The Bitcoin value has recovered above $97,000, offering a bullish outlook for the flagship crypto. Regardless of this improvement, BTC traders nonetheless look apprehensive as their technique suggests they’re nonetheless bearish on the present value motion.

Bitcoin Merchants Flip Bearish Following Worth Restoration

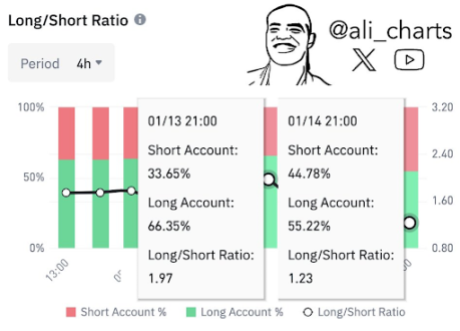

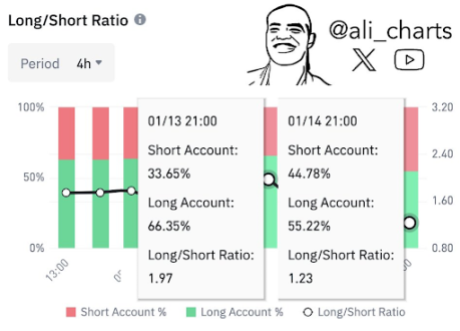

In an X post, crypto analyst Ali Martinez revealed that Bitcoin merchants have turned bearish regardless of the price recovery above $97,000. The crypto analyst talked about that the share of merchants on Binance betting BTC will rise has declined from 66.35% to 55.22% over the previous 24 hours.

Associated Studying

This improvement is critical as these Binance traders have a observe document of being proper more often than not. Whereas most merchants (55.22%) are nonetheless longing BTC, the decline in these betting on an increase suggests that there’s the chance that the current value restoration is only a reduction bounce and never a bullish reversal.

The Bitcoin value has recovered above $97,000 after dropping to beneath $90,000 two days in the past. This current rally might pave the way in which for the flagship crypto to reclaim the psychological $100,000 value stage. Crypto analyst Jelle is assured that this might occur quickly, as he acknowledged {that a} price breakout above $97,000 might result in new highs for Bitcoin.

Nevertheless, there may be nonetheless quite a lot of market uncertainty, which might clarify why a few of these Bitcoin merchants are selecting to not guess on an extra rally regardless of the current value restoration. Current macro knowledge have steered that the Federal Reserve is unlikely to implement as many quantitative easing (QE) insurance policies as in comparison with final yr.

That is bearish for the Bitcoin value since traders might turn into extra skeptical about investing on this threat asset. Then again, Donald Trump’s incoming administration gives some optimism for market individuals because the US president-elect has promised to create a Strategic Bitcoin Reserve, which might result in better adoption of BTC.

BTC’s Market Construction Has Modified

Crypto analyst Trader Tardigrade additionally supplied a bullish outlook for the Bitcoin value. In an X submit, he acknowledged that Bitcoin has shifted the market construction from a downtrend to an uptrend. He defined that when BTC was in a downtrend with decrease highs and decrease lows, it created an equal excessive, signaling a “change of character.”

Associated Studying

Now, Bitcoin has damaged by way of the resistance to kind the next excessive. In line with Dealer Tardigrade, if BTC maintains the next low on the assist/ resistance flip stage of $96,000, it might begin the bull run once more. The analyst’s accompanying chart confirmed that the flagship crypto might reclaim $100,000 after which rally to new highs.

On the time of writing, the Bitcoin value is buying and selling at round $97,300, up over 2% within the final 24 hours, in line with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com

The Bitcoin value has recovered above $97,000, offering a bullish outlook for the flagship crypto. Regardless of this improvement, BTC traders nonetheless look apprehensive as their technique suggests they’re nonetheless bearish on the present value motion.

Bitcoin Merchants Flip Bearish Following Worth Restoration

In an X post, crypto analyst Ali Martinez revealed that Bitcoin merchants have turned bearish regardless of the price recovery above $97,000. The crypto analyst talked about that the share of merchants on Binance betting BTC will rise has declined from 66.35% to 55.22% over the previous 24 hours.

Associated Studying

This improvement is critical as these Binance traders have a observe document of being proper more often than not. Whereas most merchants (55.22%) are nonetheless longing BTC, the decline in these betting on an increase suggests that there’s the chance that the current value restoration is only a reduction bounce and never a bullish reversal.

The Bitcoin value has recovered above $97,000 after dropping to beneath $90,000 two days in the past. This current rally might pave the way in which for the flagship crypto to reclaim the psychological $100,000 value stage. Crypto analyst Jelle is assured that this might occur quickly, as he acknowledged {that a} price breakout above $97,000 might result in new highs for Bitcoin.

Nevertheless, there may be nonetheless quite a lot of market uncertainty, which might clarify why a few of these Bitcoin merchants are selecting to not guess on an extra rally regardless of the current value restoration. Current macro knowledge have steered that the Federal Reserve is unlikely to implement as many quantitative easing (QE) insurance policies as in comparison with final yr.

That is bearish for the Bitcoin value since traders might turn into extra skeptical about investing on this threat asset. Then again, Donald Trump’s incoming administration gives some optimism for market individuals because the US president-elect has promised to create a Strategic Bitcoin Reserve, which might result in better adoption of BTC.

BTC’s Market Construction Has Modified

Crypto analyst Trader Tardigrade additionally supplied a bullish outlook for the Bitcoin value. In an X submit, he acknowledged that Bitcoin has shifted the market construction from a downtrend to an uptrend. He defined that when BTC was in a downtrend with decrease highs and decrease lows, it created an equal excessive, signaling a “change of character.”

Associated Studying

Now, Bitcoin has damaged by way of the resistance to kind the next excessive. In line with Dealer Tardigrade, if BTC maintains the next low on the assist/ resistance flip stage of $96,000, it might begin the bull run once more. The analyst’s accompanying chart confirmed that the flagship crypto might reclaim $100,000 after which rally to new highs.

On the time of writing, the Bitcoin value is buying and selling at round $97,300, up over 2% within the final 24 hours, in line with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com