- A bullish TD Sequential sign emerges, however resistance at $1.29 stays essential.

- Deal with and transaction exercise surge, indicating potential accumulation forward of a value restoration.

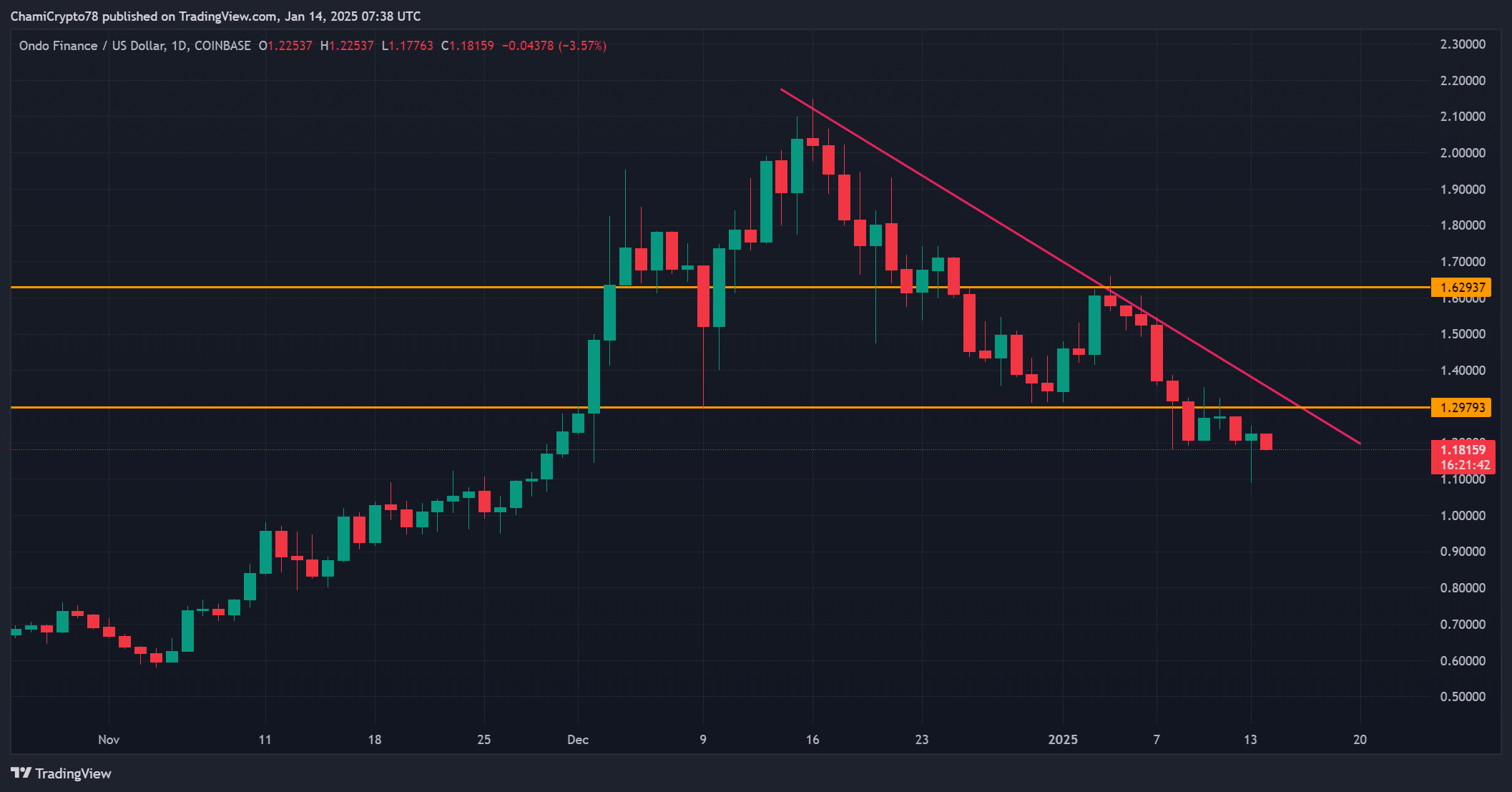

Since its peak in December, Ondo [ONDO] has corrected by practically 50%, resulting in a present buying and selling value of $1.18, reflecting a 3.09% improve, at press time.

Regardless of this restoration, the Parabolic SAR stays above the value, indicating lingering bearish stress. Moreover, ONDO has struggled to reclaim the essential $1.29 resistance, with decrease assist forming close to $1.18.

Nonetheless, the looks of a bullish TD Sequential sign on the 3-day chart suggests that promoting stress could also be easing. This might pave the way in which for a restoration if supported by elevated market exercise.

Due to this fact, merchants should carefully watch how the value reacts to the descending trendline and key resistance ranges within the coming days.

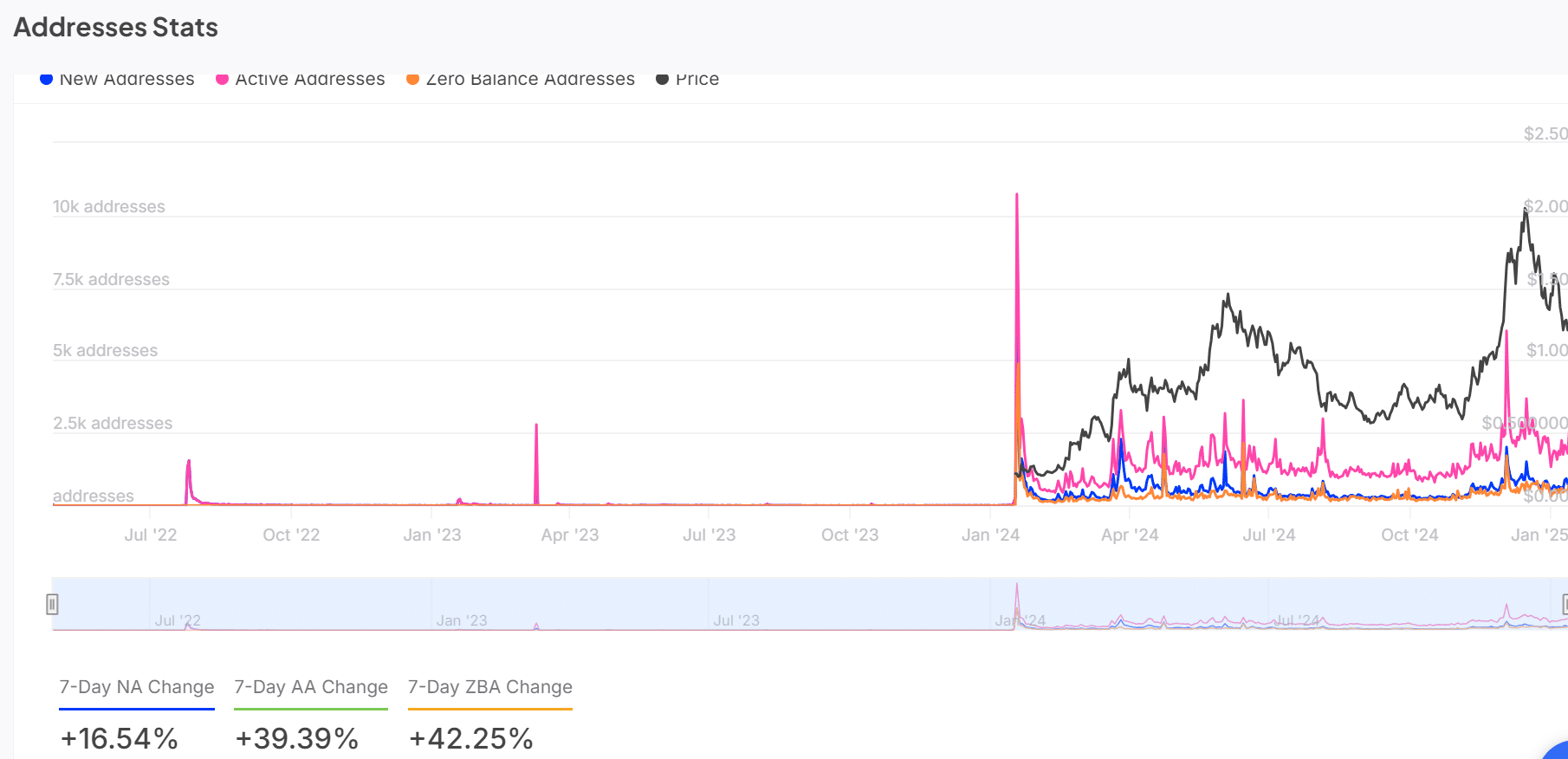

ONDO addresses stats: Are traders displaying curiosity?

Deal with exercise reveals a noticeable uptick, indicating elevated market participation. Over the previous week, new addresses grew by 16.54%, energetic addresses surged by 39.39%, and zero-balance addresses climbed by 42.25%.

This development displays heightened investor curiosity, doubtless fueled by ONDO’s sharp correction, making it extra interesting for accumulation.

Moreover, this improve in new addresses aligns with rising hypothesis concerning the token’s restoration potential. Nonetheless, sustained development in deal with exercise is important to validate a bullish outlook.

If these tendencies persist, they might point out accumulating confidence amongst traders.

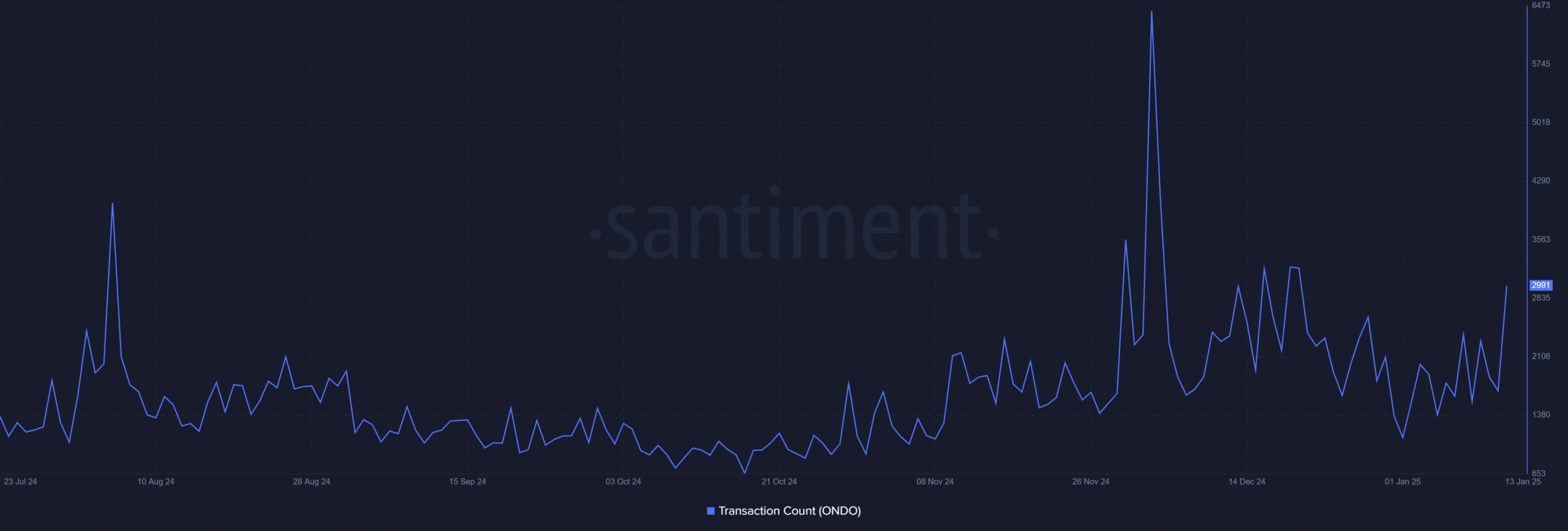

ONDO transaction depend: An increase in community exercise

ONDO’s transaction depend just lately jumped from 1,686 to 2,991, indicating a big improve in community engagement. Traditionally, such surges align with intervals of elevated accumulation, typically previous bullish value motion.

This rise means that merchants and traders are positioning themselves for potential upward motion. Nonetheless, it is very important monitor whether or not this exercise stays constant or declines.

Technical indicators: A difficult however hopeful outlook

Technical indicators current a combined narrative. The DMI reveals a dominant -D line at 27.05, whereas the +D line lags at 11.65, confirming a bearish pattern.

The ADX at 27 alerts that this pattern is well-defined. Nonetheless, the TD Sequential indicator’s bullish sign suggests this bearish part could also be nearing its finish.

The Parabolic SAR’s placement above the value reaffirms short-term bearish momentum. Due to this fact, breaking by the $1.29 resistance stays essential to shifting momentum in favor of bulls. If achieved, it might signify the beginning of a sustained restoration.

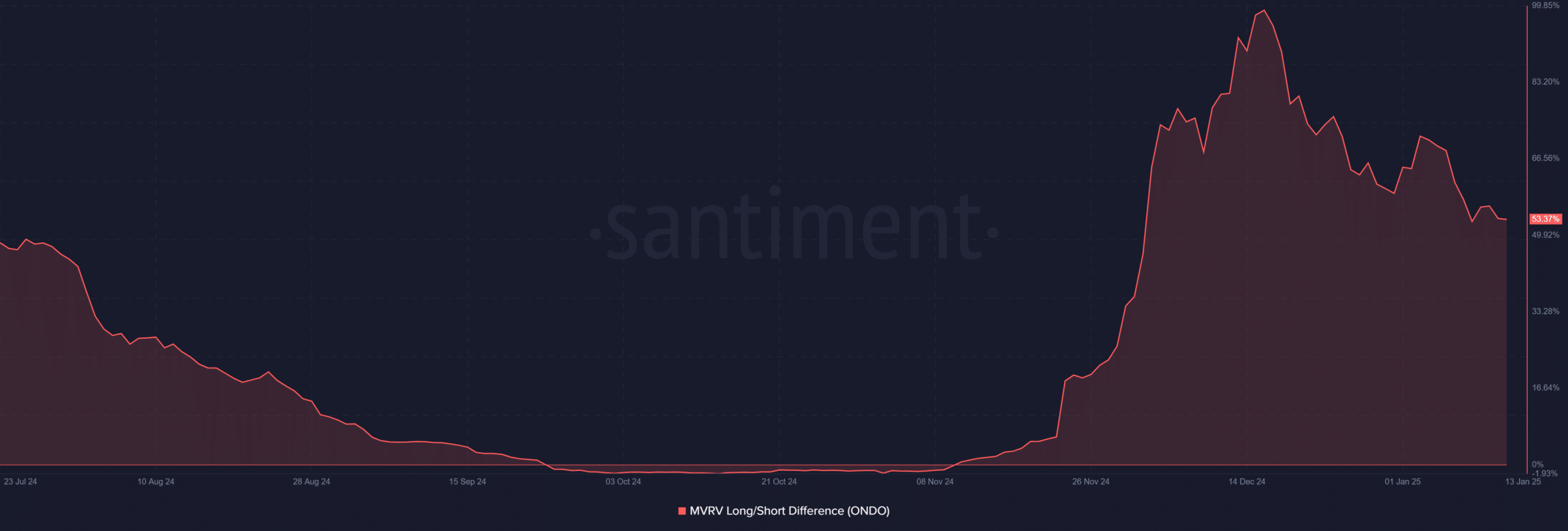

MVRV lengthy/brief distinction: Sentiment cooling off?

The MVRV lengthy/brief distinction presently sits at 53.37%, down considerably from its highs in December. This metric suggests decreased profit-taking stress, indicating that the market could also be stabilizing.

Traditionally, such declines in MVRV typically precede value recoveries, as sellers exit and patrons accumulate.

Learn Ondo Finance’s [ONDO] Price Prediction 2025–2026

Conclusion: Is ONDO prepared for a comeback?

ONDO is displaying combined however promising indicators of a possible restoration. Whereas technical indicators stay bearish, elevated deal with exercise, a spike in transaction counts, and a bullish TD Sequential sign recommend rising optimism.

A decisive breakout above $1.29 would affirm a reversal, marking the start of a sustained restoration. For now, cautious optimism seems warranted.