- Lowered buying and selling quantity confirmed indecisiveness out there

- The $0.0000247 vary excessive can be a viable worth goal for the approaching days

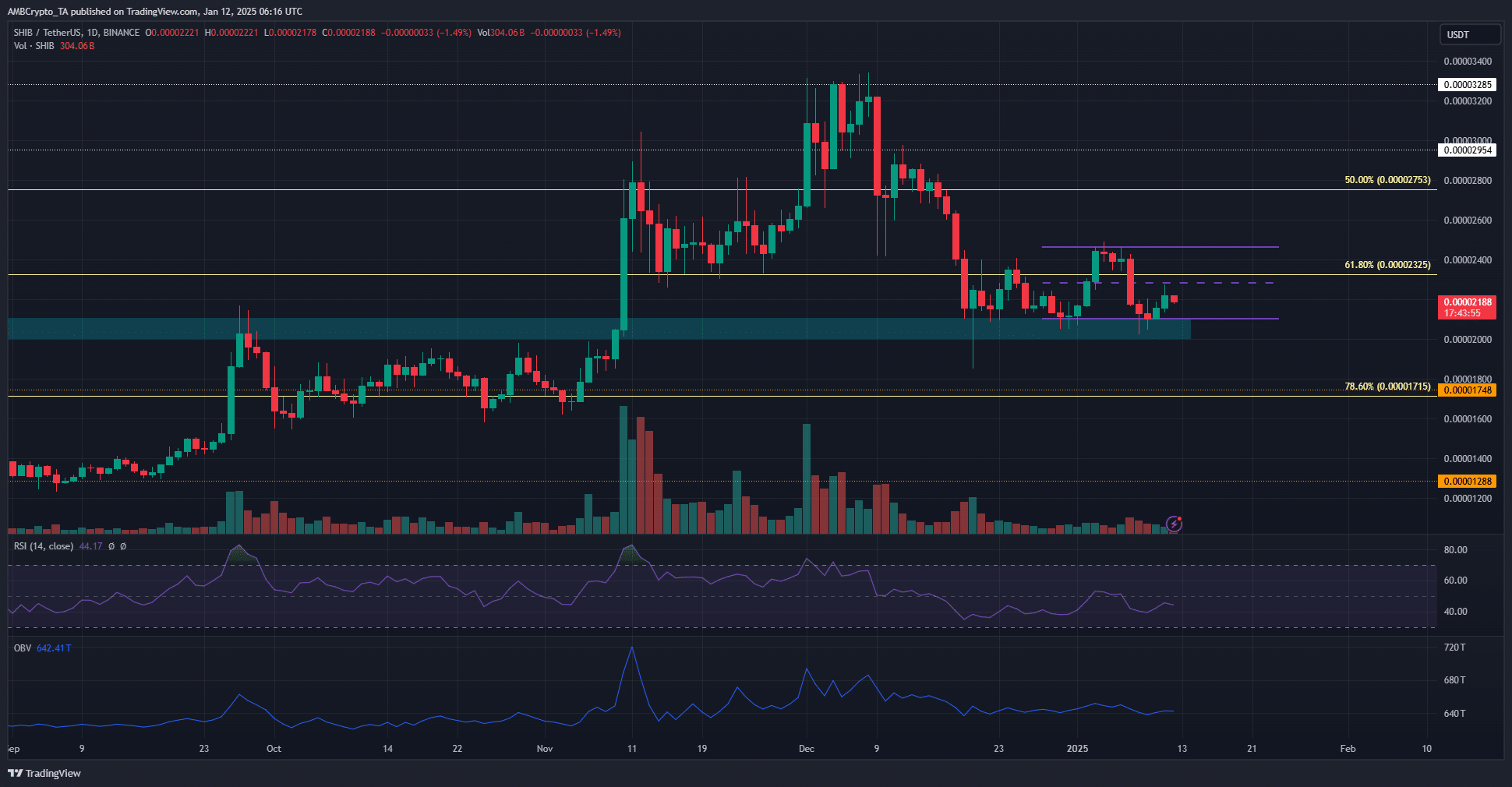

At press time, Shiba Inu [SHIB] mirrored bearish momentum, however the lowered buying and selling quantity in current weeks meant market contributors have been cautious. The bulls have been weak, however the bears didn’t exert a lot affect in current days both.

The memecoin gave the impression to be poised to maneuver both manner, relying on Bitcoin’s [BTC] pattern. A drop under the close by bullish breaker block might usher in a downtrend in direction of $0.000017 or decrease.

Shiba Inu extra prone to climb in direction of native highs, than fall decrease

Shiba Inu appeared to type a short-term vary between $0.0000211 and $0.0000246. The lows of the vary coincided with a bullish breaker block on the every day timeframe from June 2024. The vary formation across the essential 61.8% retracement stage didn’t point out bullishness on the upper timeframes.

The buying and selling quantity has been dwindling over the previous three weeks. Throughout that point, SHIB has meandered concerning the $0.00002325-level and fashioned a spread. The lowered quantity instructed contributors have been ready for the following sturdy pattern earlier than making a transfer.

The RSI on the every day was under impartial 50, displaying bearish momentum was in management. The OBV has not made decrease lows up to now three weeks. This was not a bullish discovering, however because it didn’t present bears have been dominant, it supplied patrons some hope.

Close by liquidation clusters spotlight short-term hassle areas

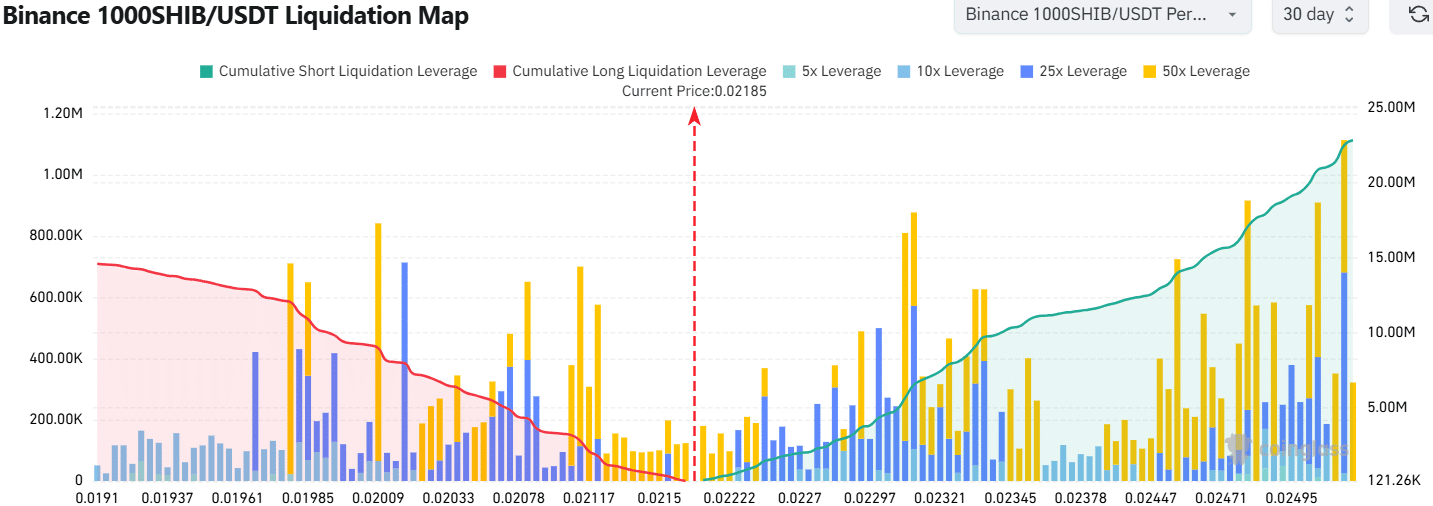

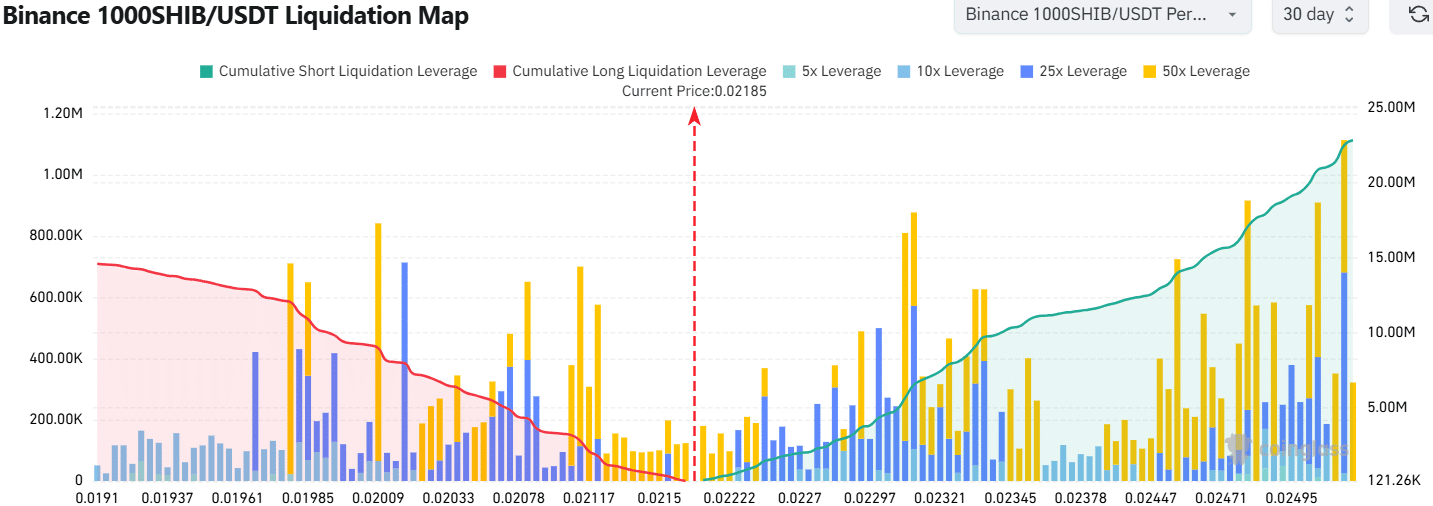

Supply: Coinglass

The liquidation map outlined two hassle areas for SHIB traders. The $0.00002117 and $0.00002312 ranges have been the close by excessive leverage liquidation clusters. They roughly lined up with the vary lows and the 61.8% Fibonacci retracement stage.

Learn Shiba Inu’s [SHIB] Price Prediction 2025-26

A push to both stage can be determination time for the memecoin. Primarily based on the amount and prevalent market sentiment, a breakout past these two areas may or won’t happen. Primarily based on the technical proof at hand, a push northward past $0.00002312 and to the vary highs at $0.00002464 could be anticipated.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion