After an surprising bearish plot twist previously week, the Bitcoin value motion has been fairly quiet over the weekend, with BTC barely holding above the $94,000 degree. The premier cryptocurrency briefly slipped beneath this value mark on Saturday, January 11, earlier than touring to as excessive as $94,870.

Curiously, a prime analyst on the social media platform X has put ahead an attention-grabbing evaluation of the Bitcoin value, suggesting that the market chief is likely to be at a pivotal juncture. May a bullish breakout be on the playing cards for the worth of BTC or is a deep correction the extra seemingly situation?

Bitcoin’s Efficiency In The Subsequent Few Weeks

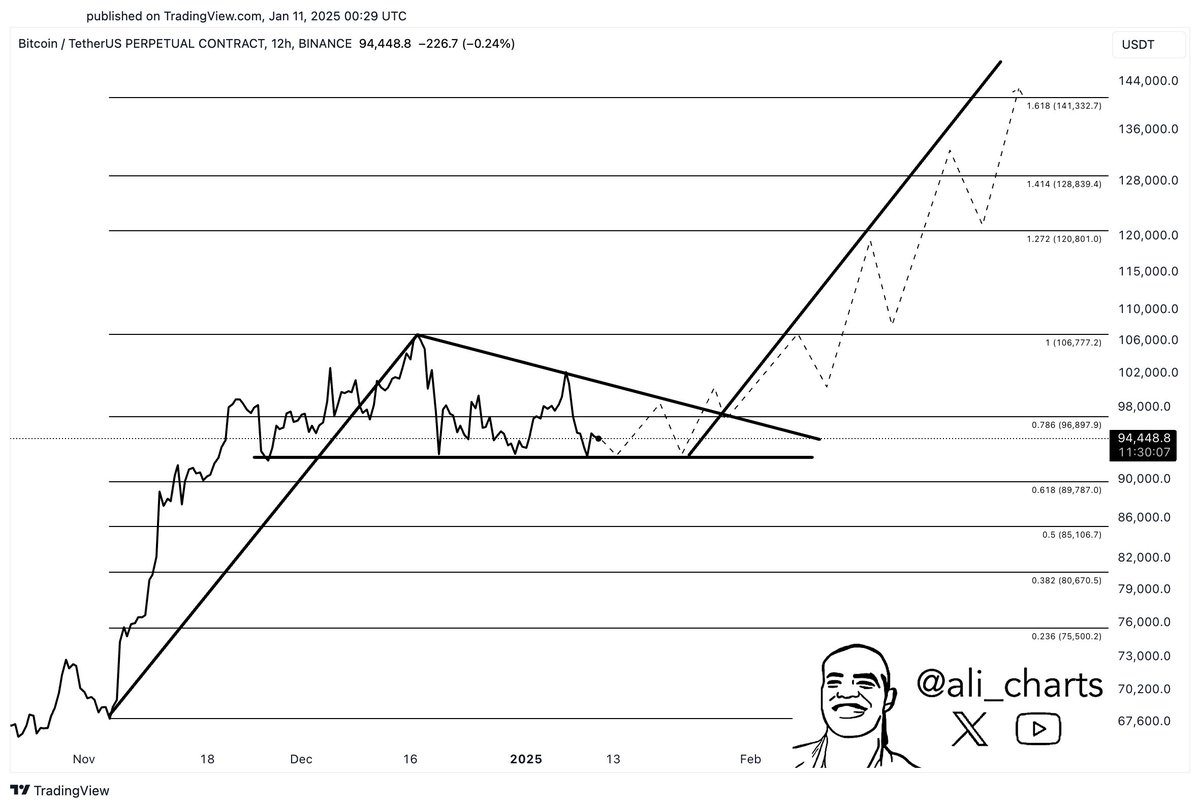

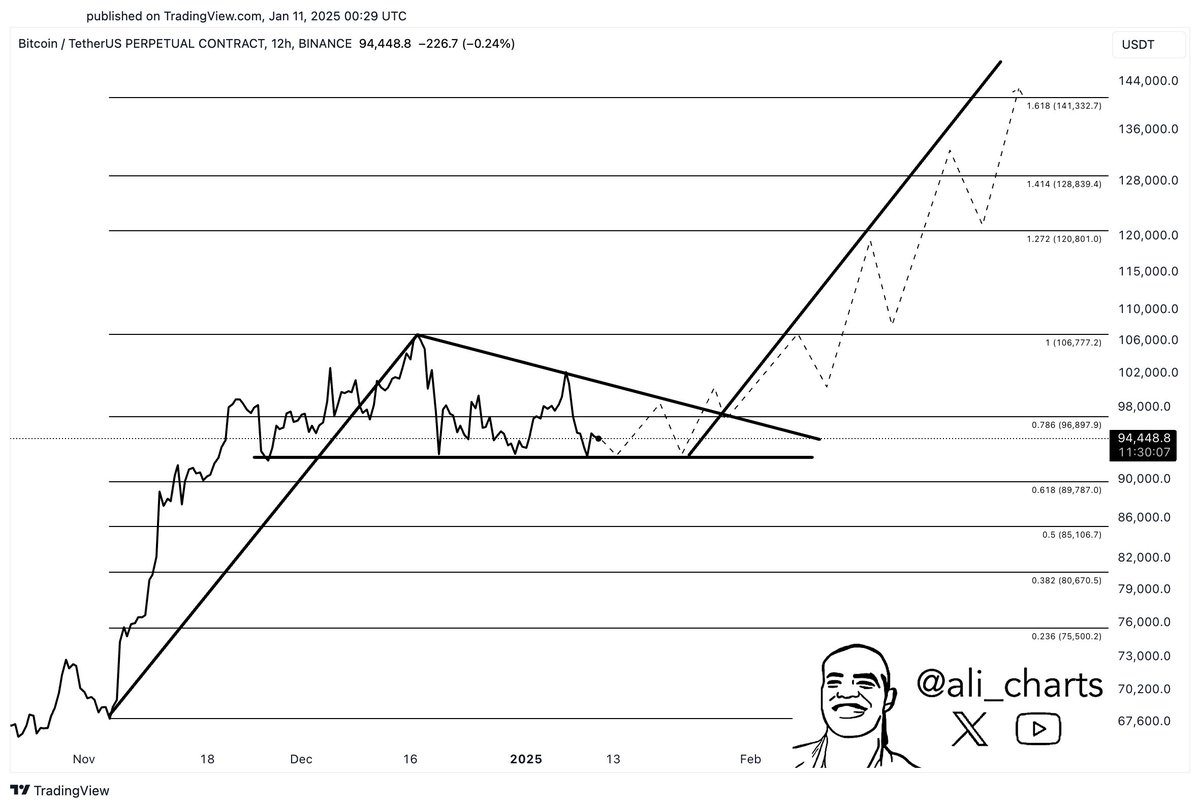

In a latest publish on X, fashionable crypto analyst Ali Martinez weighed in on the trajectory of the Bitcoin value over the following few weeks. Based on the market pundit, the flagship cryptocurrency is presently arrange such that it might see a transfer greater to $140,000 or a pullback to round $67,000.

Associated Studying

These projections are based mostly on the formation of two patterns, specifically the head-and-shoulders and the bull pennant, on the BTC 12-hour value chart. The pennant sample is marked by a value upswing (the flagpole) adopted by a consolidation vary with converging pattern strains (the pennant), whereas the head-and-shoulders formation (because the title suggests) is characterised by three distinct value highs, together with a better “head” between two decrease “shoulders.”

The pennant chart formation usually serves as a bullish continuation sample, suggesting the persistence of an upward value pattern. The pinnacle-and-shoulders sample, alternatively, sometimes signifies a possible bearish reversal, signaling a shift from an uptrend to a downtrend.

As seen within the chart above, the Bitcoin value is but to interrupt beneath the neckline of the head-and-shoulders sample, which regularly serves as affirmation for the pattern reversal. If the premier cryptocurrency breaks the neckline located at round $93,000, its value might plunge to as little as $67,000.

Nevertheless, Martinez identified that the following goal might be greater if the Bitcoin value holds above the neckline and breaks out of the bull pennant sample. If this happens, a bullish surge to round $140,000 might be on the playing cards for the worth of the market chief. This may symbolize an virtually 50% rally from the present value level.

Bitcoin Value At A Look

As of this writing, the price of BTC stands at round $94,600, reflecting no vital change previously 24 hours. Based on CoinGecko information, the premier cryptocurrency is down by practically 4% within the final seven days.

Associated Studying

.Featured picture from iStock, chart from TradingView

After an surprising bearish plot twist previously week, the Bitcoin value motion has been fairly quiet over the weekend, with BTC barely holding above the $94,000 degree. The premier cryptocurrency briefly slipped beneath this value mark on Saturday, January 11, earlier than touring to as excessive as $94,870.

Curiously, a prime analyst on the social media platform X has put ahead an attention-grabbing evaluation of the Bitcoin value, suggesting that the market chief is likely to be at a pivotal juncture. May a bullish breakout be on the playing cards for the worth of BTC or is a deep correction the extra seemingly situation?

Bitcoin’s Efficiency In The Subsequent Few Weeks

In a latest publish on X, fashionable crypto analyst Ali Martinez weighed in on the trajectory of the Bitcoin value over the following few weeks. Based on the market pundit, the flagship cryptocurrency is presently arrange such that it might see a transfer greater to $140,000 or a pullback to round $67,000.

Associated Studying

These projections are based mostly on the formation of two patterns, specifically the head-and-shoulders and the bull pennant, on the BTC 12-hour value chart. The pennant sample is marked by a value upswing (the flagpole) adopted by a consolidation vary with converging pattern strains (the pennant), whereas the head-and-shoulders formation (because the title suggests) is characterised by three distinct value highs, together with a better “head” between two decrease “shoulders.”

The pennant chart formation usually serves as a bullish continuation sample, suggesting the persistence of an upward value pattern. The pinnacle-and-shoulders sample, alternatively, sometimes signifies a possible bearish reversal, signaling a shift from an uptrend to a downtrend.

As seen within the chart above, the Bitcoin value is but to interrupt beneath the neckline of the head-and-shoulders sample, which regularly serves as affirmation for the pattern reversal. If the premier cryptocurrency breaks the neckline located at round $93,000, its value might plunge to as little as $67,000.

Nevertheless, Martinez identified that the following goal might be greater if the Bitcoin value holds above the neckline and breaks out of the bull pennant sample. If this happens, a bullish surge to round $140,000 might be on the playing cards for the worth of the market chief. This may symbolize an virtually 50% rally from the present value level.

Bitcoin Value At A Look

As of this writing, the price of BTC stands at round $94,600, reflecting no vital change previously 24 hours. Based on CoinGecko information, the premier cryptocurrency is down by practically 4% within the final seven days.

Associated Studying

.Featured picture from iStock, chart from TradingView