Bitcoin has yet to relinquish its dominance on this market cycle, leaving many buyers nonetheless holding onto hopes for the arrival of an altcoin season. Nonetheless, there stays a risk that an altcoin rally would possibly by no means come to fruition this season, given the current market developments this cycle.

Crypto analyst Ali Martinez echoed this angle in a current publish on X, claiming that an altcoin season might by no means return. His statement sheds mild on the change in market dynamics and the numerous shifts which have occurred since earlier alt seasons.

Why AltSeason May By no means Occur

An altcoin season is defined by a period of speedy worth surges throughout a variety of altcoins. Moreover, an altcoin season is characterised by buyers cashing out their Bitcoin income and pouring them into altcoins. This era is at all times accompanied by social media hype and FOMO from crypto buyers as they rush in to get in on the motion.

Associated Studying

Nonetheless, present market situations have seen the crypto business develop from its early days into a brand new market with a detailed relationship with buyers within the conventional finance sector. Moreover, the altcoin market has expanded dramatically because the final main bull run in 2021, and you might argue that it has turn out to be considerably oversaturated.

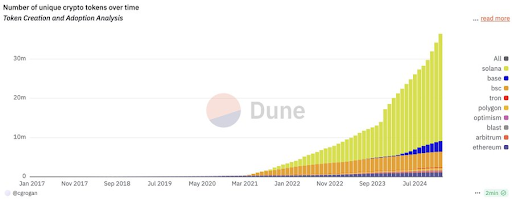

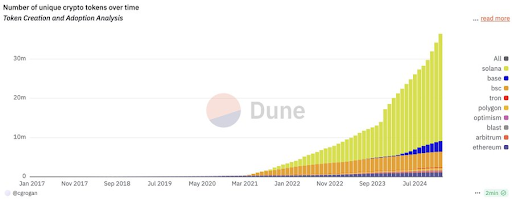

Martinez highlighted a startling statistic: over 36.4 million altcoins are actually in circulation. This can be a dramatic enhance in comparison with fewer than 3,000 altcoins throughout the 2017-2018 altcoin season and an excellent smaller pool of fewer than 500 within the 2013-2014 bull market cycle.

The sheer scale of this provide explosion has basically altered the cryptocurrency panorama, diluting consideration and capital amongst an awesome variety of property. This oversaturation implies that reaching widespread worth surges throughout altcoins has turn out to be a much more difficult proposition than in earlier market cycles. Moreover, many of those altcoins have unclear use instances or poor fundamentals and solely divert consideration from particular altcoins with robust utility.

May The Period Of Altcoin Seasons Be Over?

The idea of an altcoin season may be a relic of a much less crowded market. Ethereum, the most important altcoin, has largely didn’t carry out as much as expectations this cycle. Often known as the first driver of previous altcoin seasons, Ethereum has struggled to gain momentum for over a 12 months, at the same time as different altcoins like Solana, XRP, Cardano, and Dogecoin proceed to push to multi-year highs.

Associated Studying

If Ethereum, with its established dominance and utility, can’t ship, it raises critical questions concerning the potential of different altcoins to rally. As an alternative, particular person altcoins with robust fundamentals or distinctive propositions might proceed to thrive whereas the remainder of the market stays stagnant.

On the time of writing, Coinmarketcap’s dominance knowledge exhibits that Bitcoin instructions 57.9% of the whole crypto market cap, growing by 0.69% up to now 24 hours. In the meantime, Ethereum is steadily shedding floor, with its dominance dropping by 1.07% over the identical interval, now accounting for simply 11.1% of the general market.

Featured picture from iStock, chart from Tradingview.com

Bitcoin has yet to relinquish its dominance on this market cycle, leaving many buyers nonetheless holding onto hopes for the arrival of an altcoin season. Nonetheless, there stays a risk that an altcoin rally would possibly by no means come to fruition this season, given the current market developments this cycle.

Crypto analyst Ali Martinez echoed this angle in a current publish on X, claiming that an altcoin season might by no means return. His statement sheds mild on the change in market dynamics and the numerous shifts which have occurred since earlier alt seasons.

Why AltSeason May By no means Occur

An altcoin season is defined by a period of speedy worth surges throughout a variety of altcoins. Moreover, an altcoin season is characterised by buyers cashing out their Bitcoin income and pouring them into altcoins. This era is at all times accompanied by social media hype and FOMO from crypto buyers as they rush in to get in on the motion.

Associated Studying

Nonetheless, present market situations have seen the crypto business develop from its early days into a brand new market with a detailed relationship with buyers within the conventional finance sector. Moreover, the altcoin market has expanded dramatically because the final main bull run in 2021, and you might argue that it has turn out to be considerably oversaturated.

Martinez highlighted a startling statistic: over 36.4 million altcoins are actually in circulation. This can be a dramatic enhance in comparison with fewer than 3,000 altcoins throughout the 2017-2018 altcoin season and an excellent smaller pool of fewer than 500 within the 2013-2014 bull market cycle.

The sheer scale of this provide explosion has basically altered the cryptocurrency panorama, diluting consideration and capital amongst an awesome variety of property. This oversaturation implies that reaching widespread worth surges throughout altcoins has turn out to be a much more difficult proposition than in earlier market cycles. Moreover, many of those altcoins have unclear use instances or poor fundamentals and solely divert consideration from particular altcoins with robust utility.

May The Period Of Altcoin Seasons Be Over?

The idea of an altcoin season may be a relic of a much less crowded market. Ethereum, the most important altcoin, has largely didn’t carry out as much as expectations this cycle. Often known as the first driver of previous altcoin seasons, Ethereum has struggled to gain momentum for over a 12 months, at the same time as different altcoins like Solana, XRP, Cardano, and Dogecoin proceed to push to multi-year highs.

Associated Studying

If Ethereum, with its established dominance and utility, can’t ship, it raises critical questions concerning the potential of different altcoins to rally. As an alternative, particular person altcoins with robust fundamentals or distinctive propositions might proceed to thrive whereas the remainder of the market stays stagnant.

On the time of writing, Coinmarketcap’s dominance knowledge exhibits that Bitcoin instructions 57.9% of the whole crypto market cap, growing by 0.69% up to now 24 hours. In the meantime, Ethereum is steadily shedding floor, with its dominance dropping by 1.07% over the identical interval, now accounting for simply 11.1% of the general market.

Featured picture from iStock, chart from Tradingview.com