Over the previous yr, the Bitcoin Renaissance has introduced vital consideration to BTCfi, or “Bitcoin DeFi” functions. Regardless of the hype, only a few of those functions have delivered on their guarantees or managed to retain a significant variety of “precise” customers.

To place issues into perspective, the main lending platform for Bitcoin property, Liquidium, permits customers to borrow in opposition to their Runes, Ordinals, and BRC-20 property. The place does the yield come from, you ask? Similar to another mortgage, debtors pay an rate of interest to lenders in trade for his or her Bitcoin. Moreover, to make sure the safety of the loans, they’re at all times overcollateralized by the Bitcoin property themselves.

How large is Bitcoin DeFi proper now? It relies on your perspective.

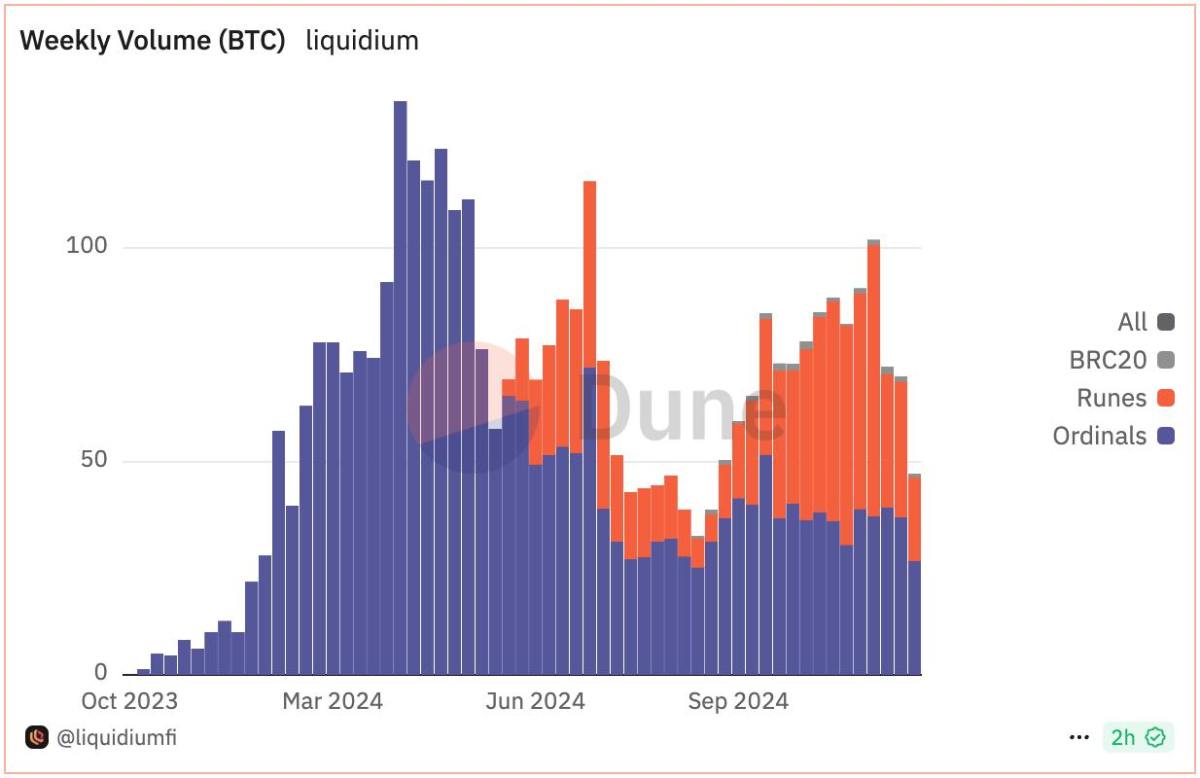

In about 12 months, Liquidium has executed over 75,000 loans, representing greater than $360 million in complete mortgage quantity, and paid over $6.3 million in native BTC curiosity to lenders.

For BTCfi to be thought-about “actual,” I’d argue that these numbers must develop exponentially and change into akin to these on different chains akin to Ethereum or Solana. (Though, I firmly consider that over time, comparisons will change into irrelevant as all financial exercise will finally choose Bitcoin.)

That mentioned, these achievements are spectacular for a protocol that’s barely a yr outdated, working on a series the place even the slightest point out of DeFi usually meets with excessive skepticism. For extra context, Liquidium is already outpacing altcoin opponents akin to NFTfi, Arcade, and Sharky in quantity.

Bitcoin is evolving in actual time, with out requiring adjustments to its base protocol — I’m right here for it.

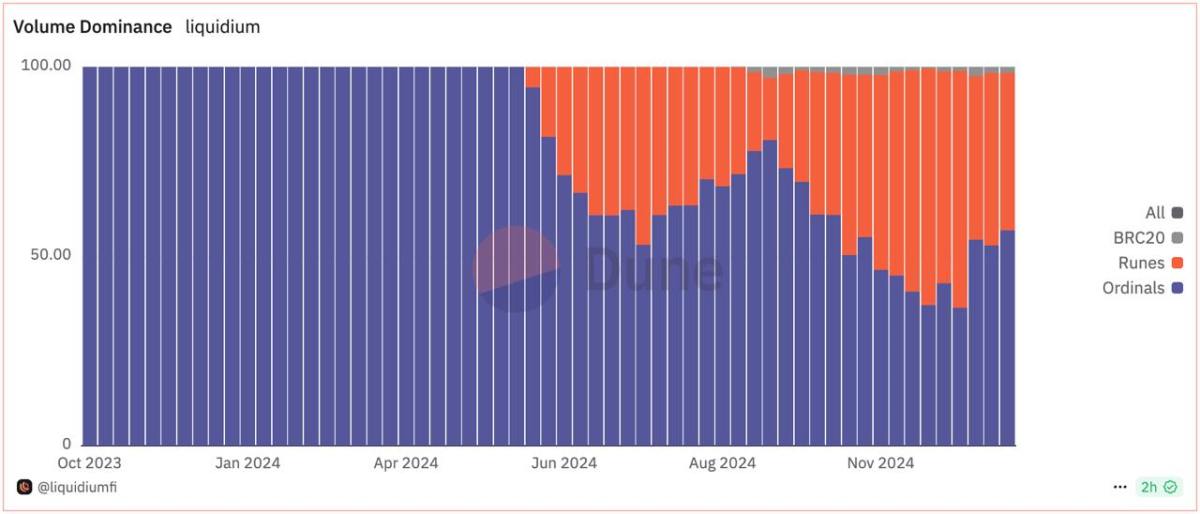

After a rocky begin, Runes are actually accountable for almost all of loans taken out on Liquidium, outpacing each Ordinals and BRC-20s. Runes is a considerably extra environment friendly protocol that gives a lighter load on the Bitcoin blockchain and delivers a barely improved person expertise. The improved person expertise offered by Runes not solely simplifies the method for present customers, but in addition attracts a considerable variety of new customers that will be prepared to curiosity on-chain in a extra complicated means. In distinction, BRC-20 struggled to amass new customers as a result of its complexity and fewer intuitive design. Having extra monetary infrastructure like P2P loans is subsequently marking a step ahead within the usability and adoption of Runes, and doubtlessly different Bitcoin backed property down the road.

The amount of loans on Liquidium has constantly elevated over the previous yr, with Runes now comprising the vast majority of exercise on the platform.

Okay so Runes are actually the dominant asset backing Bitcoin native loans, why ought to I care? Is that this good for Bitcoin?

I’d argue that, no matter your private opinion about Runes or the on-chain degen video games taking place proper now, the truth that actual folks belief the Bitcoin blockchain to take out decentralized loans denominated in Bitcoin ought to make freedom lovers arise and cheer.

We’re profitable.

Bitcoiners have at all times asserted that no different blockchain can match Bitcoin’s safety ensures. Now, others are starting to see this too, bringing new types of financial exercise on-chain. That is undeniably bullish.

Furthermore, all transactions are natively secured on the Bitcoin blockchain—no wrapping, no bridging, simply Bitcoin. We must always encourage and assist people who find themselves constructing on this means.

This text is a Take. Opinions expressed are solely the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.