- Mining provide dropped from 655k LTC to 645k LTC because the CMF hovered at 0.07

- Accumulation/Distribution line has climbed from 60M to 67.37M since March 2024

Litecoin (LTC) miners not too long ago intensified their promoting stress throughout the board, with on-chain knowledge displaying important provide actions. In actual fact, the cryptocurrency was buying and selling at $119.06 at press time, down 4.96% within the final 24 hours. It had a buying and selling quantity of 156.29k, as miners continued to regulate their positions amid the market’s volatility.

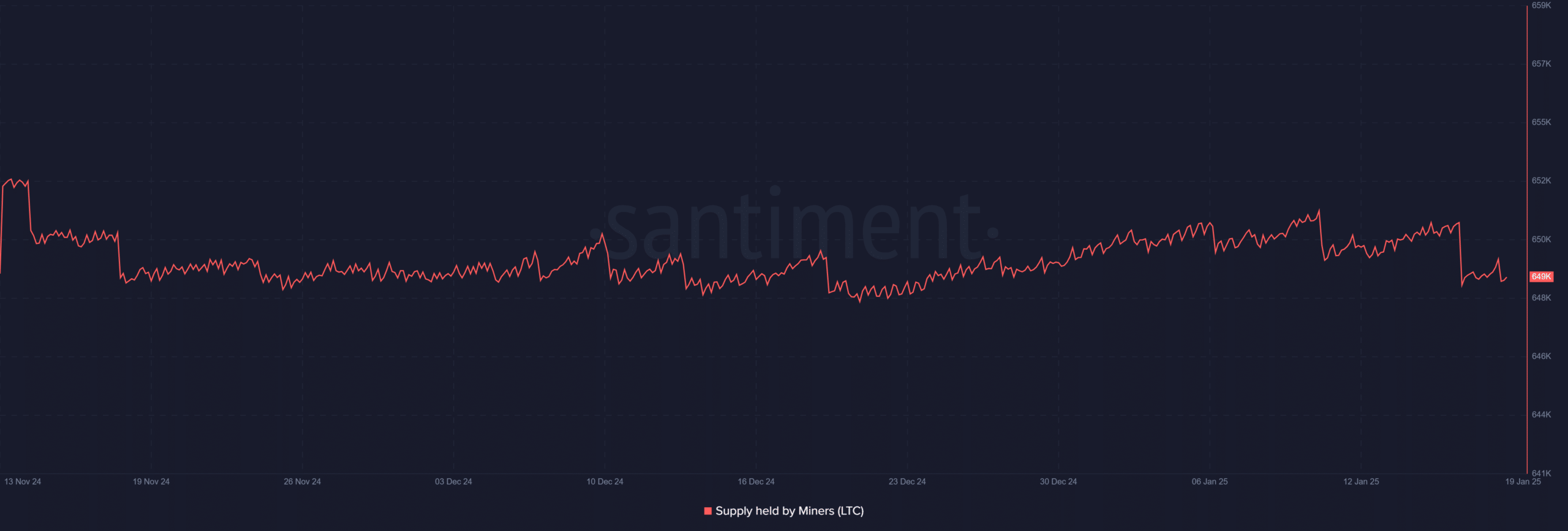

Litecoin provide motion and miner habits

On-chain data revealed a transparent shift in Litecoin miners’ holdings, with provide ranges dropping to roughly 645k LTC from earlier peaks of 655k. This decline, whereas not drastic, appeared to symbolize a constant promoting sample over the past two months.

The regular nature of this sell-off, moderately than sharp dumps, hinted at a calculated method to liquidations moderately than panic promoting.

Notably, the availability chart revealed better volatility in mid-January, indicating heightened miner exercise throughout worth fluctuations.

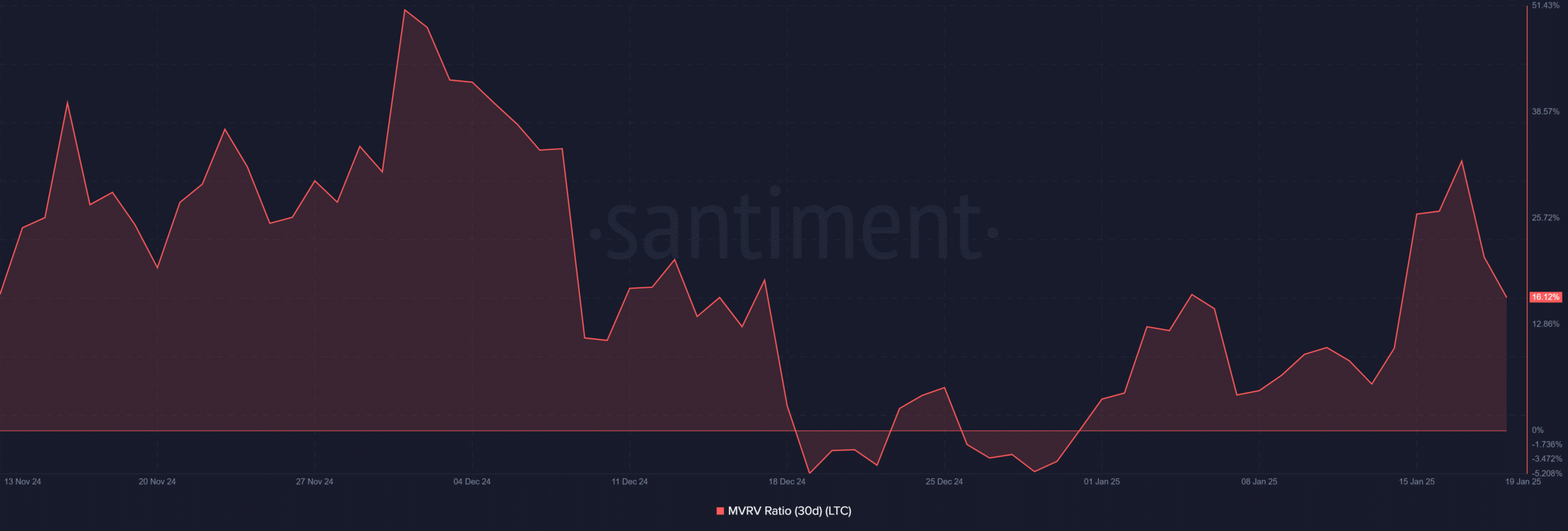

MVRV evaluation factors to market sentiment

Litecoin’s 30-day MVRV (Market Worth to Realized Worth) ratio tells us a compelling story of market sentiment shifts.

After hitting peak ranges of 38.57% in early December 2024, the ratio noticed a pointy decline to its press time ranges of 16.12%.

Such a big drop indicated that short-term holders who purchased throughout the final 30 days have been seeing considerably diminished revenue margins.

In actual fact, the MVRV’s downward trajectory since December alluded to the cooling of speculative curiosity, probably signaling a shift in direction of a extra sustainable market valuation.

Litecoin’s technical evaluation and worth motion

Litecoin’s every day chart underlined a number of crucial technical developments too.

The 50-day transferring common at 113.31 and the 200-day transferring common at 80.84 maintained a bullish cross formation – Traditionally a optimistic indicator for medium-term worth motion.

The Accumulation/Distribution line additionally famous outstanding power, climbing steadily to 67.37M from 60M in March 2024. This may be interpreted to be an indication of sustained shopping for stress, regardless of miner sell-offs.

The Chaikin Cash Move (CMF) oscillating round 0.07 supplied some extra context, indicating that regardless of current worth weak point, shopping for stress has been marginally stronger than promoting stress. This appeared to create an fascinating divergence with the miners’ promoting sample, suggesting retail and institutional buyers is perhaps absorbing the promoting stress.

Additionally, buying and selling quantity patterns highlighted important spikes throughout worth declines, significantly in current weeks. The quantity profile hitting 156.29k indicated lively market participation through the sell-off intervals.

Lastly, regardless of the hike in promoting stress, the worth has maintained assist above the essential 50-day transferring common, demonstrating underlying market power.

Trying forward – Market implications

The prevailing market construction presents an intriguing situation, one the place Litecoin miner habits seems disconnected from the broader market sentiment. Whereas miners proceed their methodical sell-off, probably attributable to profit-taking or operational prices, regular accumulation metrics hinted at robust purchaser curiosity at press time ranges. The MVRV ratio’s place, whereas decrease than current peaks, has remained in optimistic territory too – Underlining the potential for worth restoration if promoting stress subsides.

The interaction between these numerous metrics recommended that Litecoin is in a crucial part the place miners’ habits might considerably affect short-term worth motion. The approaching weeks shall be essential in figuring out whether or not the present miner sell-off represents a wholesome market redistribution or the start of a extra important development shift.

– Learn Litecoin (LTC) Price Prediction 2024-25

The sustained assist ranges round $113, coinciding with the 50-day transferring common, shall be very important for sustaining market construction. If these ranges maintain regardless of sustained miner promoting, it might allude to robust elementary demand for LTC at its press time valuation.