- Coinbase analysts and a crypto VC anticipate an altcoin rally after the inauguration

- Analysts cited weakening BTC dominance and capital inflows to altcoins

Analysts consider the crypto market may very well be positioning itself for an enormous altcoin rally after Donald Trump’s inauguration on Monday. The truth is, Coinbase analysts famous that the slight drop in Bitcoin’s [BTC] dominance earlier this week drove the most recent altcoin pump.

Moreover, the analysts added that merchants are positioning themselves for renewed altcoin momentum below the brand new administration. A part of their weekly market commentary read,

“In the meantime, the drop in BTC dominance from 58.5% to its assist stage of 57.3% in the course of the inflation print aid rally on January 15 suggests to us that merchants could also be positioning for an outsized altcoin market rally on the again of optimistic catalysts for threat belongings and crypto.”

Bitcoin dominance retreats

Chris Burniske, a companion at crypto VC agency Placeholder and former ARK Make investments crypto lead, echoed the same sentiment, citing BTC dominance. He said,

“Importantly for the lengthy tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues.”

Based on Coinbase analysts David Duong and David Han, stablecoin inflows are one other bullish sign for a possible altcoin pump.

They famous robust capital inflows within the area and an enormous portion of it went to altcoins as BTC and ETH recorded outflows.

“Stablecoin provide – maybe probably the most clear proxy for capital flows to those lengthy tail belongings in our view – elevated by $1.3B final week, a continuation of traits we’ve noticed over the previous two months. This stands in distinction to internet outflows from US spot BTC and ETH ETFs of $457M and $206M respectively.”

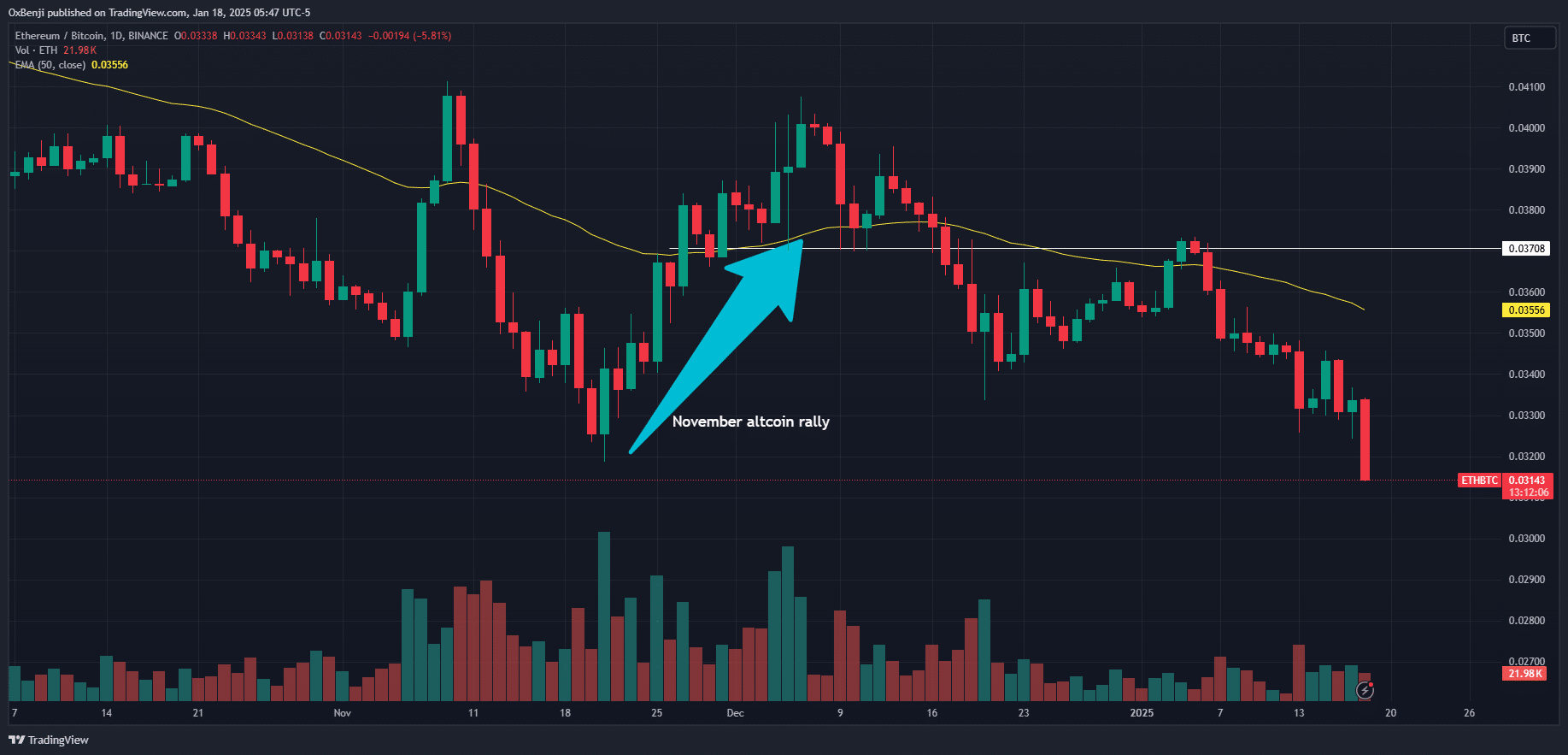

Regardless of the bullish outlook, nonetheless, one other indicator – ETH/BTC – didn’t align with the remaining, at the very least on the time of writing. Right here, this ratio tracks ETH’s relative efficiency in opposition to BTC, with the identical rallying throughout November’s robust altcoin season.

The truth is, the ratio additionally hit a brand new report low of 0.31 at press time. As a part of the altcoin sector’s barometer, this doesn’t bode nicely for the anticipated altcoin rally, particularly if the November development is repeated.

That being mentioned, altcoins like Fartcoin and XRP had been the weekly winners, with almost 100% and 30% beneficial properties, respectively. Solana [SOL] additionally logged 30% beneficial properties, whereas Hedera posted 22% beneficial properties.

Right here, it’s additionally value noting that Hedera and XRP had been among the many prime performers in November’s altcoin run too. It stays to be seen whether or not they can maintain the momentum this time.

- Coinbase analysts and a crypto VC anticipate an altcoin rally after the inauguration

- Analysts cited weakening BTC dominance and capital inflows to altcoins

Analysts consider the crypto market may very well be positioning itself for an enormous altcoin rally after Donald Trump’s inauguration on Monday. The truth is, Coinbase analysts famous that the slight drop in Bitcoin’s [BTC] dominance earlier this week drove the most recent altcoin pump.

Moreover, the analysts added that merchants are positioning themselves for renewed altcoin momentum below the brand new administration. A part of their weekly market commentary read,

“In the meantime, the drop in BTC dominance from 58.5% to its assist stage of 57.3% in the course of the inflation print aid rally on January 15 suggests to us that merchants could also be positioning for an outsized altcoin market rally on the again of optimistic catalysts for threat belongings and crypto.”

Bitcoin dominance retreats

Chris Burniske, a companion at crypto VC agency Placeholder and former ARK Make investments crypto lead, echoed the same sentiment, citing BTC dominance. He said,

“Importantly for the lengthy tail, $BTC dominance has been slowly fading since late November ’24 – fireworks if that continues.”

Based on Coinbase analysts David Duong and David Han, stablecoin inflows are one other bullish sign for a possible altcoin pump.

They famous robust capital inflows within the area and an enormous portion of it went to altcoins as BTC and ETH recorded outflows.

“Stablecoin provide – maybe probably the most clear proxy for capital flows to those lengthy tail belongings in our view – elevated by $1.3B final week, a continuation of traits we’ve noticed over the previous two months. This stands in distinction to internet outflows from US spot BTC and ETH ETFs of $457M and $206M respectively.”

Regardless of the bullish outlook, nonetheless, one other indicator – ETH/BTC – didn’t align with the remaining, at the very least on the time of writing. Right here, this ratio tracks ETH’s relative efficiency in opposition to BTC, with the identical rallying throughout November’s robust altcoin season.

The truth is, the ratio additionally hit a brand new report low of 0.31 at press time. As a part of the altcoin sector’s barometer, this doesn’t bode nicely for the anticipated altcoin rally, particularly if the November development is repeated.

That being mentioned, altcoins like Fartcoin and XRP had been the weekly winners, with almost 100% and 30% beneficial properties, respectively. Solana [SOL] additionally logged 30% beneficial properties, whereas Hedera posted 22% beneficial properties.

Right here, it’s additionally value noting that Hedera and XRP had been among the many prime performers in November’s altcoin run too. It stays to be seen whether or not they can maintain the momentum this time.