- Cardano whales purchased 100 Million ADA over the previous 48 hours, coinciding with the broader crypto market rebound.

- ADA is again above $1, however the altcoin is consolidating inside a bullish pennant sample on the 4-hour timeframe

Cardano (ADA) is again on the watch of whales as they bought 100 million ADA, considerably affecting the community and its value. In truth, the value surged from $0.998 to $1.11, reflecting intensified exercise by these giant holders.

This shopping for spree coincided with a basic market rebound, suggesting potential for additional value hikes if whale acquisitions persist. Conversely, a slowdown in whale exercise may see ADA retract to its decrease help ranges on the charts.

The market’s trajectory hinges on sustained large-scale investments and broader market traits. These are essential in figuring out whether or not ADA will problem increased resistances or consolidate at its present ranges, underlining the pivotal position of whale transactions in shaping market instructions.

ADA future value depends on…

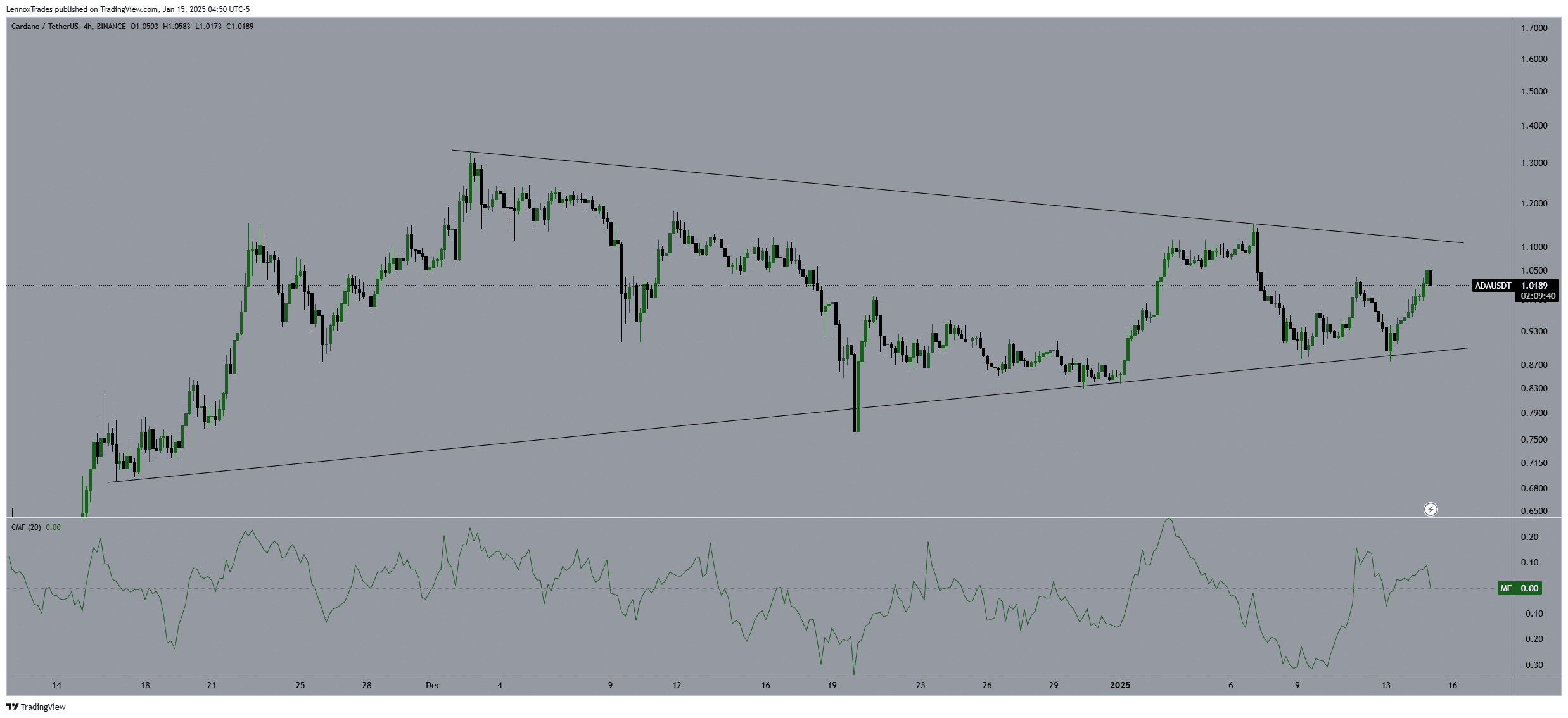

Following a broader market rebound, Cardano’s value motion ascended previous the $1.00 threshold, indicating sturdy shopping for momentum.

This motion on the 4-hour chart noticed ADA oscillating inside an outlined bullish pennant, with the value presently close to $1.08. Notably, ADA not too long ago touched a low of $0.87 earlier than rebounding to its press time ranges – An indication of sturdy help inside this zone.

A breakout from this pennant, notably above the $1.10 resistance degree, would level to a possible rally in direction of $1.50. This may align with the altcoin’s historic resistance factors.

Lending extra weight to the evaluation, the Chaikin Cash Circulate (CMF) index hovered across the zero line to mirror balanced market strain, whereas additionally supporting a secure ascent. This, regardless of the broader correction that was seen within the crypto markets.

Therefore, concentrating on the resistance at $1.50 turns into possible. Particularly if the CMF stays above the impartial threshold – An indication of sustained shopping for momentum.

Nonetheless, ADA’s current consolidation inside this sample additionally introduced warning for attainable pullbacks if a breakout fails, underscoring the criticality of market sentiment and buying and selling quantity in figuring out the following important value motion.

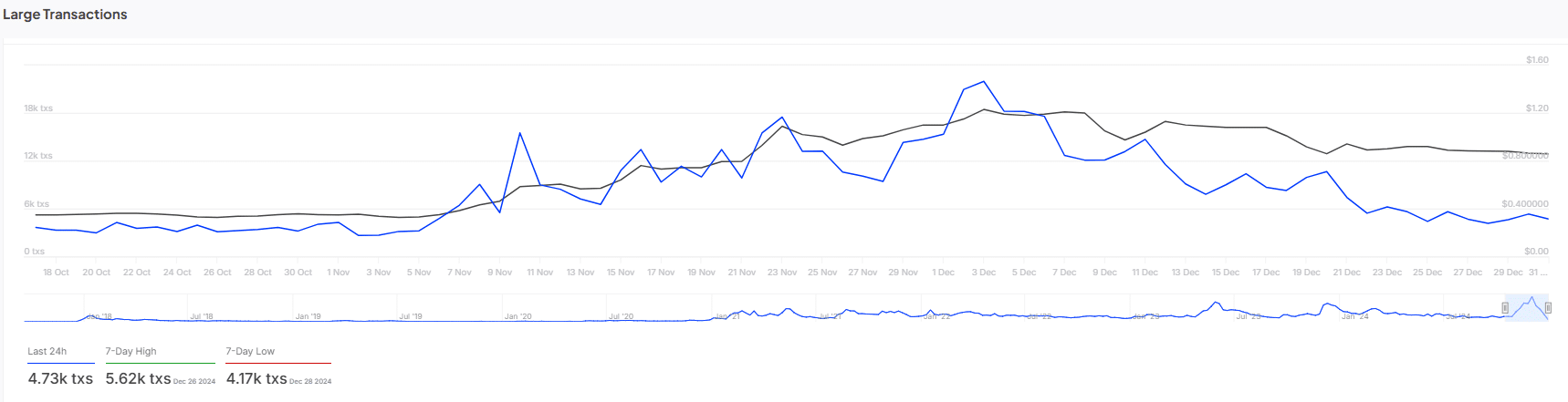

Variety of giant transactions

The variety of giant ADA transactions spiked, hitting a excessive of 5.62k transactions in early December, notably on the third. Since then, this exercise has steadily fallen, at the same time as ADA’s value stabilized round $1.20.

Proper now, giant transactions have settled at a 7-day low of 4.17k – Highlighting the decreased quantity of serious trades.

This fall in large-scale buying and selling exercise may sign a weakening of shopping for momentum or a consolidation part, which could cap additional value features within the brief time period.

If this development continues, ADA may battle to maintain increased value ranges, probably resulting in sideways or downward value motion. Except renewed giant transaction exercise emerges to drive the value north once more.

- Cardano whales purchased 100 Million ADA over the previous 48 hours, coinciding with the broader crypto market rebound.

- ADA is again above $1, however the altcoin is consolidating inside a bullish pennant sample on the 4-hour timeframe

Cardano (ADA) is again on the watch of whales as they bought 100 million ADA, considerably affecting the community and its value. In truth, the value surged from $0.998 to $1.11, reflecting intensified exercise by these giant holders.

This shopping for spree coincided with a basic market rebound, suggesting potential for additional value hikes if whale acquisitions persist. Conversely, a slowdown in whale exercise may see ADA retract to its decrease help ranges on the charts.

The market’s trajectory hinges on sustained large-scale investments and broader market traits. These are essential in figuring out whether or not ADA will problem increased resistances or consolidate at its present ranges, underlining the pivotal position of whale transactions in shaping market instructions.

ADA future value depends on…

Following a broader market rebound, Cardano’s value motion ascended previous the $1.00 threshold, indicating sturdy shopping for momentum.

This motion on the 4-hour chart noticed ADA oscillating inside an outlined bullish pennant, with the value presently close to $1.08. Notably, ADA not too long ago touched a low of $0.87 earlier than rebounding to its press time ranges – An indication of sturdy help inside this zone.

A breakout from this pennant, notably above the $1.10 resistance degree, would level to a possible rally in direction of $1.50. This may align with the altcoin’s historic resistance factors.

Lending extra weight to the evaluation, the Chaikin Cash Circulate (CMF) index hovered across the zero line to mirror balanced market strain, whereas additionally supporting a secure ascent. This, regardless of the broader correction that was seen within the crypto markets.

Therefore, concentrating on the resistance at $1.50 turns into possible. Particularly if the CMF stays above the impartial threshold – An indication of sustained shopping for momentum.

Nonetheless, ADA’s current consolidation inside this sample additionally introduced warning for attainable pullbacks if a breakout fails, underscoring the criticality of market sentiment and buying and selling quantity in figuring out the following important value motion.

Variety of giant transactions

The variety of giant ADA transactions spiked, hitting a excessive of 5.62k transactions in early December, notably on the third. Since then, this exercise has steadily fallen, at the same time as ADA’s value stabilized round $1.20.

Proper now, giant transactions have settled at a 7-day low of 4.17k – Highlighting the decreased quantity of serious trades.

This fall in large-scale buying and selling exercise may sign a weakening of shopping for momentum or a consolidation part, which could cap additional value features within the brief time period.

If this development continues, ADA may battle to maintain increased value ranges, probably resulting in sideways or downward value motion. Except renewed giant transaction exercise emerges to drive the value north once more.