- Bitcoin’s bullish value motion highlighted whale exercise and community development, focusing on $110,000.

- Blended market alerts, together with the alternate whale ratio, mirrored cautious optimism amidst a possible breakout.

Bitcoin [BTC] whales have bought over 22,000 BTC price a staggering $2.24 billion prior to now 72 hours, sparking bullish momentum out there.

With Bitcoin buying and selling at $105,275.37 and up 3.78%, at press time, the surge in whale exercise highlights rising confidence amongst massive holders.

Nevertheless, can this upward development push Bitcoin previous $110,000 and ensure a brand new bullish cycle?

Bitcoin value motion alerts bullish potential

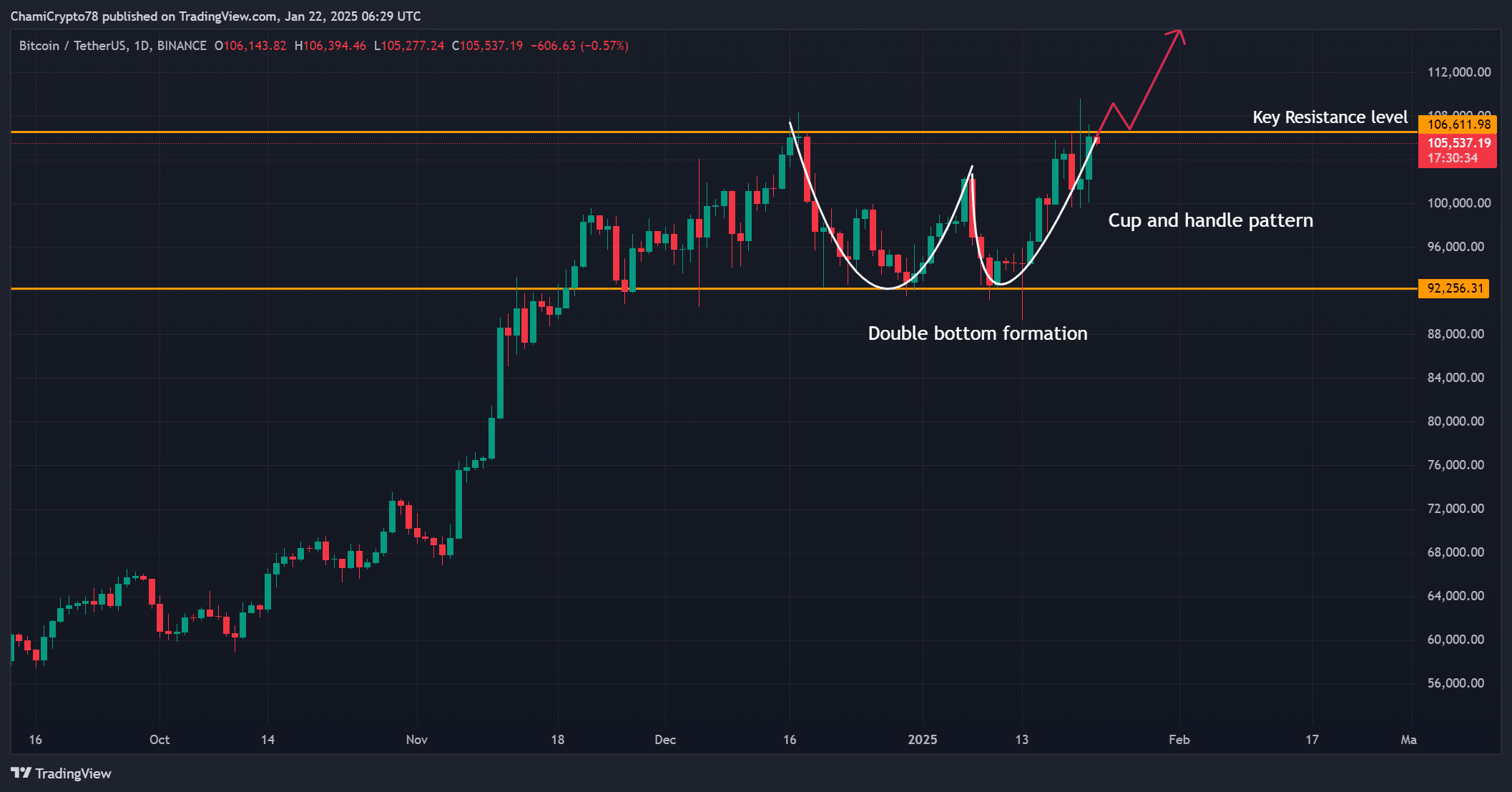

Bitcoin’s value chart was displaying a textbook cup and deal with formation, typically signaling a bullish continuation.

The sample developed after BTC established robust assist close to $92,256, adopted by a breakout above $106,600, a essential resistance degree.

The double-bottom construction additional solidifies the bullish case, as this technical indicator traditionally results in value recoveries.

BTC’s current rally seems to have sufficient momentum to focus on the subsequent vital degree of $110,000.

Nevertheless, if the worth fails to carry above $106,600, a short-term pullback may happen, testing decrease assist ranges. Sustained quantity and additional shopping for strain are important for Bitcoin to take care of its upward trajectory.

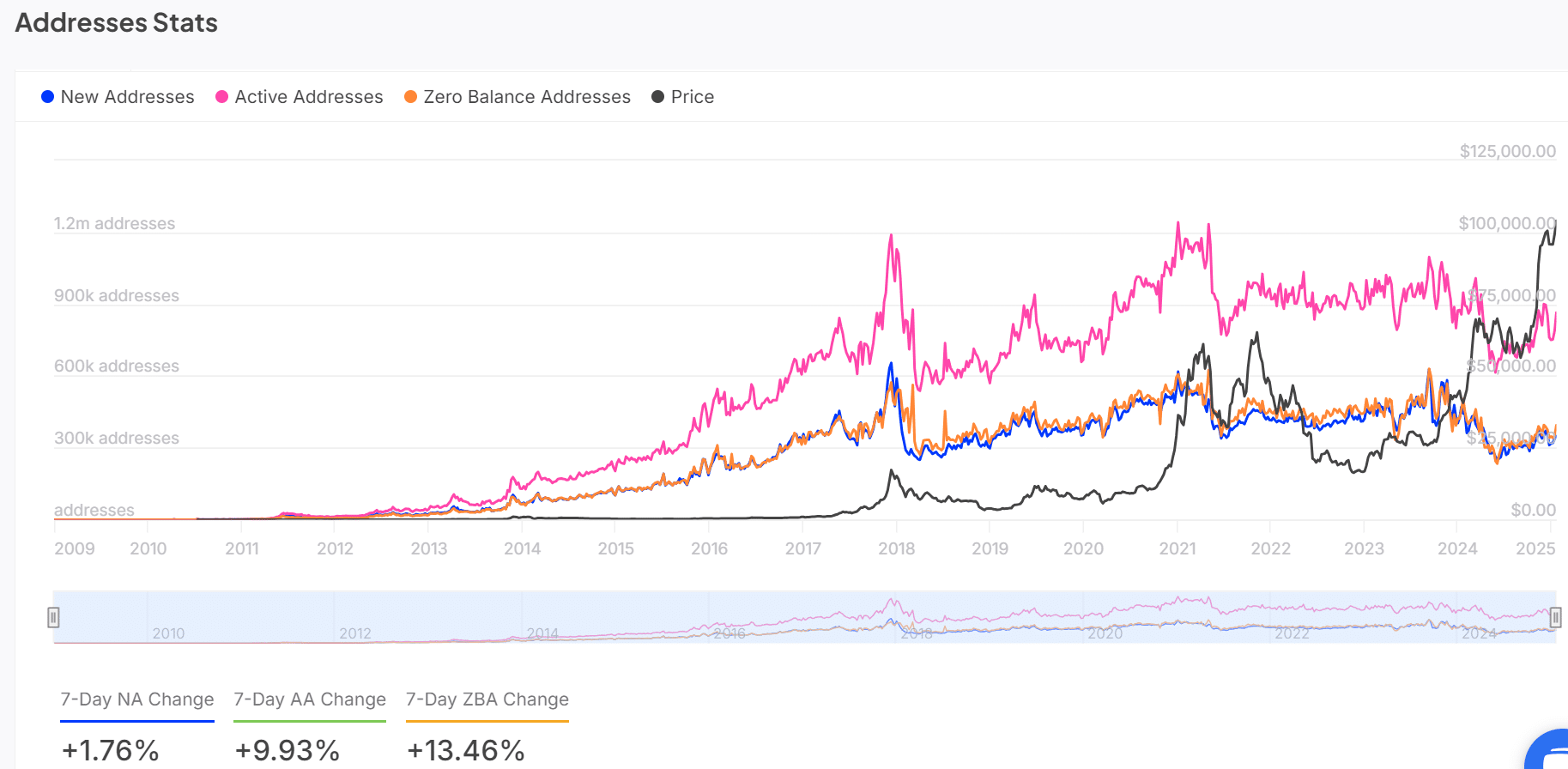

BTC lively addresses present rising community demand

Bitcoin’s community is witnessing elevated exercise, supporting the bullish outlook. Over the previous week, lively addresses have risen by 9.93%, indicating extra participation from present holders.

Moreover, new addresses grew by 1.76%, signaling recent demand as new customers entered the ecosystem. This rise in community exercise aligns with the current value motion, reinforcing the narrative of heightened curiosity in BTC.

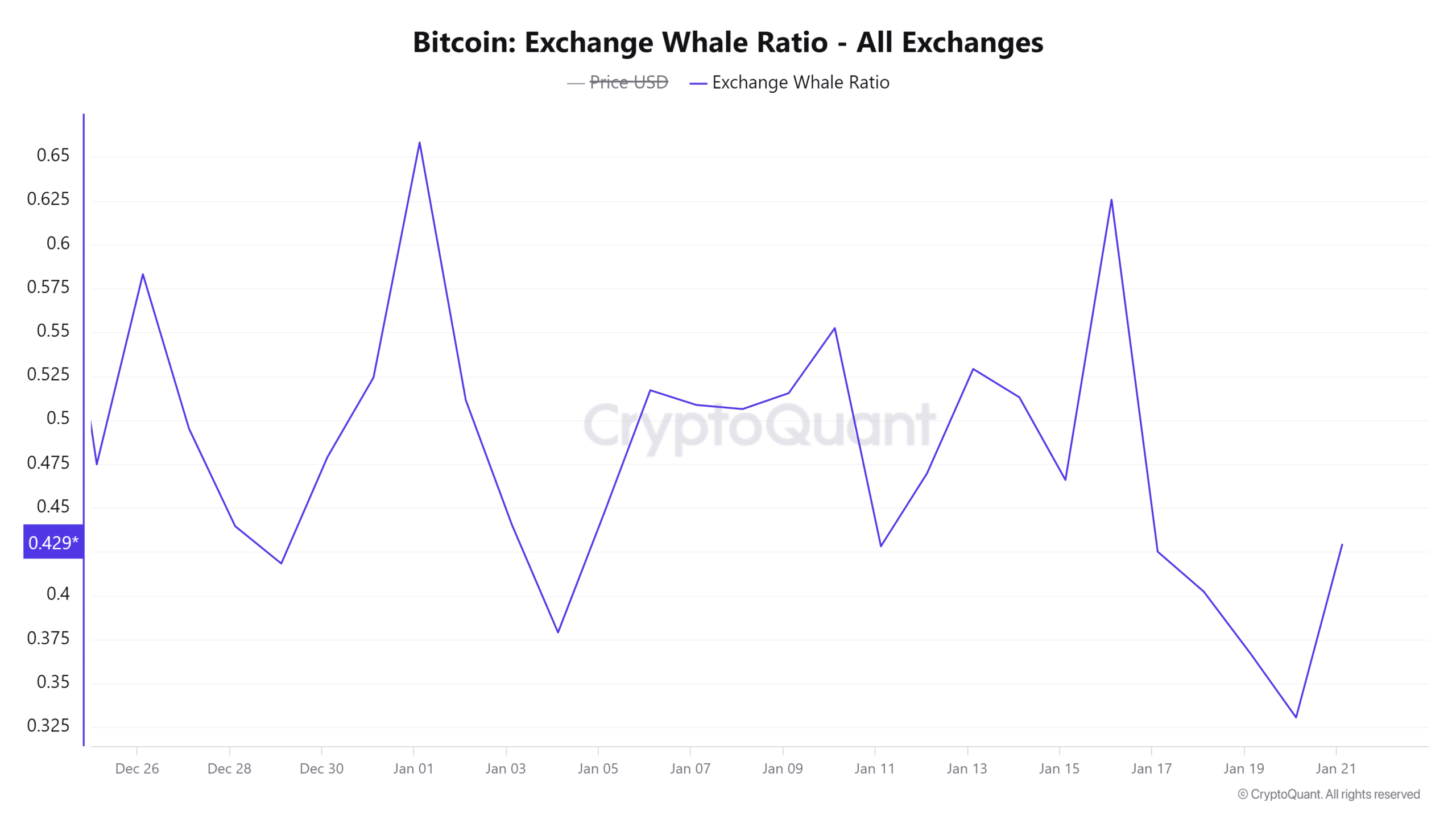

Change Whale Ratio highlights cautious optimism

The alternate whale ratio is 0.96, marking a slight 1.03% improve. This ratio displays the proportion of high inflows into exchanges from whales relative to complete inflows.

Whereas whales are accumulating BTC, the uptick in alternate exercise signifies some are getting ready to take earnings or mitigate dangers. This information suggests a mixture of optimism and warning.

An additional decline within the ratio may strengthen bullish sentiment, signaling a decreased probability of promoting strain.

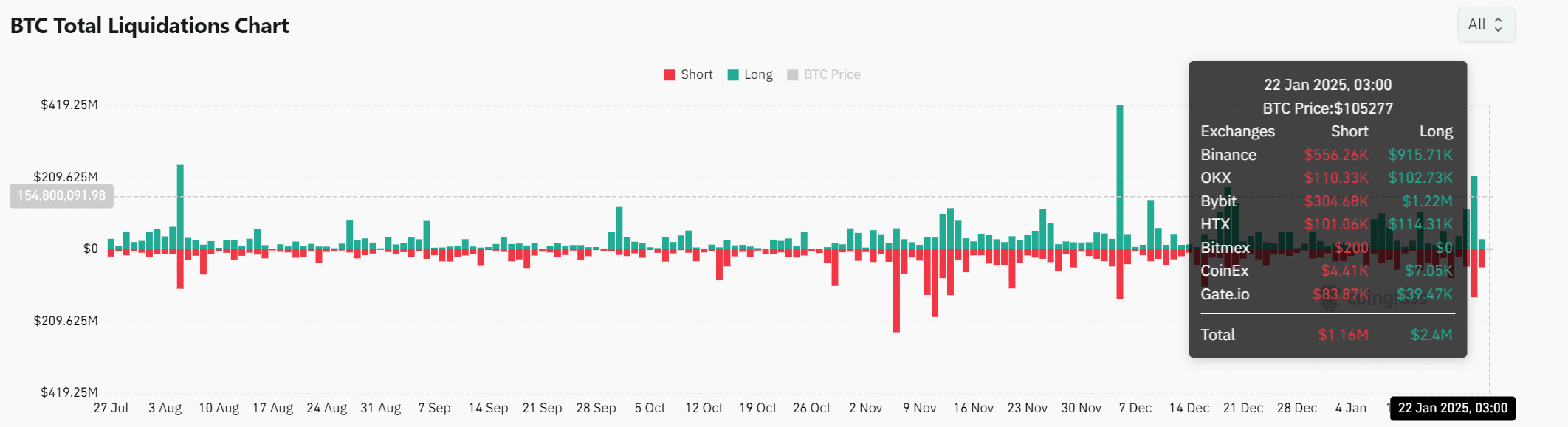

BTC liquidations reveal market indecision

Bitcoin liquidations prior to now 24 hours present insights into present market sentiment. Lengthy positions price $2.4 million have been liquidated, in comparison with $1.16 million in shorts, highlighting a balanced tug-of-war between bulls and bears.

This equilibrium displays market indecision, as merchants await affirmation of BTC’s subsequent vital transfer.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Bitcoin’s technical patterns, rising community exercise, and whale accumulation level to a possible breakout past $110,000. Nevertheless, cautious alternate exercise and liquidation tendencies counsel some market hesitation.

If BTC can preserve its bullish momentum and maintain ranges above key resistance, a transfer previous $110,000 appears possible within the close to time period.