- Ethereum’s accumulation soared, signaling rising bullish sentiments.

- ETH has declined by 3.21% in 24 hours because the altcoin remained caught in a consolidation vary.

For the reason that begin of 2025, Ethereum [ETH] has struggled to keep up an upward momentum. Over this era, it has declined beneath $3k whereas reaching a excessive of $3.7k.

On weekly charts, Ethereum has continued to commerce inside a consolidation vary between $3.5k and $3k.

In reality, as of this writing, Ethereum was buying and selling at $3215. This marked a 3.21% drop on each day charts, extending this bearish outlook on weekly charts by 4.57%.

On the upside, traders have taken this decline as a shopping for alternative. As such, most market contributors are actively accumulating ETH, anticipating worth restoration.

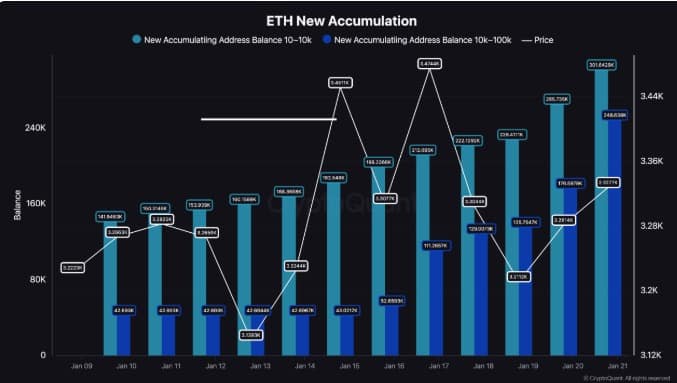

Ethereum accumulation soars

In line with CryptoQuant, Ethereum accumulation has skyrocketed over the previous two weeks. As such, traders have turned to accumulating ETH, signaling rising confidence in Ethereum’s future prospects.

Though ETH is at present experiencing sturdy market volatility, traders are optimistic and are taking this chance to HODL.

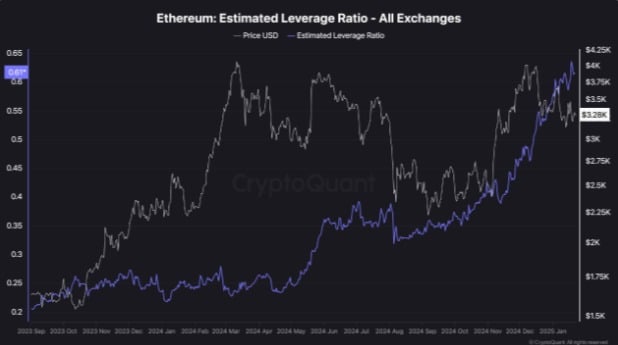

This market dynamic is extra prevalent amongst futures market contributors. Thus, Ethereum’s leverage ratio has surged, reflecting a rising urge for food for high-leverage positions within the derivates markets.

With ETH nonetheless caught in a consolidation vary, the elevated leverage may end in a breakout. A breakout pushed by excessive leverage may in flip set off an impulsive worth transfer.

Subsequently, the present market circumstances level in the direction of a possible breakout to the upside. When traders are accumulating whereas the urge for food for leverage positions stays excessive, it factors in the direction of bullish investor conduct.

Any influence on ETH charts?

Notably, when the buildup charge soars, it suggests traders usually are not solely bullish however understand the present market charge as undervalued and the asset has extra potential for development sooner or later.

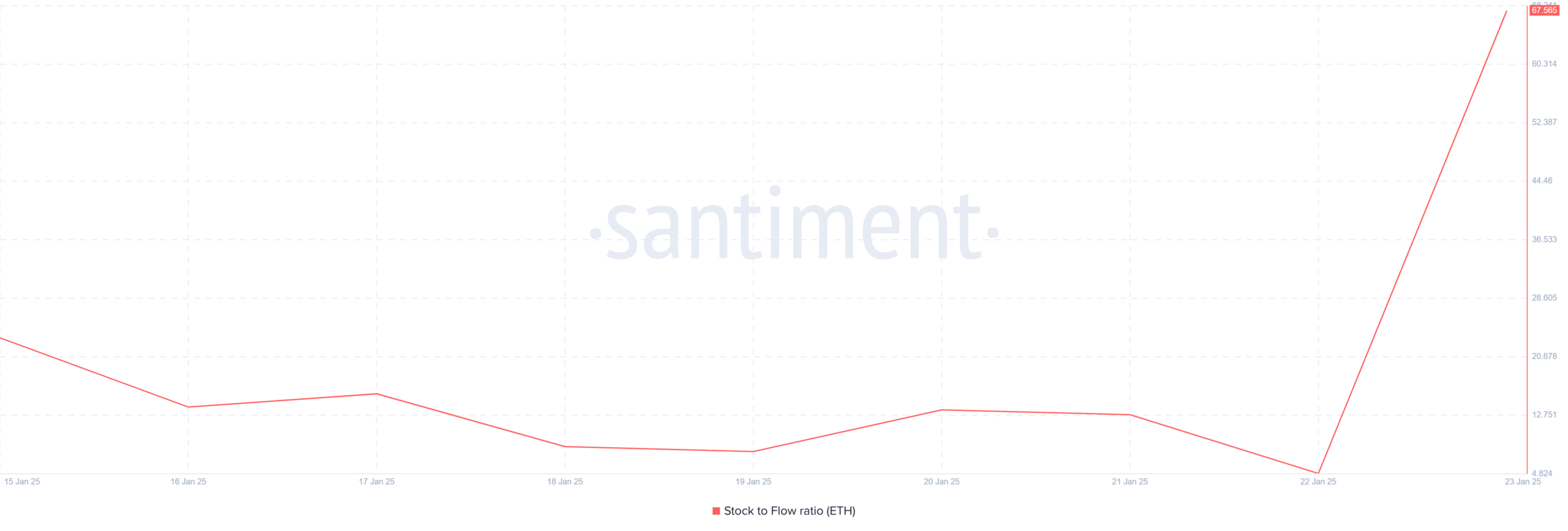

In line with AMBCrypto’s evaluation, Ethereum is seeing elevated constructive sentiments. For starters, Ethereum’s stock-to-flow ratio has spiked from 6.87 to 67.57 signaling elevated shortage.

When SFR rises, it implies that ETH is turning into extra scarce on exchanges as traders switch their property to non-public wallets or chilly storage. Such market conduct implies elevated accumulation.

Normally, a excessive shortage ends in increased costs if demand will increase or stays fixed.

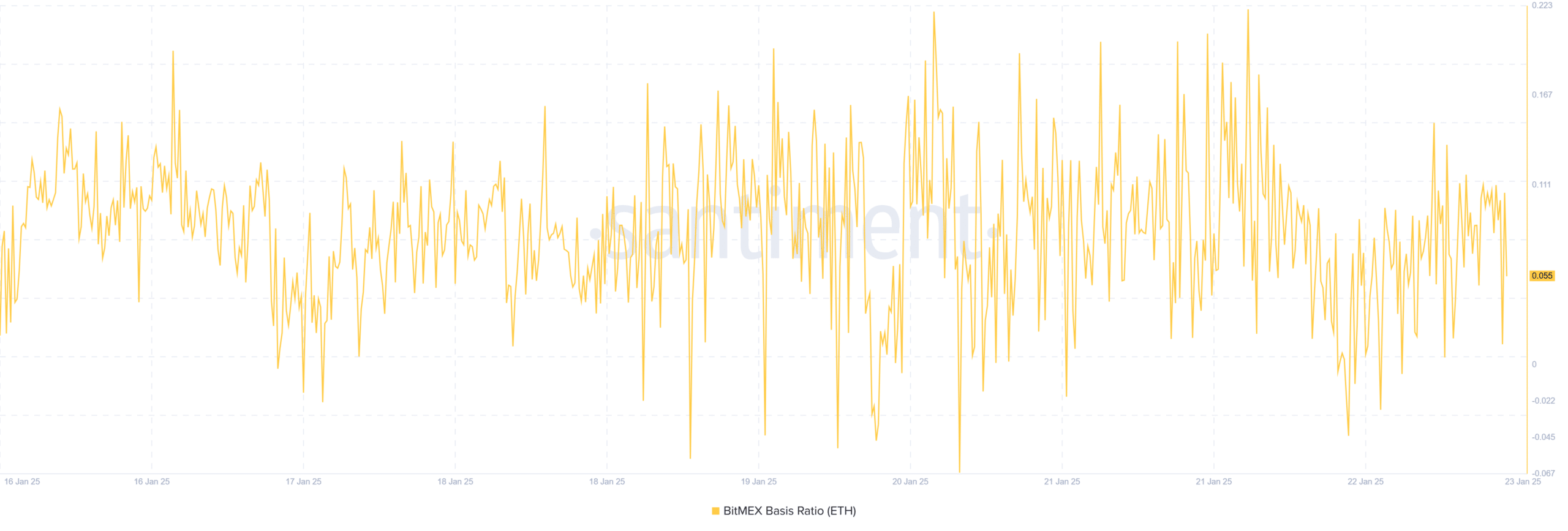

Lastly, Ethereum’s Bitmex foundation ratio has remained constructive over the previous seven days. This alerts that traders count on increased costs for ETH sooner or later, thus ending up paying a premium for future contracts.

Such a development displays bullishness, as longs are paying shorts to carry their positions.

Merely put, elevated accumulation alerts a shift in sentiments as traders flip bullish. These market circumstances place ETH for potential worth restoration and a breakout from the consolidation vary.

Learn Ethereum’s [ETH] Price Prediction 2025–2026

If traders can maintain their not too long ago noticed urge for food, ETH may reclaim $3450 and breach above the $3500 resistance.

Nevertheless, if the bulls fail on this try, we may see the altcoin dip to $3k and breach beneath this essential assist stage.