whereas profitability percentages have proven a minor decline relative to earlier weeks and months, the BTC market is unlikely to slide right into a bearish part so long as short-term holders and new market entrants proceed to report substantial income.

The relevance of those tiers of Bitcoin holders stems from ongoing distribution by Bitcoin long-term holders who’re at present taking revenue. For instance, fashionable crypto analyst Ali Martinez reports that Bitcoin long-term holders shedded 75,000 BTC prior to now week.

These substantial quantities of Bitcoin offloaded by long-term holders are bought by short-term holders and new buyers, mopping the impact of any potential promoting stress in the marketplace. Subsequently, if these buyers start to incur losses, it might set off a powerful bearish stress on BTC.

BTC Worth Overview

At press time, Bitcoin trades at $104,737 reflecting a 0.09% achieve within the final day. The maiden cryptocurrency is down by 0.46% on the weekly chart. Nevertheless, a worth achieve of 8.71% over the last 30 days displays the present bullish construction of the BTC market.

Following the inauguration of Donald Trump, expectations for BTC are more likely to develop greater contemplating the brand new US President’s pro-crypto manifesto. So far, President Trump’s administration seems to be off to a promising begin, marked by the SEC’s repeal of the controversial SAB 121 and an government order exploring the institution of a national digital asset stockpile.

Featured picture from bitperfect, chart from Tradingview