- Ethereum sees a poor efficiency towards Bitcoin, with the ETH/BTC pair reaching a four-year low.

- ETH has declined by 2.48% over the previous 24 hours.

Over the previous months, Ethereum [ETH] has struggled to maintain an upward momentum, whereas Bitcoin [BTC] has frequently made new highs.

As such, Ethereum has continued to battle towards Bitcoin as BTC.Dominance pushed the pair to current lows.

The truth is, as of this writing, ETH/BTC was buying and selling at $0.031, hitting a four-year low for the pair. This dip raises issues about Ethereum’s future prospects and whether or not it could reverse its fortunes.

Ethereum continues to battle towards Bitcoin

All through the previous yr, Bitcoin has made important beneficial properties, rising by 144.45%. This marked an increase from $40K to $101K on the time of writing, whereas BTC has reached an ATH of $109K over the identical interval.

As compared, Ethereum has made reasonable beneficial properties over the identical interval, rising by 30.27% to $3219 at press time. Over this era, ETH remained roughly 33% under its ATH of $4891 recorded in 2021.

With the ETH/BTC ratio dropping to 0.031, it has erased all beneficial properties realized over the previous 4 years. Traditionally, the pair peaked at 0.087 in 2021, when the market noticed a robust upsurge in altcoins.

Nevertheless, since reaching this degree, the altcoin has skilled sturdy downward strain.

Elements behind this decline

Varied elements have resulted in Ethereum’s underperformance towards Bitcoin. Notably, the king coin has skilled excessive desire from establishments and governments.

On this regard, many governments have thought of establishing Bitcoin reserves, inflicting BTC to see greater desire and adoption charges in comparison with different crypto belongings.

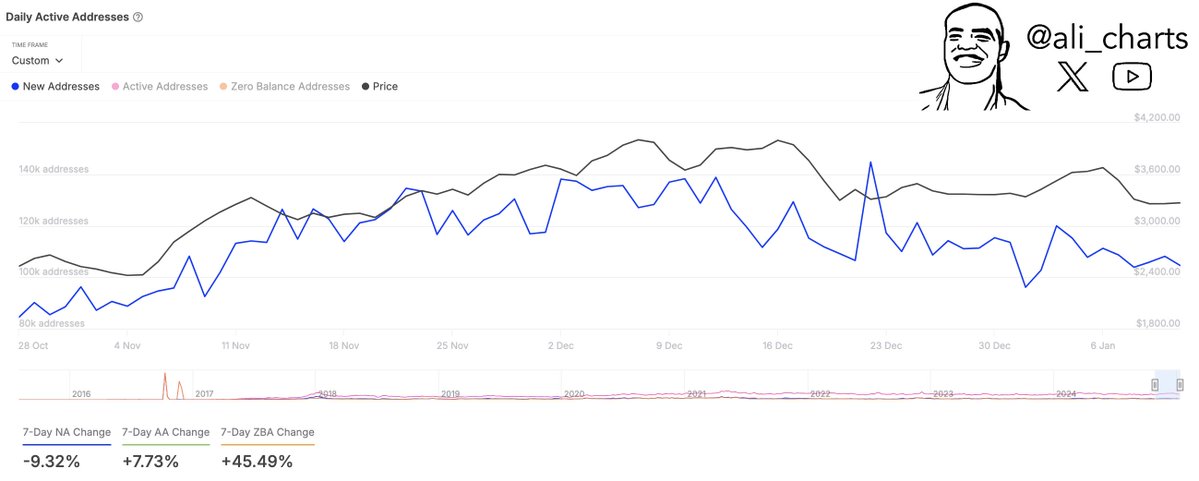

Ethereum, alternatively, has skilled an adoption charge decline, with new addresses dipping by 9.32%.

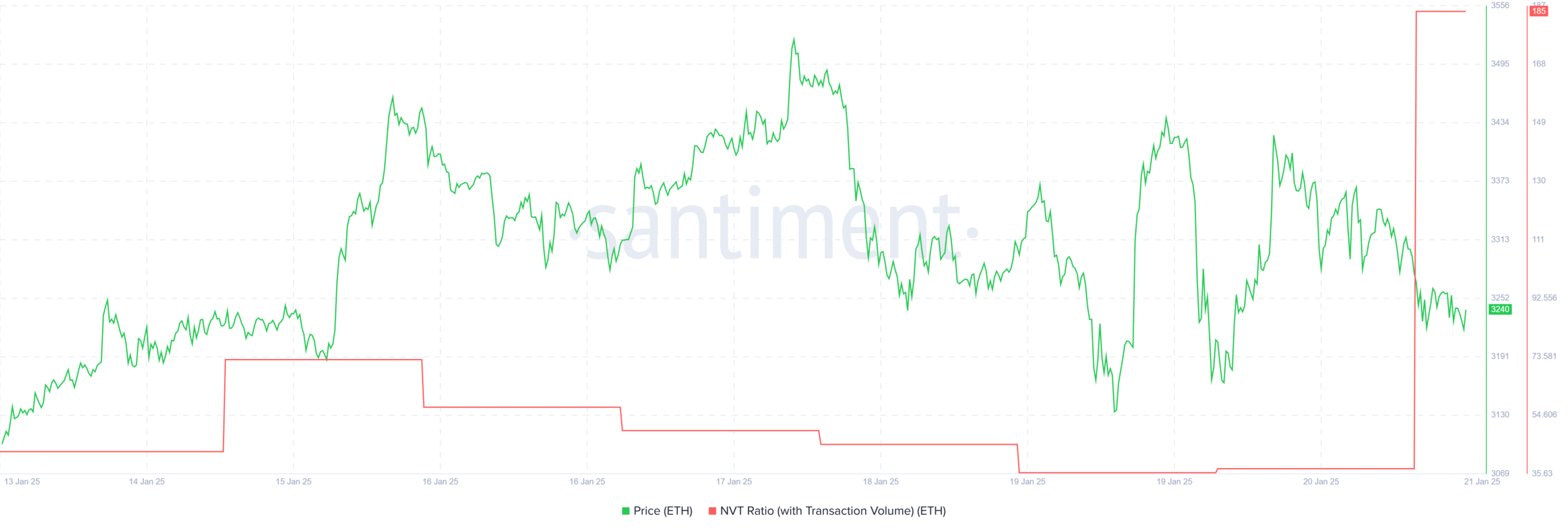

This drop in addresses is additional evidenced by a rising NVT ratio, which has spiked to 185.5, signaling diminished transaction exercise. As such, transactions on the Ethereum community have frequently diminished.

This drop in community exercise raises overvaluation issues, thus extending ETH’s poor efficiency.

What lies forward?

With diminished market desire, ETH might see extra losses, and its poor efficiency towards Bitcoin might proceed.

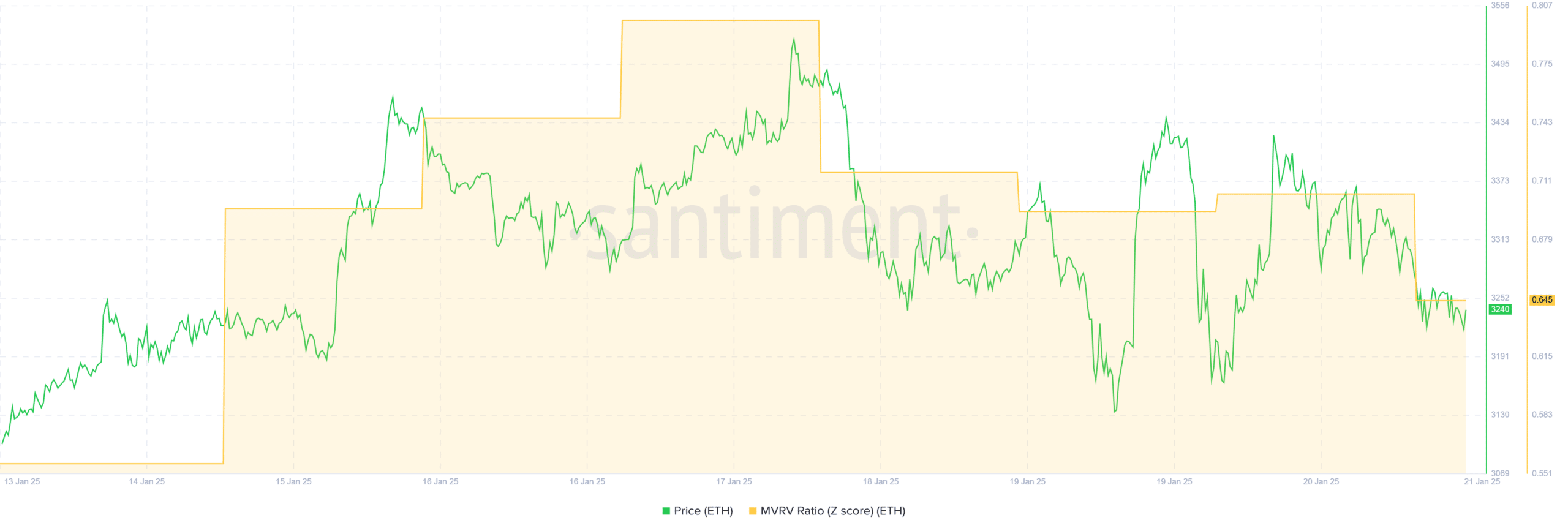

This potential drop is supported by the truth that the MVRV ratio has dropped to 0.64. Such a drop implies that traders are bearish and have low confidence in short-term worth restoration.

Life like or not, right here’s ETH’s market cap in BTC’s phrases

Subsequently, within the brief time period, Ethereum is going through sturdy bearish sentiment which might see ETH drop to $3160. Nevertheless, if patrons take this drop as a shopping for alternative, ETH will reclaim $3300 and try $4k.

This can strengthen the ETH/BTC pair and push it to reclaim $0.04.