- Exchanges have recorded an outflow of PEPE value $161.36 million.

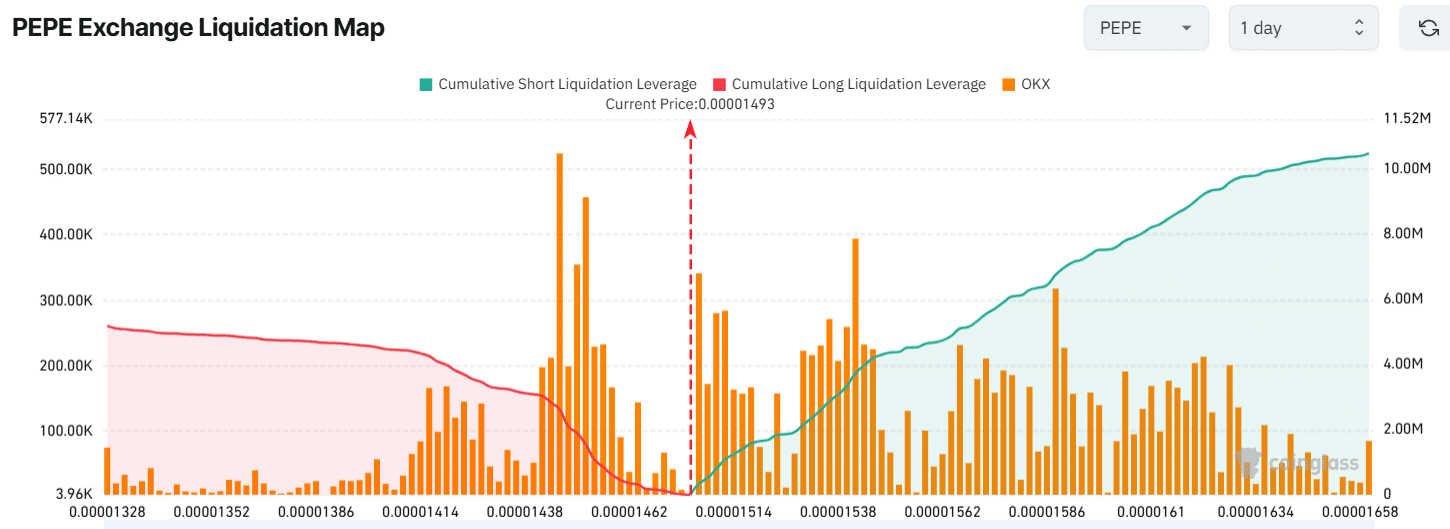

- Merchants are over-leveraged at $0.00001446 on the decrease aspect and $0.00001542 on the higher aspect.

Since December 2024, Pepe [PEPE], the favored crypto memecoin, has skilled a value decline of over 45%, and seemed to be struggling at press time.

The present market outlook is inadequate to reverse PEPE’s market pattern, as main cryptocurrencies, together with Bitcoin [BTC] and Ethereum [ETH], are going through comparable challenges.

Primarily based on the day by day chart and on-chain metrics, PEPE’s downtrend seemed to be nearing a reversal.

PEPE value prediction

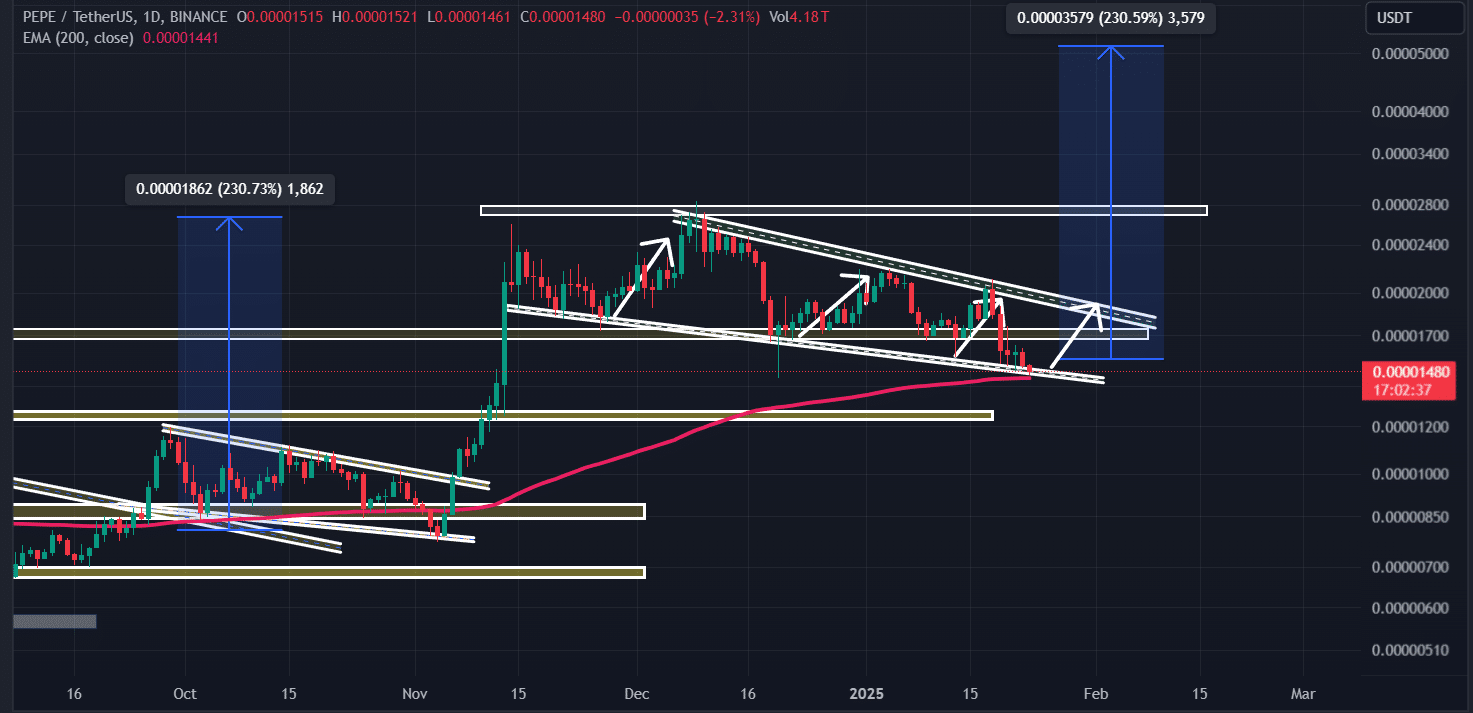

In keeping with AMBCrypto’s technical evaluation, PEPE has been in a steady value decline over the previous few weeks, and has shaped a bullish falling wedge sample on its day by day time-frame.

The falling wedge sample is much like the descending channel sample, however its width narrows after a sure interval.

The memecoin was on the decrease boundary of this sample, the place it has traditionally proven a powerful reversal.

Since December 2024, PEPE has reached this boundary greater than 4 instances, and every time it has proven an upward momentum.

If PEPE holds this decrease boundary of the falling wedge, there’s a sturdy risk that it may soar by 30% to succeed in the $0.000019 degree within the coming days.

THIS is strengthening PEPE

Nonetheless, the present degree is supported not solely by the decrease boundary of the sample but in addition by the 200 Exponential Transferring Common (EMA) on the day by day time-frame, which strengthens its potential to carry this degree.

The retest of the 200 EMA is bullish for the asset, indicating that it’s in an uptrend. In the meantime, the Relative Energy Index (RSI) is near the oversold space, suggesting that PEPE may quickly expertise upward momentum.

Combined sentiment from on-chain metrics

Analyzing the value motion, long-term holders have proven sturdy curiosity and confidence within the memecoin, in line with the on-chain analytics agency Coinglass.

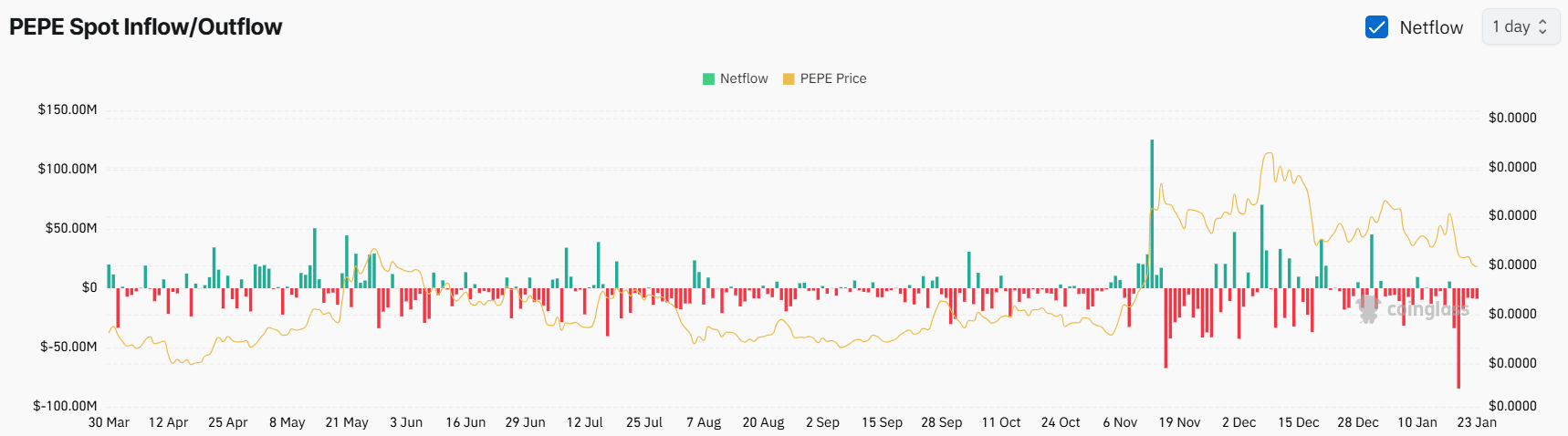

Knowledge from spot influx/outflow revealed that exchanges have recorded an outflow of PEPE value $161.36 million over the previous six days.

This steady outflow from exchanges indicated that traders and long-term holders have been withdrawing belongings, which may result in a value improve and additional amplify shopping for strain.

Along with these actions, merchants have been over-leveraged at $0.00001446 on the decrease aspect, the place they’ve constructed $2.62 million value of lengthy positions.

Conversely, at $0.00001542 on the higher aspect, sellers have constructed $3.73 million value of brief positions. Nonetheless, these important positions may very well be liquidated if PEPE’s value strikes in both route.

Nonetheless, brief sellers’ bets are considerably larger than the lengthy positions held by merchants, indicating that intraday merchants’ sentiment is bearish because of the present market circumstances.

Learn Pepe’s [PEPE] Price Prediction 2025–2026

At press time, PEPE was buying and selling close to $0.00001494, having skilled a value decline of over 4.50% previously 24 hours.

This value decline has impacted dealer and investor participation, resulting in a 35% drop in buying and selling quantity.