- XRP’s spectacular rally clears quick liquidations, however raises dangers of an extended squeeze

- Elevated danger metrics and skinny liquidity beneath $2.50 hinted at heightened volatility forward

XRP traders have loved important good points currently following the token’s spectacular rally. Nevertheless, looming danger metrics appeared to trace at potential turbulence forward. With over 90% of bearish liquidation ranges exhausted and normalized danger hitting excessive ranges, might this be the proper second to lock in income earlier than the momentum shifts?

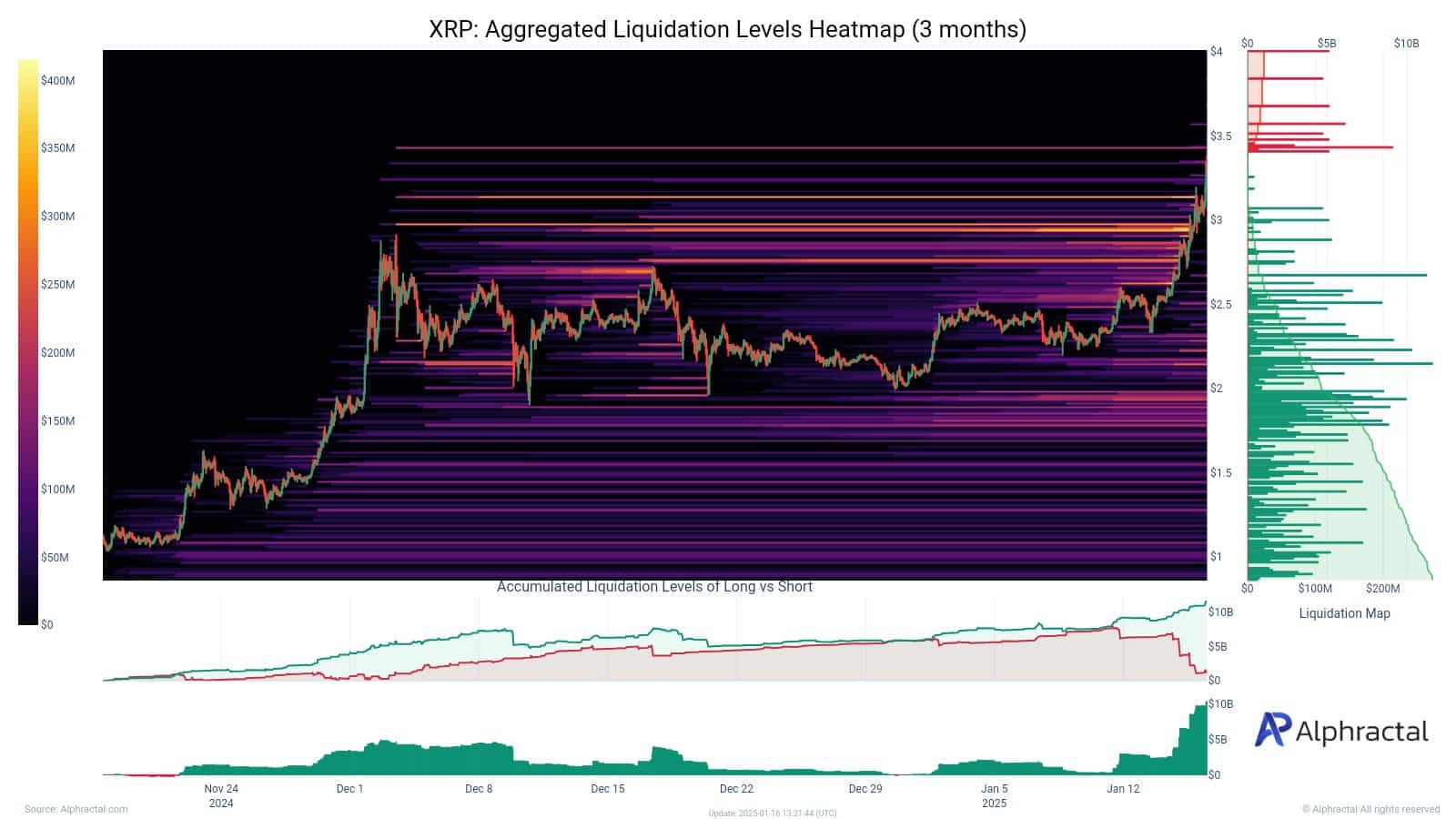

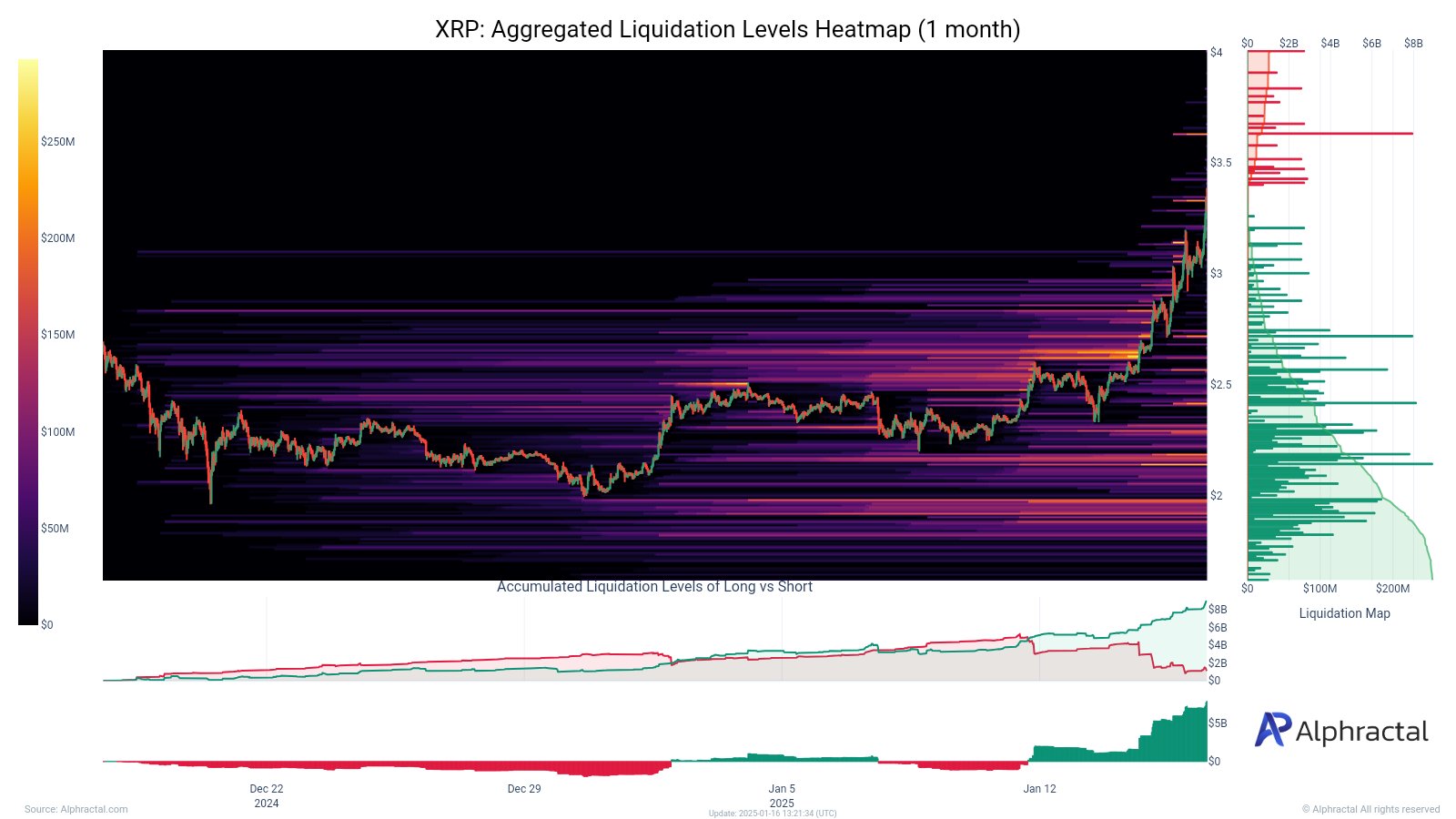

Liquidation heatmaps reveal XRP’s fragile market dynamics

Whereas XRP’s liquidation heatmaps highlighted the token’s spectacular rally, additionally they uncovered rising market vulnerabilities. The three-month heatmap revealed dense liquidation clusters within the $3.00-$3.50 vary, the place most quick positions have been cleared, fueling the rally.

Nevertheless, beneath $2.50, liquidity thins significantly, suggesting restricted help if the value drops on the charts.

The one-month heatmap strengthened this view, revealing near-total exhaustion of bearish liquidation ranges and a buildup of lengthy positions within the $3.25-$3.50 vary.

This raises the danger of an extended squeeze if XRP loses momentum, doubtlessly triggering a pointy sell-off.

Moreover, the imbalance between plateauing quick liquidations and rising lengthy liquidations is an indication of a market skewed in the direction of bullish sentiment.

Whereas XRP’s rally has thrived on quick squeezes, the dearth of bearish liquidity and concentrated lengthy positions imply there is perhaps heightened volatility forward.

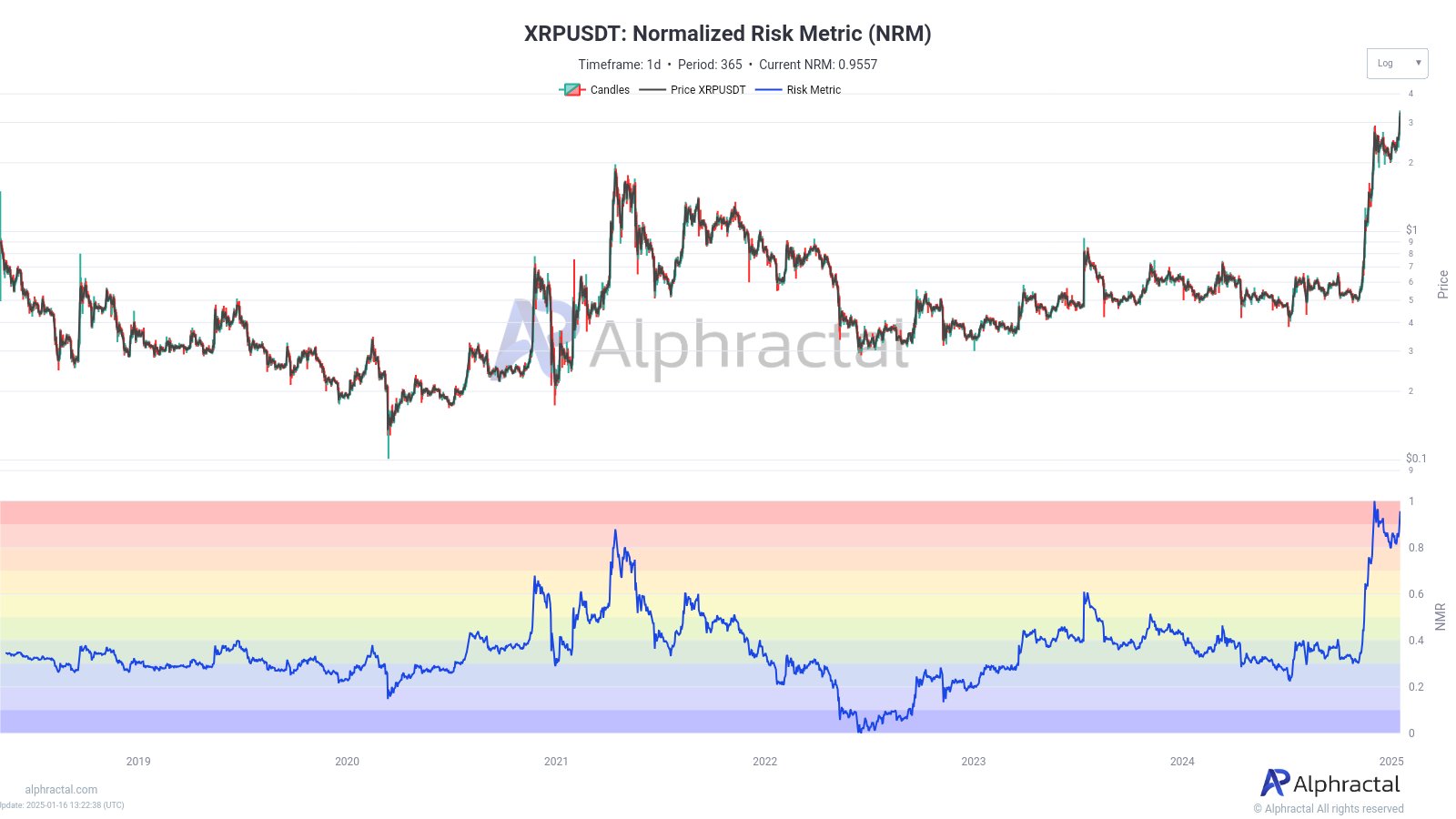

XRP’s elevated danger metrics

XRP’s current rally has been accompanied by regarding indicators of heightened danger, as each the Normalized Danger Metric and Sharpe Ratio approached excessive ranges.

The NRM’s press time studying of 0.9557 appeared to be nearing historic highs which have preceded main market corrections prior to now – An indication of overheated situations. With XRP firmly within the crimson zone of the danger chart now, the chance of a value pullback will likely be excessive.

Equally, the Sharpe Ratio, which measures risk-adjusted returns, is hitting unsustainable optimistic ranges too – Echoing patterns seen earlier than earlier market corrections.

Which means XRP’s risk-reward stability is skewed, making the present market dynamics precarious.

A mix of those danger metrics, alongside an already overheated market, raises the likelihood of heightened volatility and a possible retracement on the charts.

Sensible or not, right here’s XRP market cap in BTC’s phrases