Key Notes

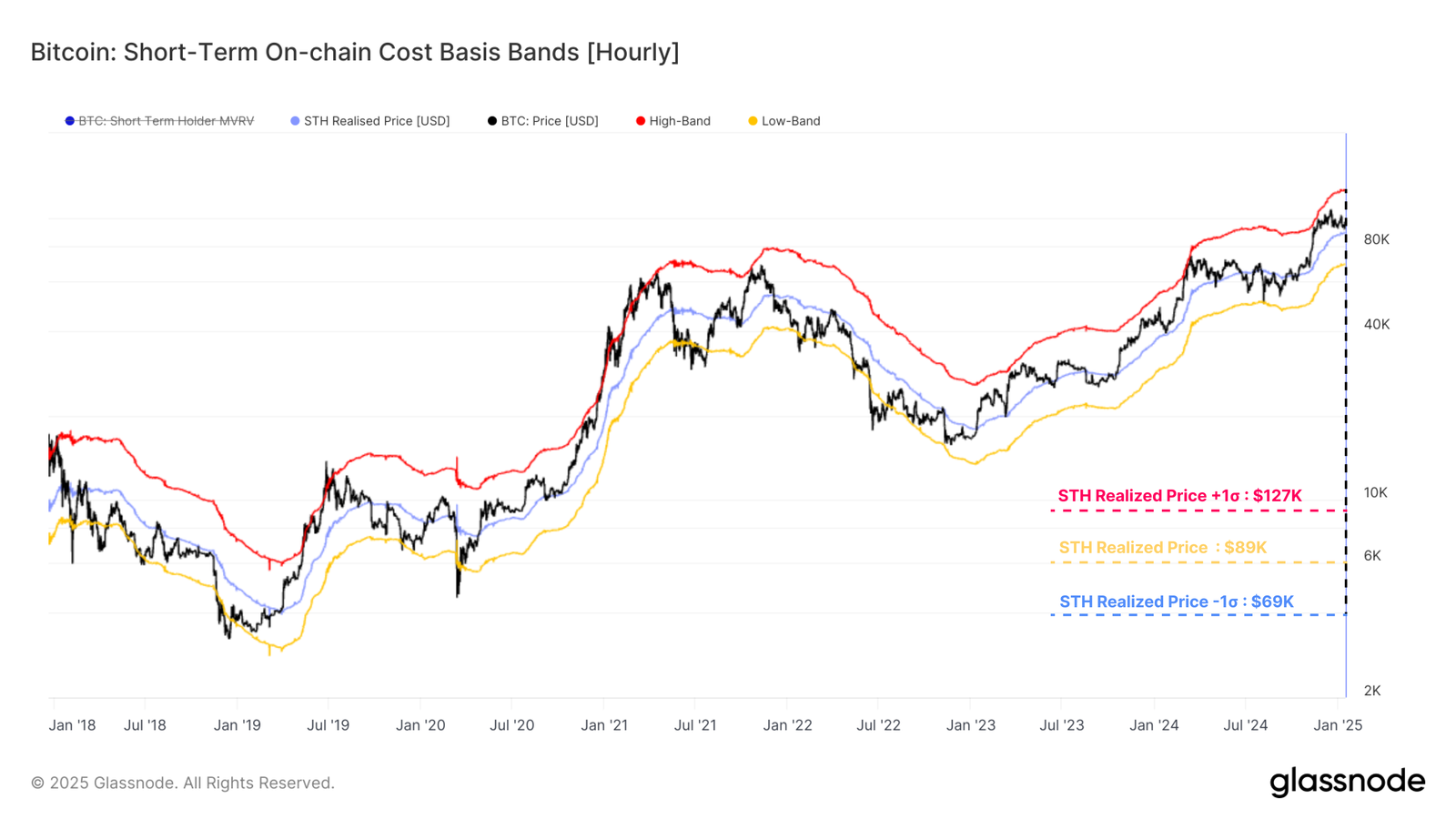

- For bullish sentiment to be sustained, BTC worth should keep above STH price foundation of $88.4K.

- Over 2M BTC held by short-term holders (STH) have been underwater, but it surely wasn’t a pink flag.

The incoming Trump Administration will undoubtedly be bullish for Bitcoin and the general crypto market. Nonetheless, this week’s market volatility and a quick drop beneath $90K have highlighted an important short-term threat issue price monitoring – BTC short-term holders (STH).

These traders have held BTC

BTC

$100 312

24h volatility:

0.2%

Market cap:

$1.99 T

Vol. 24h:

$52.76 B

for about six months (155 days) or much less. Their price foundation or common acquisition worth (STH realized worth) at all times acts as a key help degree.

Moreover, their degree of profitability can rapidly affect the market, as they’ll promote at a loss when the value declines beneath their price foundation. This pattern was seen through the liquidation cascade on August fifth and December fifth, dragging BTC decrease.

Glassnode marked the present STH realized worth at $88.4K, a whisker away from the low of $89.25K recorded on January thirteenth. Merely put, bulls should maintain BTC above this degree for a sustained uptrend.

Over 2 Million BTC underwater

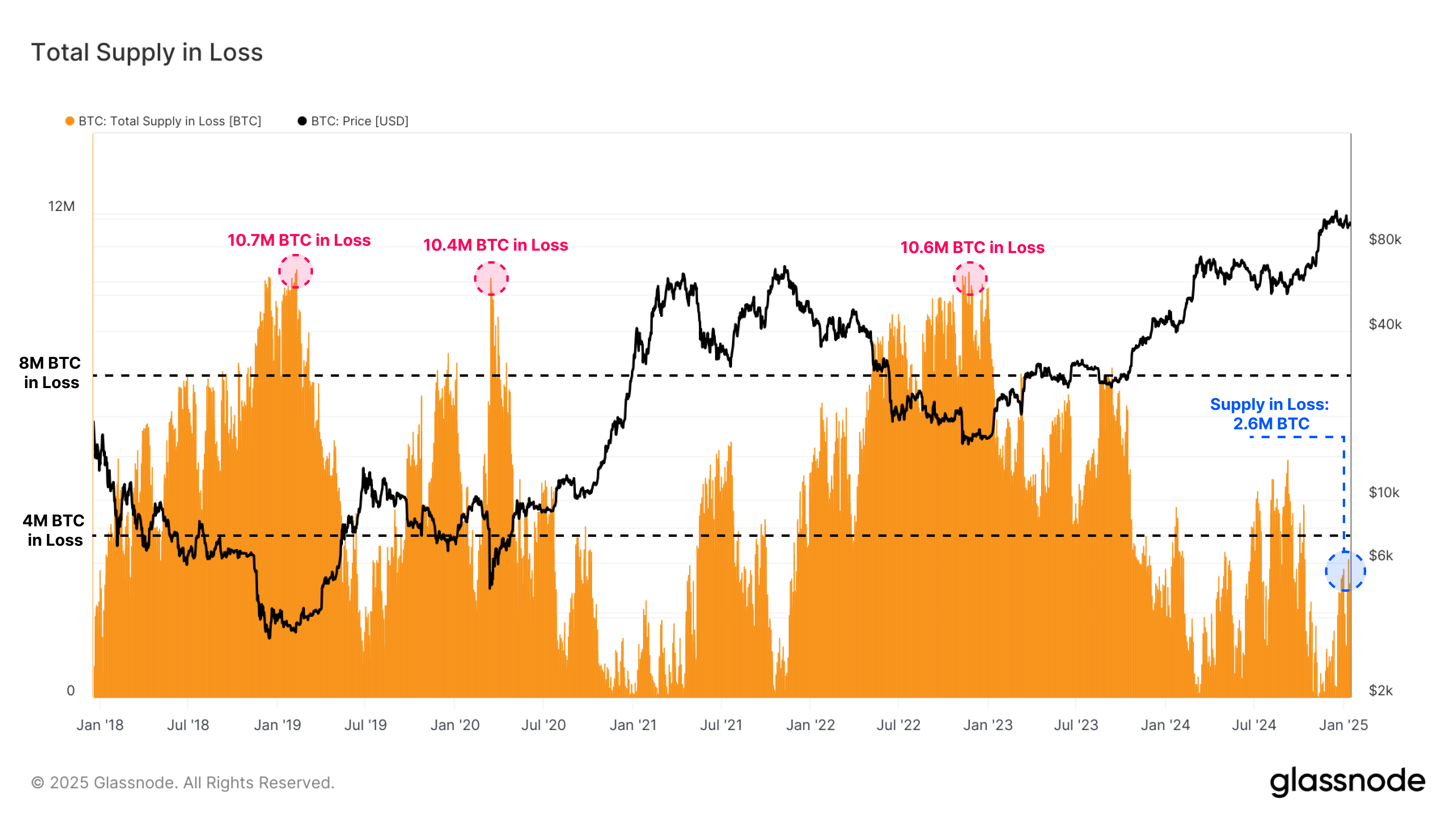

Glassnode added that this week’s market volatility pushed 2 million to three.6 million BTC held by STH underwater. Nonetheless, the blockchain analytics agency clarified that the figures have been beneath a key historic threshold to trigger an alarm.

“Whereas vital, this vary remains to be decrease than the 4 million cash in loss through the native market low set between July and September 2024. This implies that the present market is probably going in a much less distressed state than it was through the earlier corrective section,” wrote Glassnode.

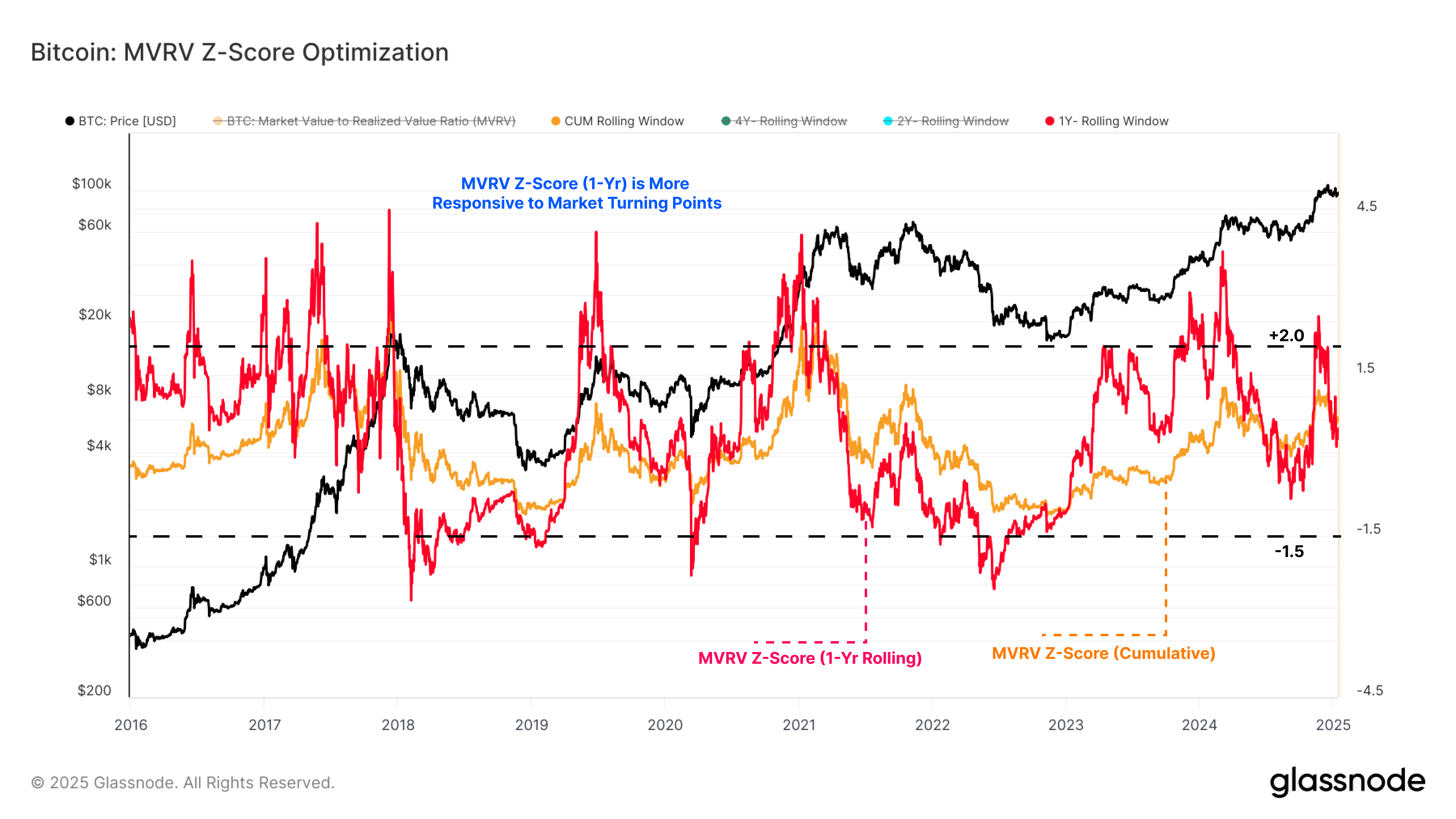

- That mentioned, analysts anticipate a surge to $118K within the medium time period, which might deliver most of STH BTC again to revenue. The optimism was additionally supported by the MVRV-Z rating (1-year-rolling), a valuation and market cycle indicator.

The metric (pink) had beforehand flagged BTC native and cycle peaks when it crossed above 2. When it soared above 2, the crypto hit native tops in March ($73K) and December ($108K).

Presently, the indicator has retreated beneath 1.5, suggesting sufficient room for progress for BTC to climb larger earlier than hitting a neighborhood or cycle peak. By extension, it additionally implied that BTC was comparatively undervalued at present ranges.

It’s price noting, nevertheless, that regardless of BTC’s enticing progress potential, a worth drop beneath the STH price foundation of $88.4K might dent the present bullish market sentiment. Therefore, it’s price monitoring as a threat administration issue.

Within the meantime, BTC was valued at $99.9K at press time, about 7% away from its all-time excessive of $108.3K.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Benjamin is a Telecommunication Engineering graduate who’s captivated with crypto-markets and unraveling market tendencies. Armed with information, charts and patterns, he is fascinated by making the intricate, complicated panorama of digital property simpler for each consumer.