Days earlier than Donald Trump was inaugurated because the forty seventh President of the USA, digital forex merchants realized through an X put up that the President-elect had launched an official $TRUMP memecoin on Solana.

Initially questioning if the Trump account had been hacked, merchants quickly realized it was actual, inflicting a stampede to “decentralized” exchanges like Raydium whereas centralized exchanges like Coinbase (NASDAQ: COIN) scrambled to checklist the Trump token.

What adopted was nothing wanting a debacle. Leaving apart questions of ethics and securities laws, the race to snap the President’s official coin up drove costs sky-high and introduced the Solana community to a standstill. It’s not the first time that has happened.

Whereas the Solana blockchain formally “stayed up” and didn’t go offline for a tough reset prefer it has earlier than, shopping for and buying and selling $TRUMP was a lower than spectacular consumer expertise. But, the mania had simply begun as a result of the very subsequent day, the First Woman launched her personal token, $MELANIA, inflicting one other pile-on as merchants scrambled to purchase it earlier than the pump started.

The business nonetheless hasn’t accepted that it’s all in regards to the unique Bitcoin protocol

For those who have a look at the “Prime 20” tokens on any web site like CoinMarketCap.com, you’ll discover tokens with market caps value tens of billions, but not one of the blockchains can deal with an inflow of hundreds of thousands of customers, not to mention billions. Think about how they’d cope if a popular game or app went viral globally.

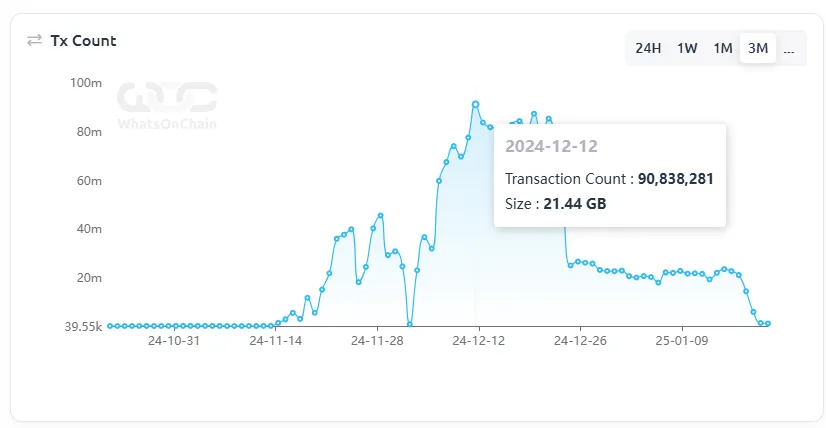

But, exterior the limelight, some blockchains scale. The BSV blockchain has efficiently scaled to 1 million transactions per second due to its Teranode update. Blockchains like this take plenty of flack for supposed “spam” transactions, with critics claiming they aren’t real and are managed by bots, however moments like this present that it doesn’t matter, even when it had been true (it’s not).

A transaction is a transaction, whether or not despatched by a human or a bot. What issues is that the blockchains in query can deal with the demand reliably with out a dramatic charge spike. In BSV’s case, it has confirmed it may well deal with 90 million every day transactions with out a hiccup. But, after Teranode goes dwell, it may well deal with that quantity in 90 seconds flat. Stress testing is vital, and BSV has handed with flying colours.

Critics can level to among the drama surrounding BSV and the characters concerned in it over time, however they will’t lay a glove on it in terms of technical capabilities. When push involves shove, BSV delivers, and the extra fashionable blockchains buckle below stress repeatedly.

Fascinating perception: The Visa (NASDAQ: V) community processed 192.5 billion transactions in 2022. With the Teranode improve enabling a million transactions per second, the BSV blockchain might course of your entire Visa community quantity for that yr in simply over 53 hours.

It’s time to embrace options that work

Sooner or later, blockchain entrepreneurs and builders should set tribalism apart and embrace know-how that works. Customers received’t tolerate ledgers that fold or charges that spike throughout an inflow of customers for lengthy. Ought to one thing go viral that appeals to common individuals who don’t use blockchain usually, the know-how had higher be prepared.

With the elevated consideration from establishments, governments, and monetary giants embracing tokenization, central financial institution digital currencies (CBDCs), and different blockchain options, efficiency issues. Whereas memecoins might steal the highlight within the brief time period, know-how that works will win the lengthy sport.

Watch: Historical past of Bitcoin with Kurt Wuckert Jr.

title=”YouTube video participant” frameborder=”0″ enable=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>