- Whale exercise surged as Bitcoin fashioned a double-bottom sample, testing key resistance ranges

- Market sentiment strengthened on the again of rising lively addresses, declining alternate reserves, and the bullish purchase/promote ratio

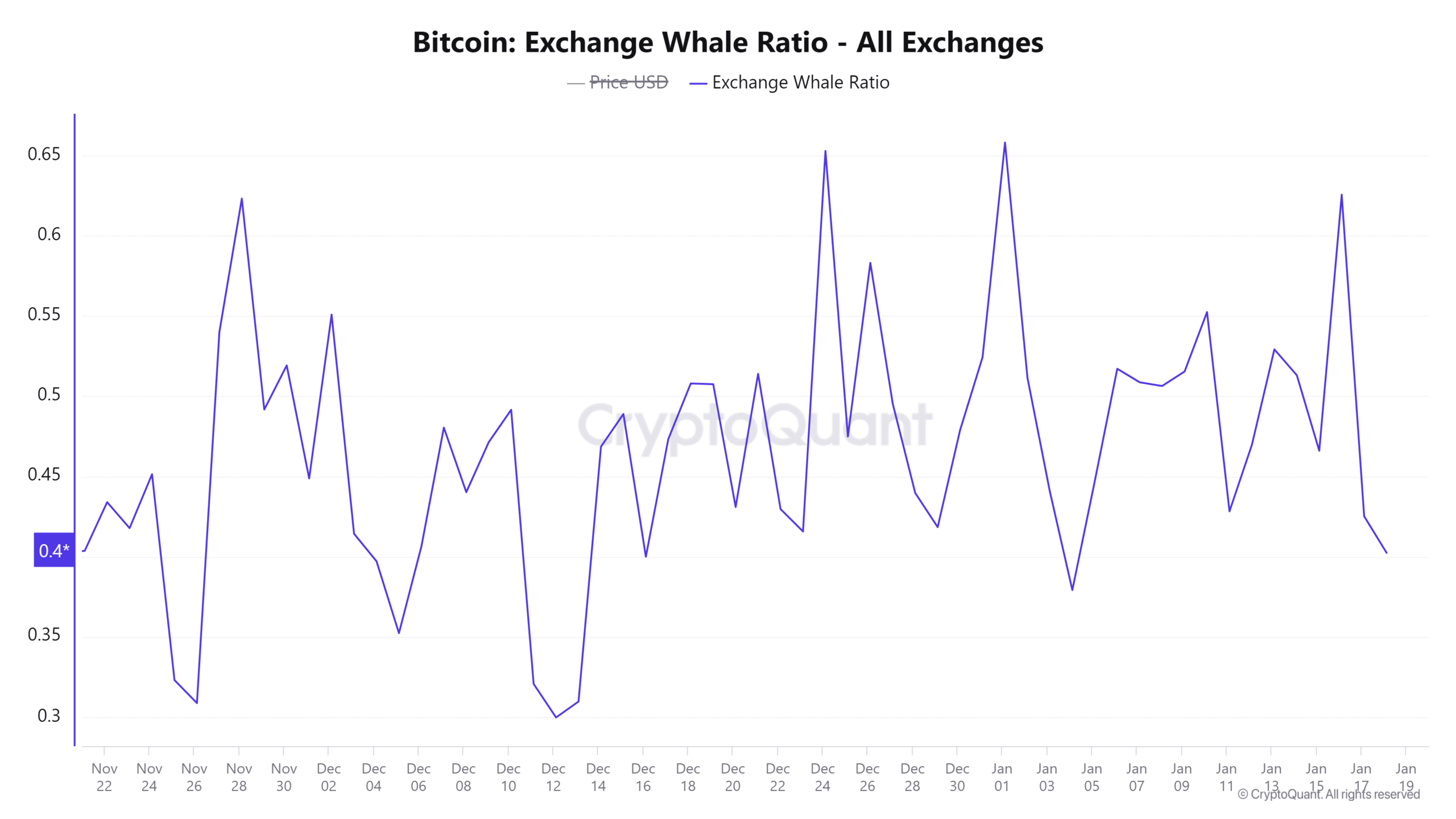

Whale exercise on Binance has spiked considerably currently, with the whale ratio climbing by over 1.02%. This metric, which tracks the highest inflows in comparison with complete inflows, is used to evaluate giant actions by main Bitcoin holders.

Traditionally, such elevated whale exercise is usually seen as a precursor to large-scale shopping for or promoting. In truth, this usually precedes main worth actions on the charts too.

For sure, its newest surge has raised questions on whether or not Bitcoin [BTC] is on the verge of a big market shift or only a short-term rally.

Is Bitcoin prepared to check new highs?

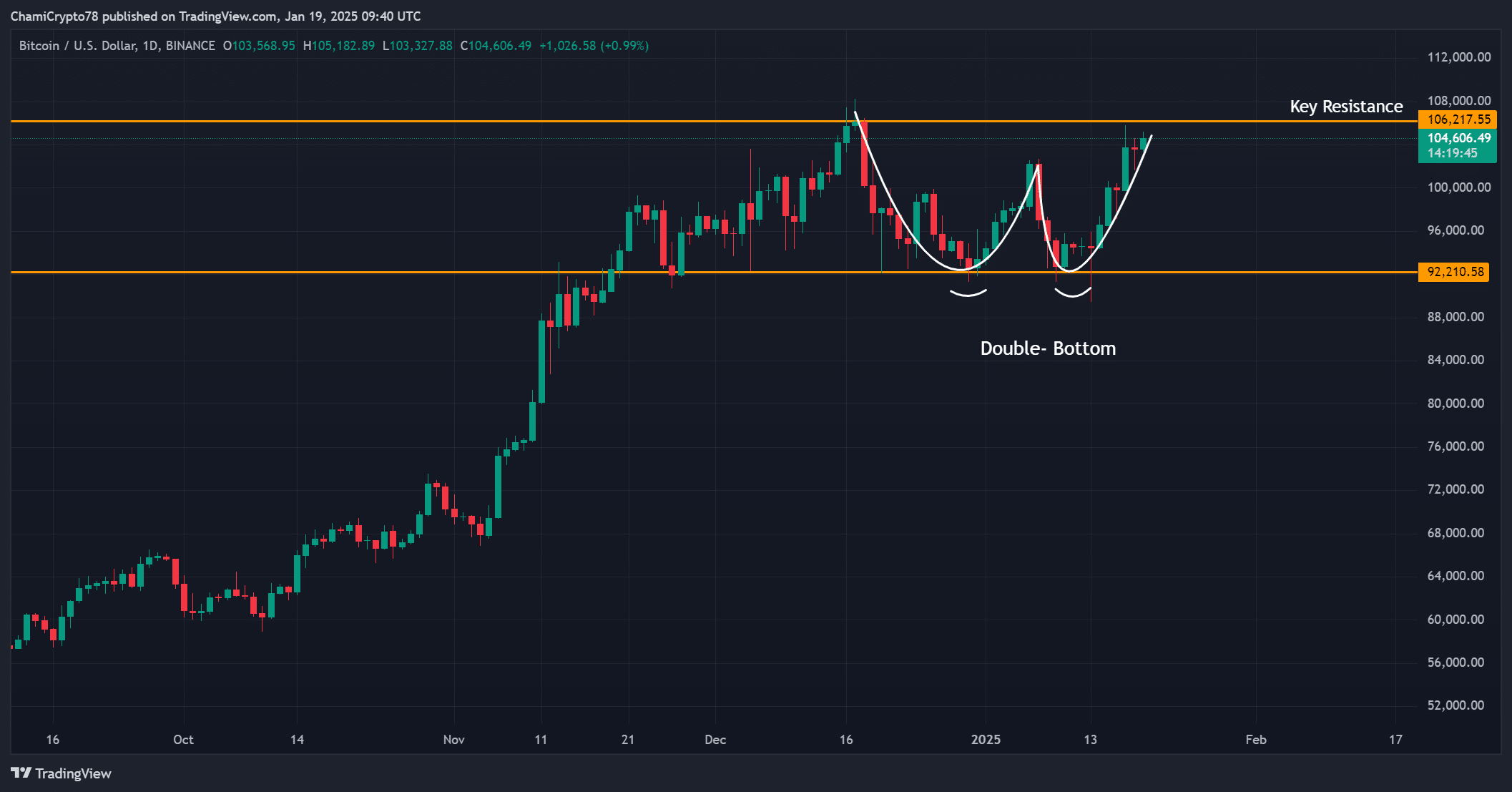

Bitcoin, on the time of writing, was buying and selling at $104,473.77, following a 1.39% hike within the final 24 hours. Its worth motion on the charts revealed a double-bottom sample forming sturdy help close to $92,000, whereas the resistance at $106,200 remained a key hurdle.

If BTC can breach this resistance, it might pave the best way for a serious breakout. Nonetheless, failure to keep up upward momentum might set off a retest of decrease ranges, presenting a vital juncture for merchants to observe carefully.

How can lively addresses form the market?

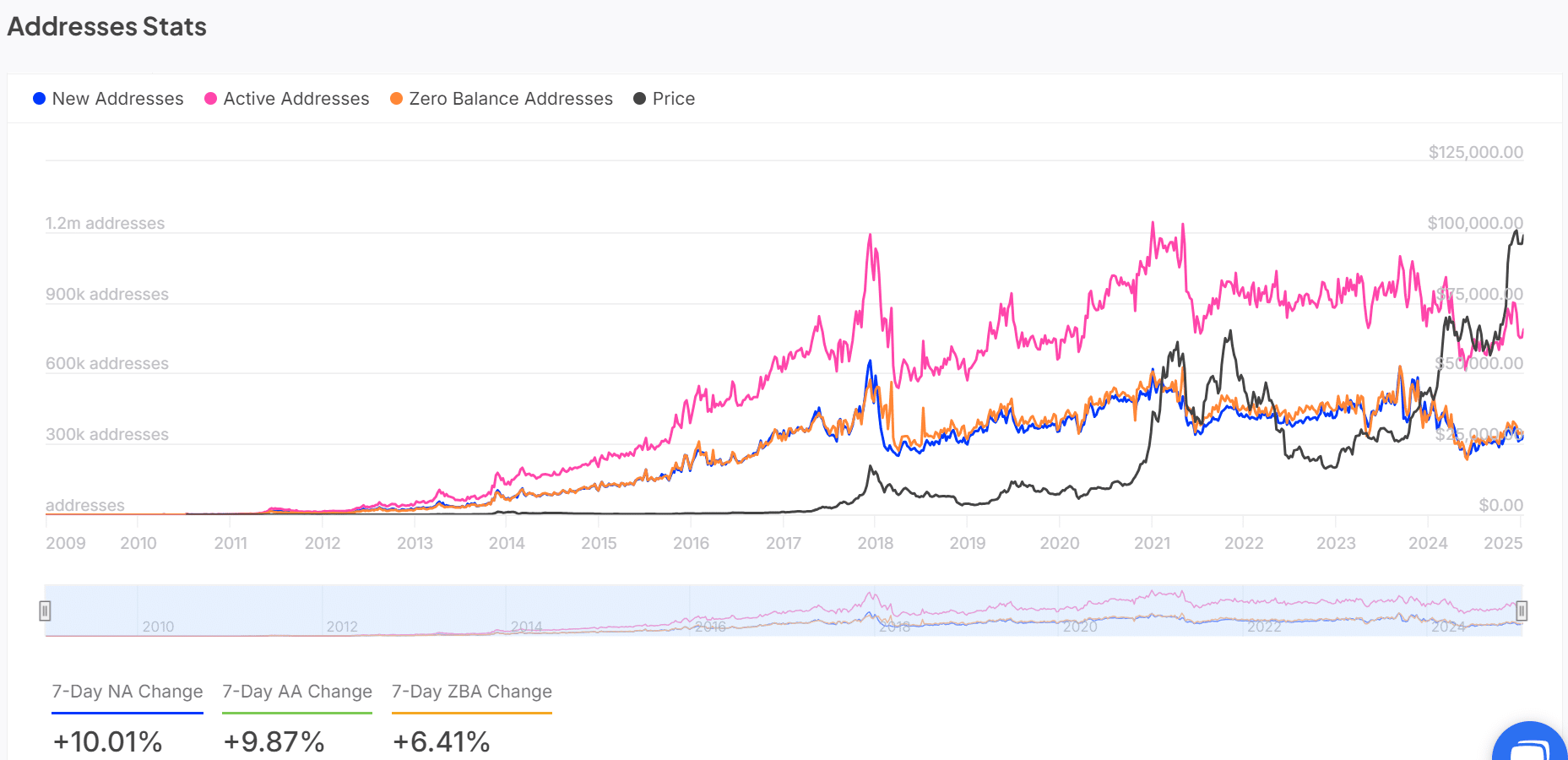

Bitcoin’s lively addresses surged by 9.87% during the last 7 days, reflecting rising curiosity within the crypto-asset. Such a hike is an important indicator of market exercise, hinting at heightened transactional demand from each retail and institutional buyers.

Additionally, an uptick within the variety of lively addresses is usually seen as a measure of market confidence. If this pattern continues, it might present the transactional help wanted to push BTC to greater worth ranges.

Trade reserves sign lowered promoting stress

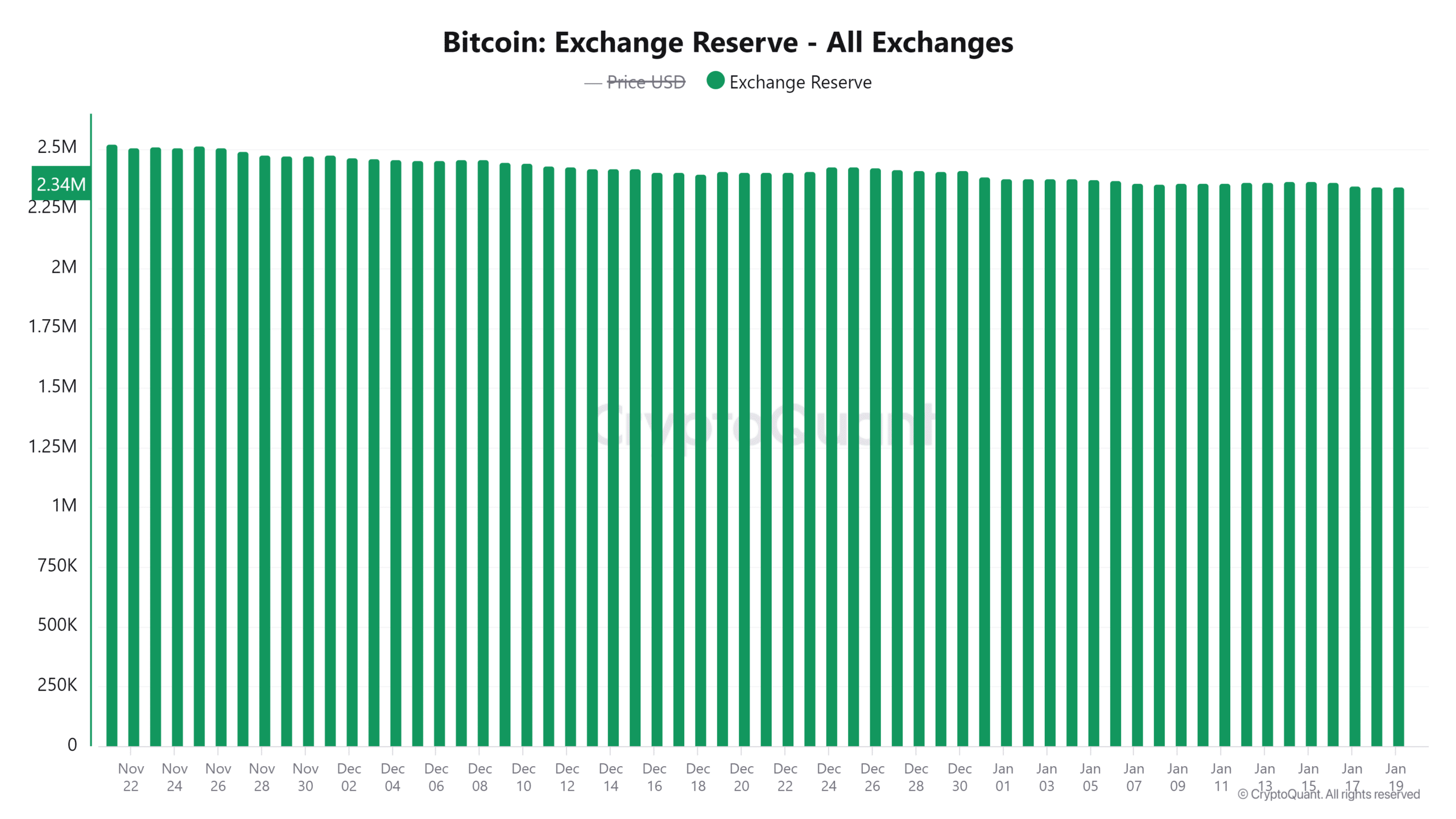

During the last 96 hours, greater than 20,000 BTC, value over $2 billion, have been withdrawn from exchanges. On the time of writing, alternate reserves sat at 2.344 million BTC, reflecting a sustained decline.

This pattern indicated that buyers have been transferring their holdings to personal wallets – An indication of long-term bullish sentiment.

Right here, it’s value noting that lowered alternate reserves usually correlate with a fall in promoting stress, a discovering that will additional help a possible BTC rally.

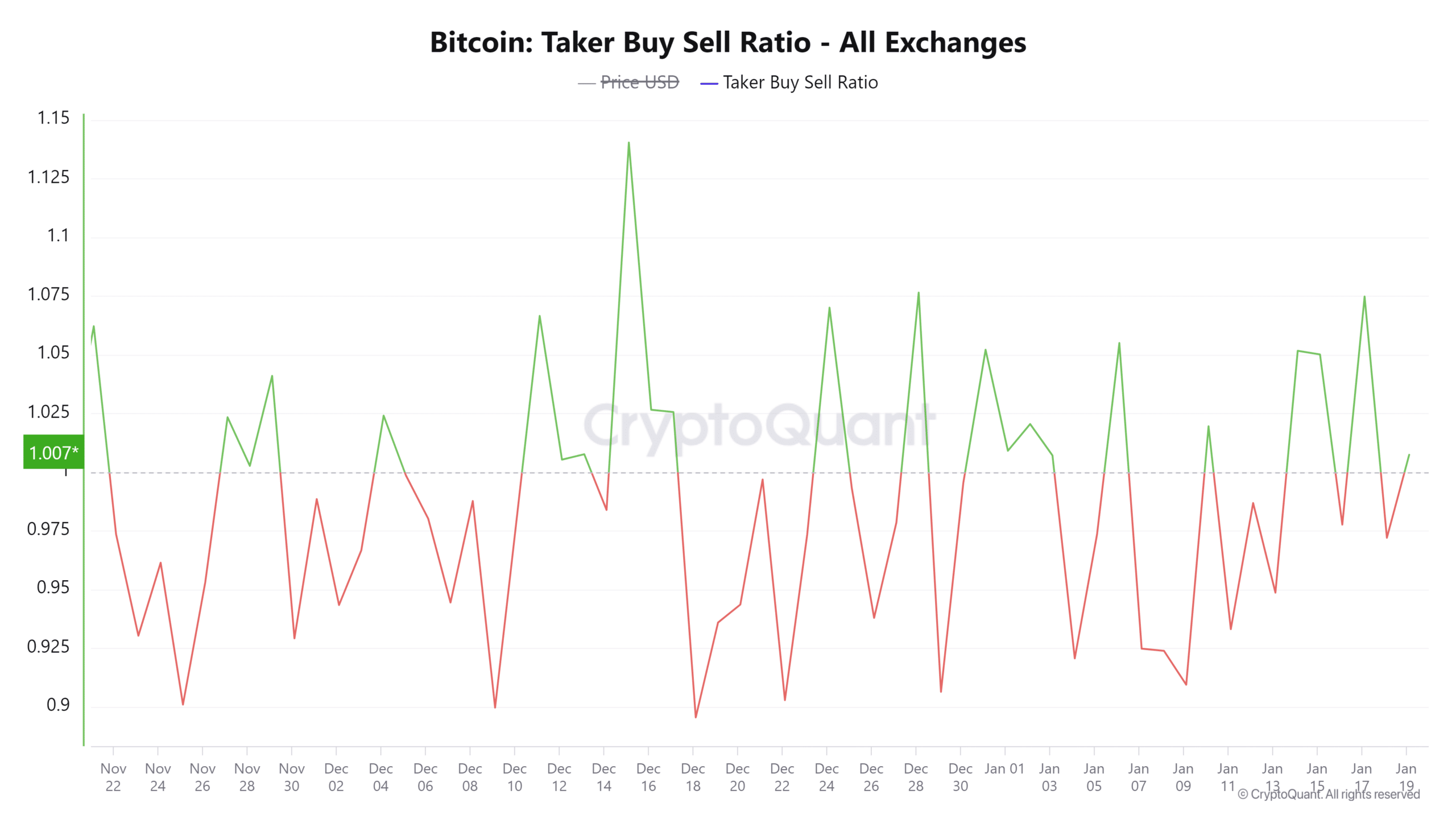

Taker purchase/promote ratio signifies bullish momentum

At press time, the taker purchase/promote ratio had a studying of 1.01, with a 0.99% hike in purchaser dominance. This metric highlighted that market members have been actively buying Bitcoin at greater costs – An indication of rising demand.

Moreover, this bullish sentiment complemented the broader narrative of accelerating curiosity in BTC, additional solidifying the opportunity of upward momentum within the brief time period.

Is your portfolio inexperienced? Try the Bitcoin Profit Calculator

Given the surge in whale exercise, rising lively addresses, declining alternate reserves, and bullish taker purchase/promote ratios, Bitcoin seems primed for a breakout.

Whereas dangers of a pullback stay, knowledge strongly supported a bullish case for the cryptocurrency.