- Raydium noticed regular demand all through its range-bound worth motion.

- The short-term bullish goal was the $8-$8.2 liquidity pocket.

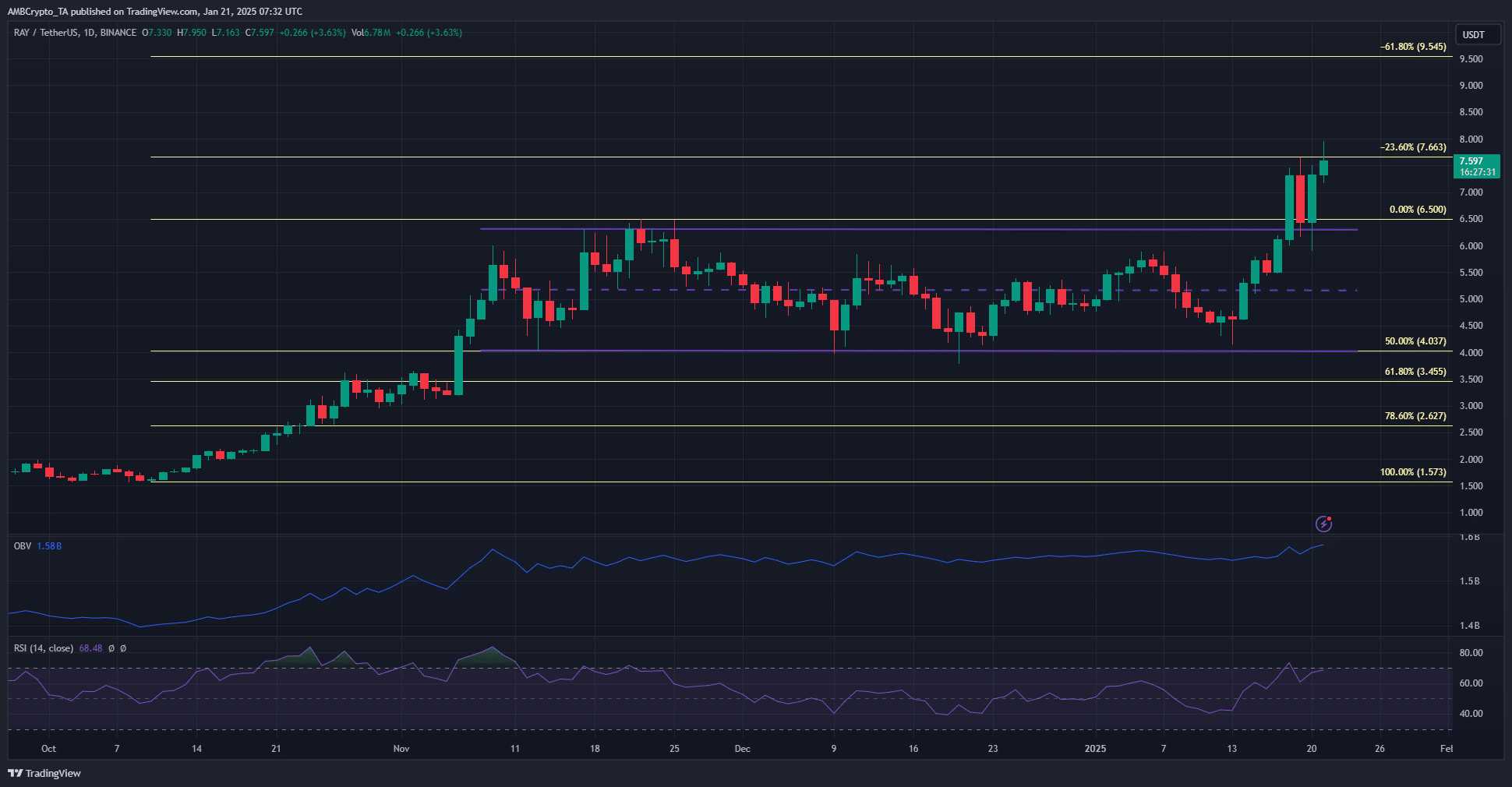

Raydium [RAY] noticed 62% features over the previous eight days. The rise of Official Trump [TRUMP] on the Solana [SOL] chain has additionally probably boosted demand for RAY, however its rally started earlier than the launch of the TRUMP meme coin.

Since November, it had traded inside a variety that prolonged from $4.02 to $6.3. This vary was damaged on the 18th of January, and its highs have been retested as a help zone.

Raydium breaks vary formation, set to sail greater

The robust demand for Raydium was mirrored on the worth charts. Over the previous two months, regardless of the vary formation, the OBV continued to development greater. This was an indication of regular shopping for strain.

Moreover, the breakout past the vary highs occurred on excessive buying and selling quantity, indicating conviction. The Fibonacci retracement and extension ranges have been plotted based mostly on the October and November rally from $1.57 to $6.5.

It confirmed that the subsequent targets for RAY bulls have been $7.66 and $9.54. The each day RSI was above 60, displaying robust bullish momentum.

Mixed with the regular shopping for strain, Raydium was more likely to transfer towards $9.54 within the coming days and weeks.

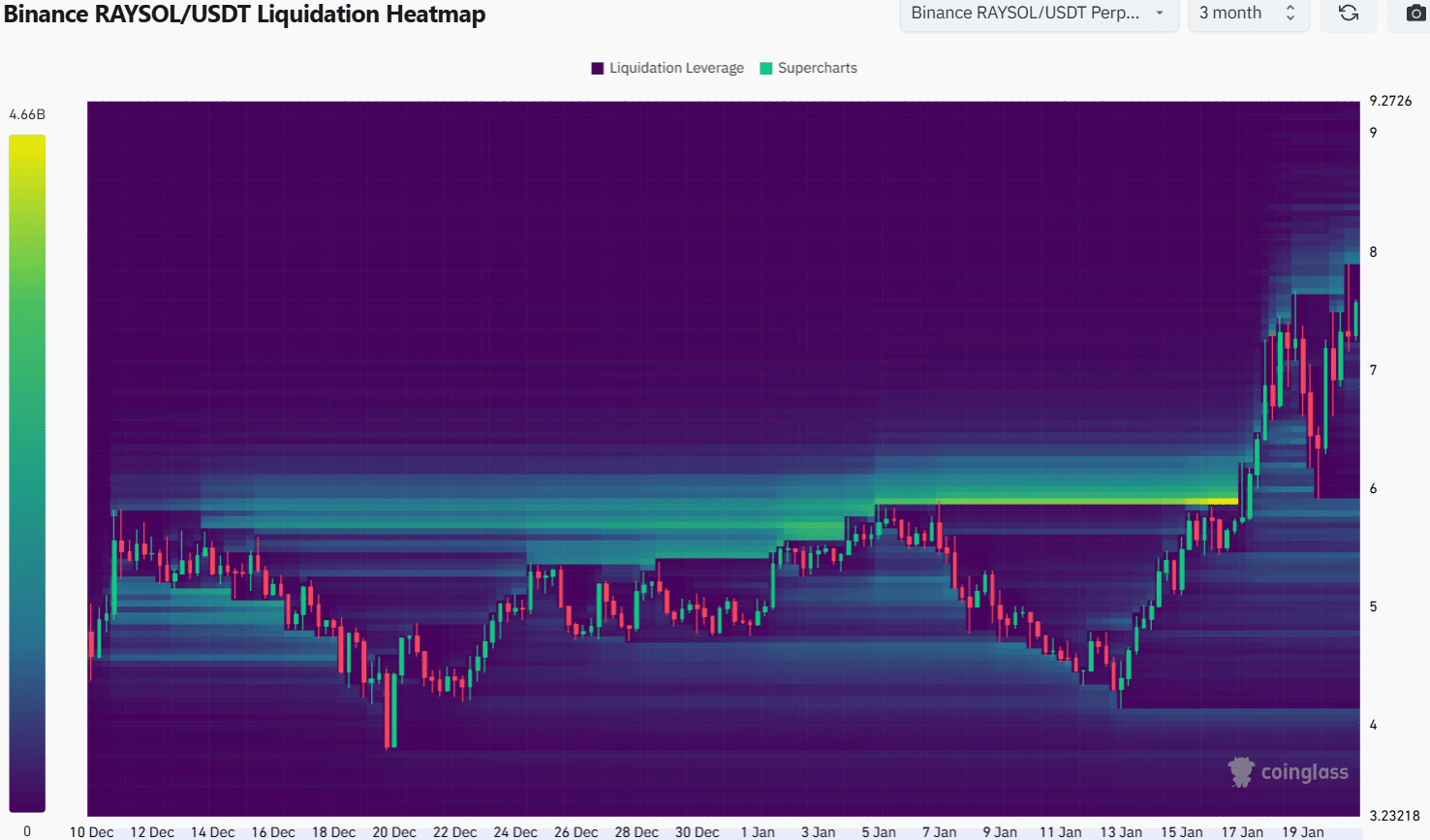

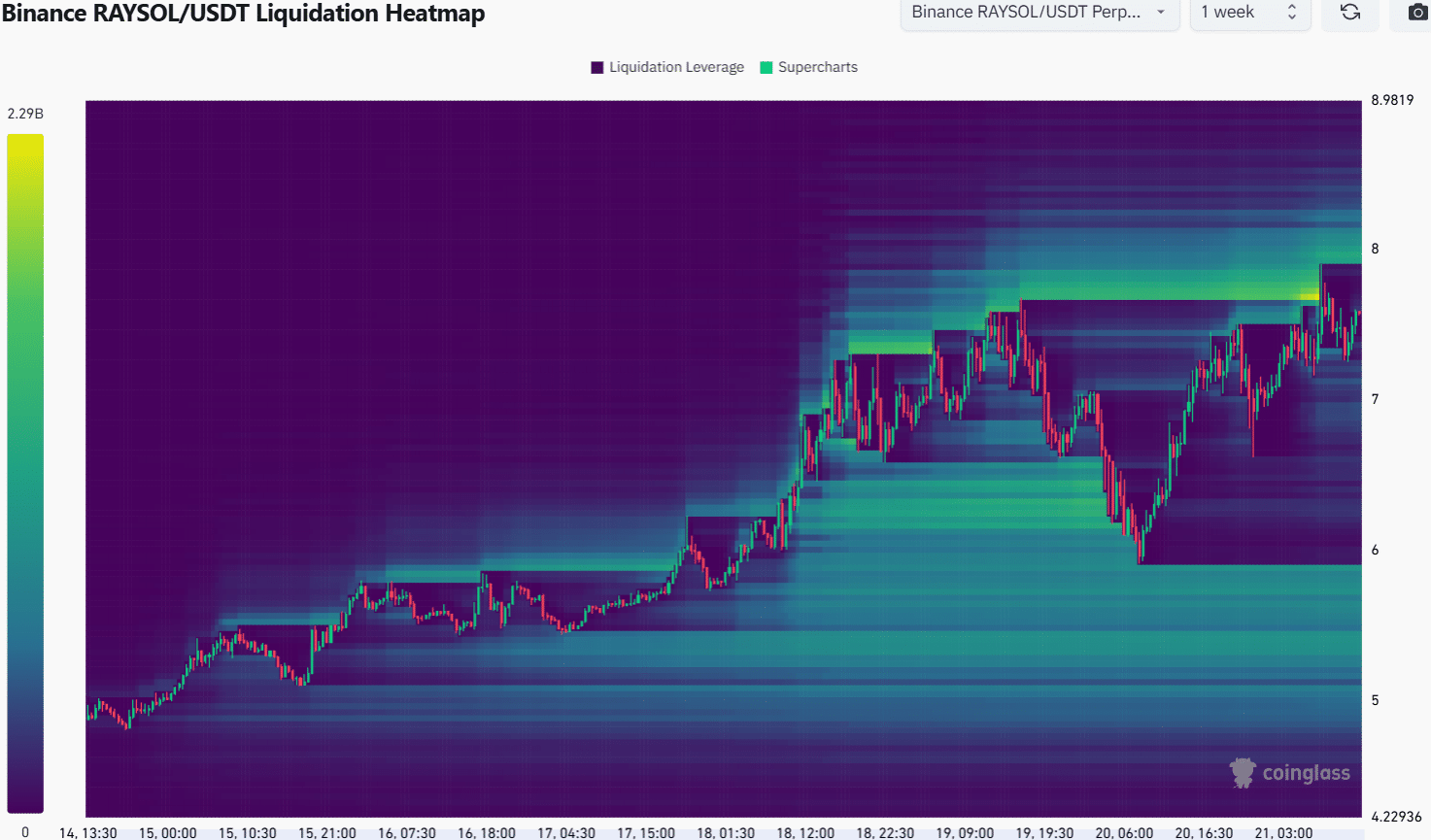

Supply: Coinglass

The three-month liquidation heatmap highlighted a pocket of liquidity at $8 and one other at $7.12. Under this, the $7 was one other magnetic zone.

Because the latest transfer has already retested the vary highs at $6.3, one other fast dip to $7.12 was unlikely.

As an alternative, a transfer towards $8 after which a reversal and a sweep of the $7-$7.1 area appeared extra probably.

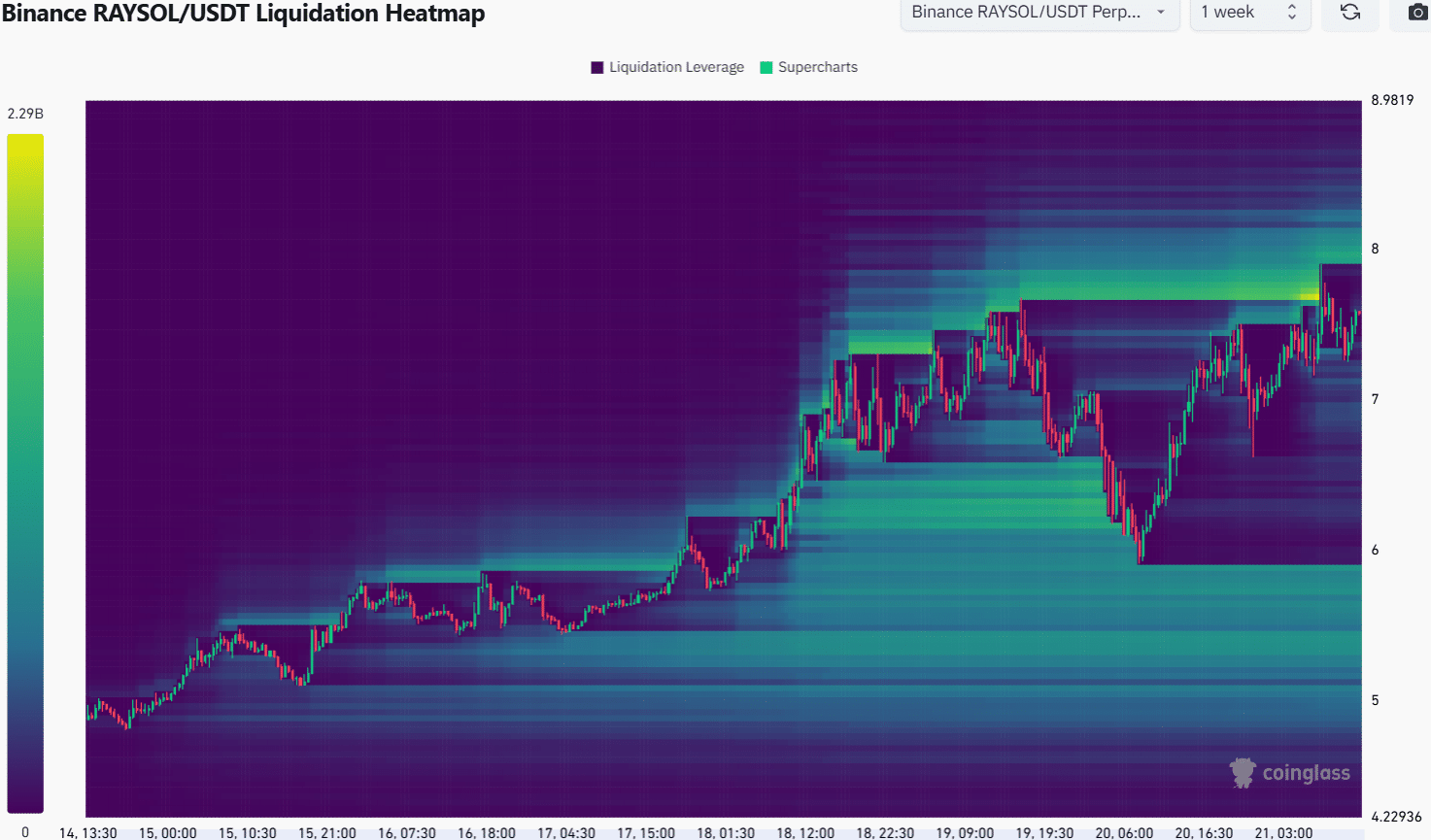

Supply: Coinglass

The 1-week liquidation heatmap additionally highlighted the $8 liquidity pocket. It made it clear that the $7.93-$8.21 had a noticeable density of liquidation ranges that would draw RAY costs towards it.

Learn Raydium’s [RAY] Price Prediction 2025-26

To the south, the $7.12 and $6.96 ranges have been much less vibrant, since that they had fewer liquidation ranges.

A transfer to $8 and some days of consolidation may construct up lengthy liquidation ranges to the south, which Raydium costs can later take out earlier than persevering with the upward transfer.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion