- On-chain information reveals renewed shopping for curiosity and decrease provide on Binance, driving Bitcoin’s latest value improve.

- Open Curiosity and lively addresses additionally counsel stronger market participation and potential for additional good points.

Bitcoin [BTC] has been on a unstable path because the begin of the 12 months. Following an early rally, the cryptocurrency confronted a pointy correction that left many buyers unsure concerning the market’s direction.

Nonetheless, a latest surge on the twentieth of January pushed Bitcoin’s value to a brand new all-time excessive, briefly breaking above $109,000.

Though the asset skilled a slight pullback, buying and selling at $107,945, it remained up by 3.5% within the final 24 hours, reflecting a double-digit achieve over the previous week.

Amid this value exercise, analysts have been carefully monitoring key on-chain metrics.

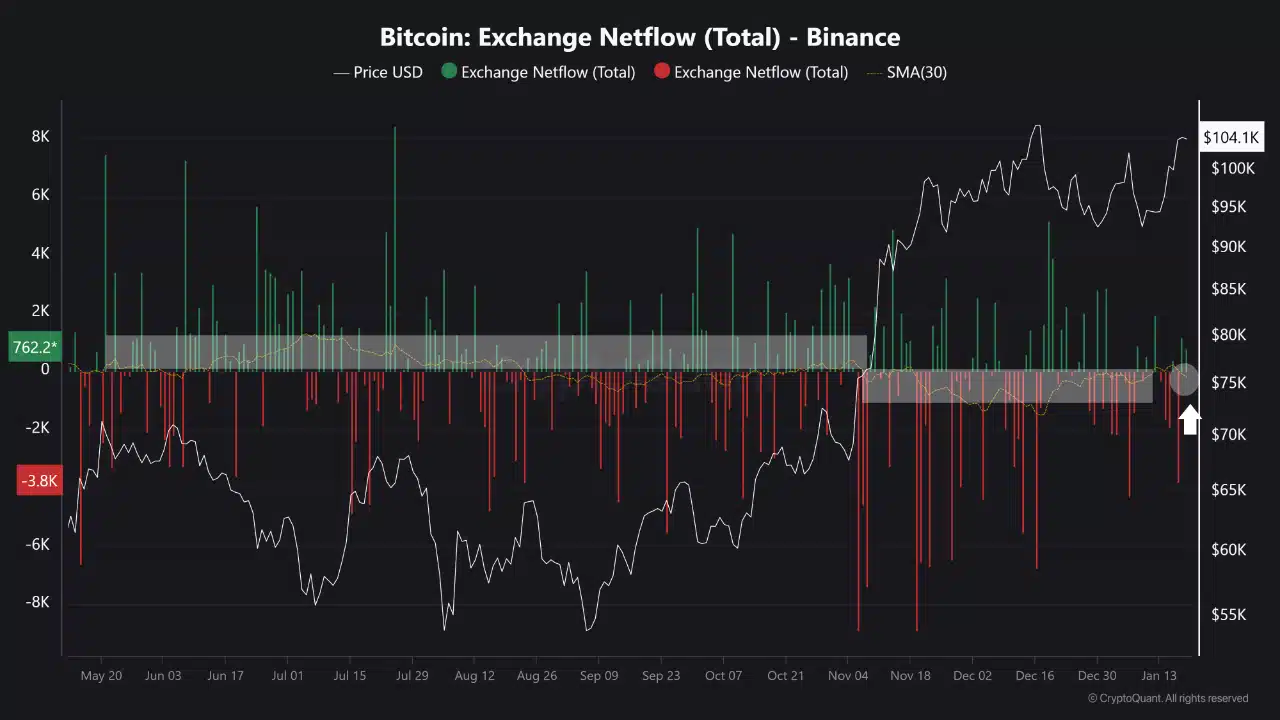

In line with one CryptoQuant analyst, the Binance Netflow SMA30—a 30-day transferring common of netflows on Binance—has supplied priceless insights into market sentiment and value developments.

The analyst factors out that shifts on this metric typically correlate with notable value actions, indicating that the present rally could have extra room to run.

Bitcoin netflow developments and market dynamics

The Binance Netflow SMA30 metric has traditionally been a helpful indicator for anticipating Bitcoin’s short-term value course.

When the metric enters optimistic territory, it typically indicators elevated promoting stress as extra Bitcoin flows into Binance.

For instance, in Might 2024, a optimistic Netflow SMA30 coincided with a drop in Bitcoin’s value from $71,000 to $50,000, highlighting a interval of elevated provide and bearish sentiment.

Conversely, when the Netflow SMA30 turns destructive, it sometimes signifies lowered spot provide and stronger upward momentum.

This sample was evident in November 2024, when the metric shifted destructive, and Bitcoin climbed from $74,000 to $108,000.

As of the seventeenth of January, the SMA30 returned to destructive territory, sitting at -207.85, suggesting renewed shopping for curiosity and elevating the potential of one other rally to a brand new all-time excessive.

Further insights

Past the Binance Netflow SMA30, different indicators offered a broader perspective on Bitcoin’s near-term outlook.

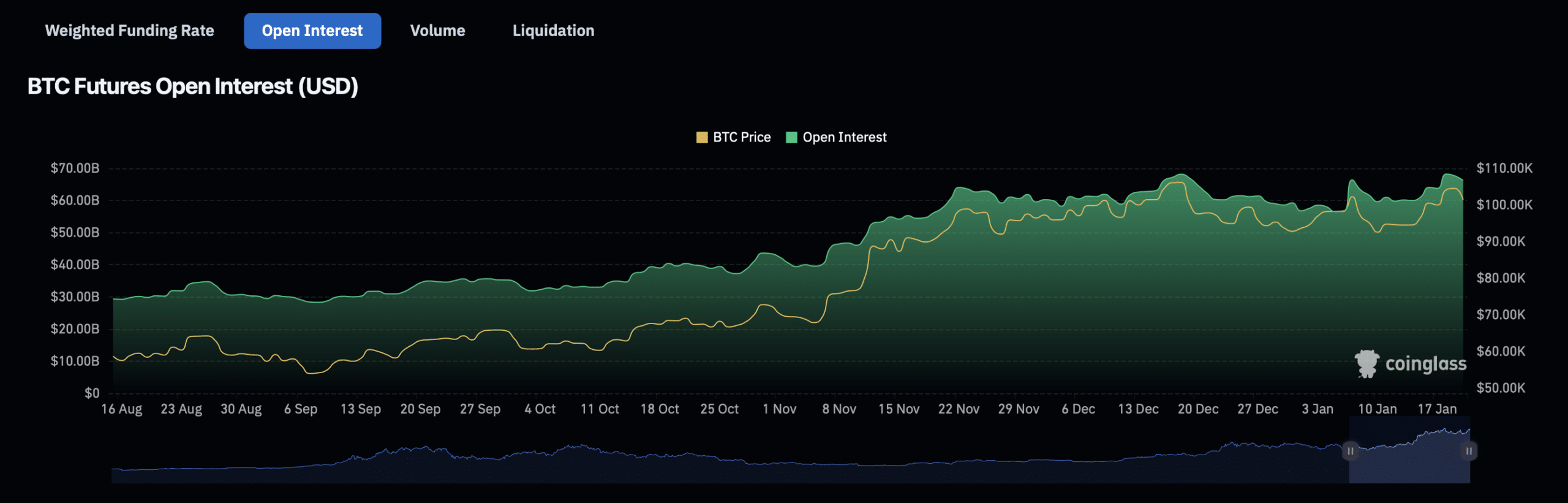

Open Curiosity information from Coinglass shows a 4.61% improve within the final 24 hours, reaching a valuation of $71.21 billion.

Open Curiosity quantity has additionally risen by 156.60% over the identical interval, hitting $179.14 billion.

These will increase mirrored rising dealer engagement and potential momentum within the derivatives market, which may affect Bitcoin’s spot value.

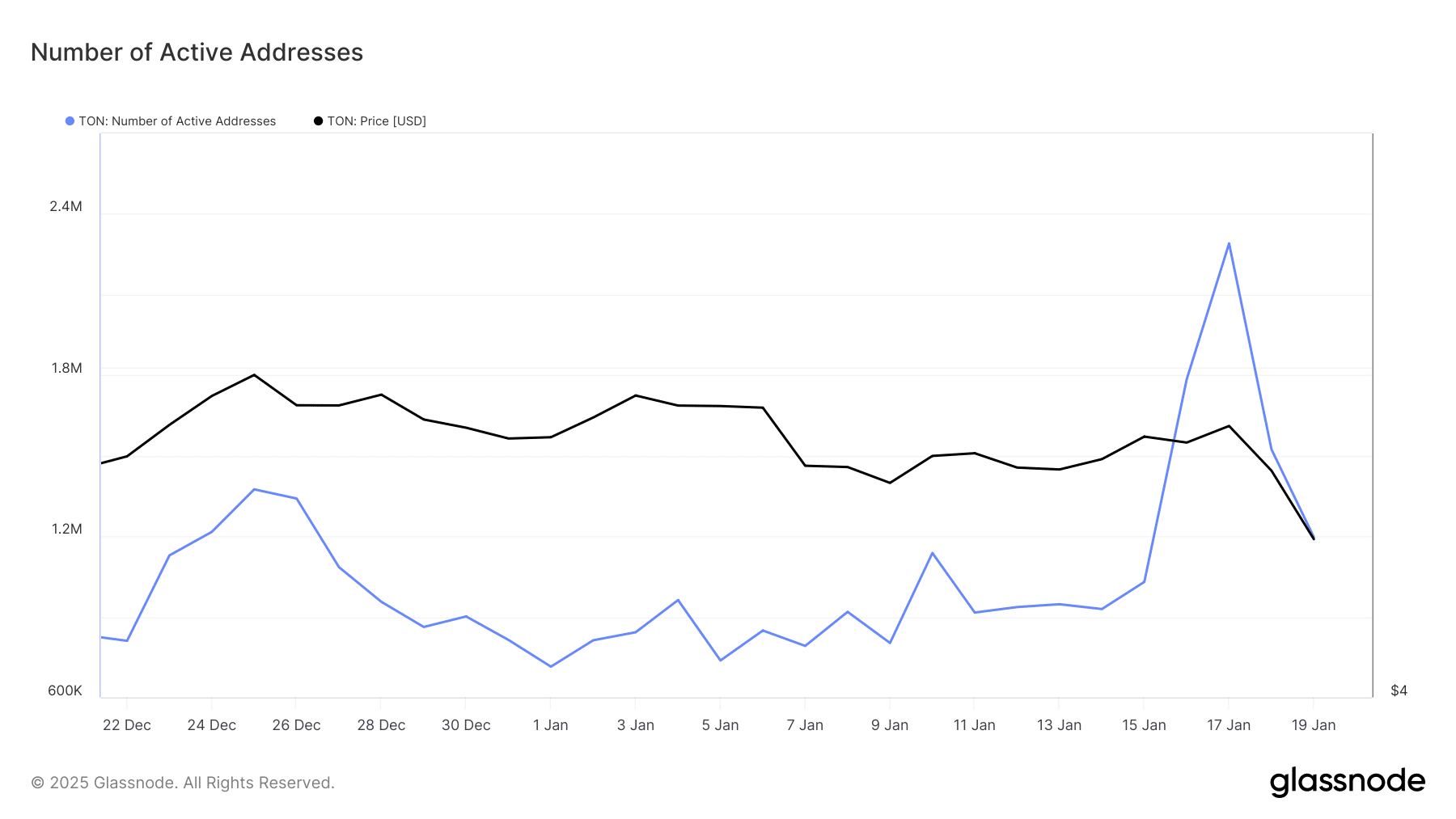

As well as, Glassnode data on lively addresses—a proxy for retail participation—revealed latest spikes in consumer exercise.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

The variety of lively addresses surged from under 1 million earlier this month to 2.2 million by the seventeenth of January, earlier than retreating to 1.1 million as of the nineteenth of January.

Whereas the fluctuation in lively addresses signifies variability in retail curiosity, the general improve earlier within the month means that extra contributors are participating with the Bitcoin community.