Earlier at the moment, Coinbase announced the launch of “Bitcoin-Backed Loans” utilizing Base, its native blockchain. However there’s one downside. (Truly, two.)

These loans aren’t backed by Bitcoin, nor are they even on the Bitcoin blockchain.

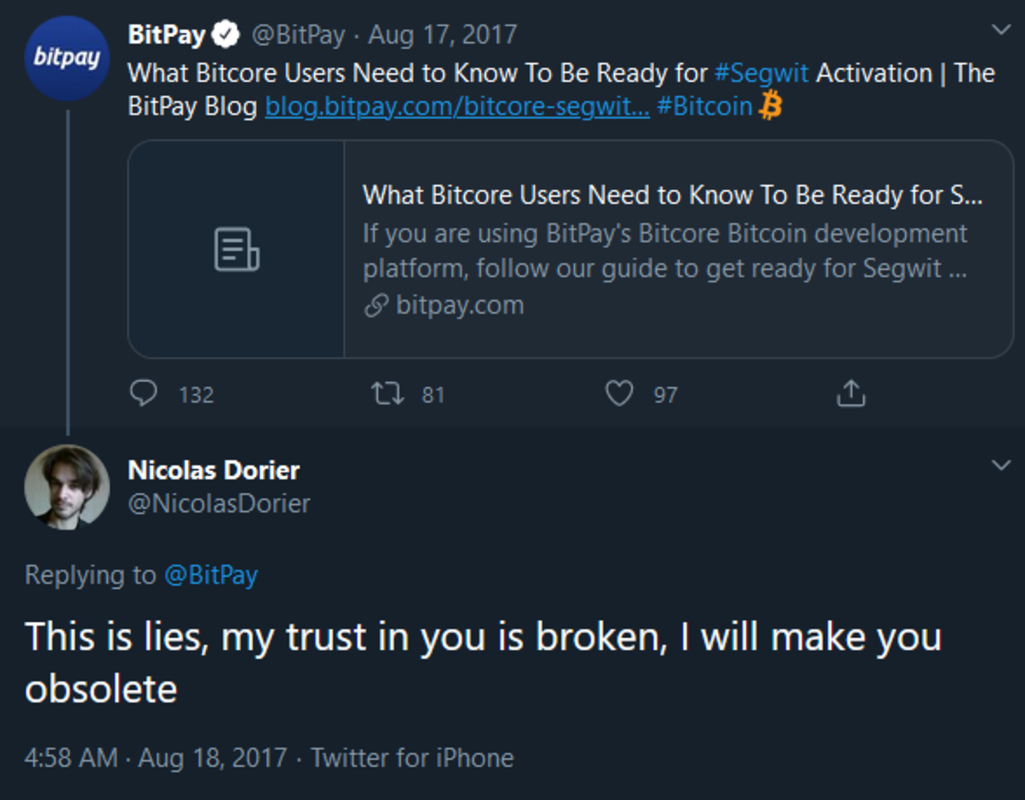

It’s disappointing that, in 2025, corporations are nonetheless willingly omitting key particulars to mislead Bitcoin holders into giving up custody of their cash.

Right here’s the reality: these loans are collateralized by cbBTC, Coinbase’s Bitcoin-wrapped product designed to compete with wBTC and tBTC. This isn’t Bitcoin. The truth is, cbBTC is arguably essentially the most centralized of those “wrapped” BTC tokens. To grasp the belief assumptions related to wrapped BTC, I like to recommend this wonderful put up by the Bitcoin Layers crew: Analyzing tBTC Against wBTC and cbBTC.

Right here’s the TL;DR:

“The BTC backing the cbBTC token is held in reserve wallets managed by Coinbase, a US-based centralized custodial supplier. Coinbase holds funds backing cbBTC in chilly storage wallets throughout various geographically distributed places and moreover has insurance coverage on funds they custody.”

Moreover, as an alternative of issuing these loans on a blockchain even remotely associated to Bitcoin (akin to Bitcoin sidechains or Bitcoin L2s), Coinbase is issuing them by Morpho Labs, a DeFi platform finest described as an AAVE competitor. Whereas Morpho is a well-established platform—and I don’t doubt its safety—it has no connection to Bitcoin.

I, for one, sit up for seeing precise Bitcoin-backed loans issued on the Bitcoin community itself. Many L2 groups are working exhausting to make this a actuality, striving to reduce belief assumptions—and even remove the necessity for bridging altogether (bullish!).

Why do we’d like native Bitcoin-backed loans within the first place? Take into account this: many Bitcoiners at the moment face stringent tax laws that impose hefty liabilities on long-term holders who promote their Bitcoin to fund important purchases like a home or a automotive. Taking out a mortgage backed by BTC permits people to keep away from triggering these tax occasions.

Furthermore, most Bitcoiners are assured that Bitcoin’s value shall be considerably greater sooner or later than it’s at the moment. So why would anybody promote an asset with such promising long-term potential? Bitcoin-backed loans allow holders to retain publicity to Bitcoin’s upside whereas accessing the liquidity wanted to satisfy life’s monetary calls for.

In at the moment’s market, the choices for Bitcoin-backed lending are restricted. You may both depend on centralized corporations (just like the respected crew at Unchained) or flip to “DeFi” protocols, which are sometimes centralized themselves and, in some circumstances, riskier than centralized options like Unchained. Nonetheless, there’s presently no actually Bitcoin-native answer—no possibility for Bitcoiners to take care of custody of their cash whereas accessing loans.

Some corporations, like Lava.xyz, are starting to deal with this hole. Nonetheless, their market share stays a small fraction of the volumes dealt with by present DeFi platforms. (Control Lava—they’re poised to make waves in 2025!)

One quote from the unique announcement stood out to me:

“The combination of Bitcoin-backed loans on Coinbase is ‘TradFi within the entrance, DeFi within the again,’” stated Max Branzburg, Coinbase’s vp of product, in an announcement to The Block.

Let’s name it what it truly is: centralized within the entrance, and centralized within the again.

It’s time to depart these deceptive choices behind and produce true Bitcoin Finance (BTCfi) to customers—not simply advertising and marketing buzzwords and half-truths.

As a substitute of claiming: Bitcoin backed on-chain loans let’s say: multisig-backed derivatives loans on a centralized chain.

This text is a Take. Opinions expressed are fully the writer’s and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

Articles I write could talk about matters or corporations which might be a part of my agency’s funding portfolio (UTXO Management). The views expressed are solely my very own and don’t characterize the opinions of my employer or its associates. I’m receiving no monetary compensation for these takes. Readers shouldn’t take into account this content material as monetary recommendation or an endorsement of any specific firm or funding. All the time do your individual analysis earlier than making monetary selections.