Key Notes

- The Crypto Concern and Greed Index shift from months of “Excessive Greed” to a “Impartial” sentiment zone amid BTC worth drop.

- Studies of the US authorities promoting 69,000 BTC and expectations of tighter financial coverage in 2025 led to adverse sentiment.

- Actual Imaginative and prescient CEO Raoul Pal stays bullish, stating that the crypto market is in a “Banana Zone”, a section signaling a powerful rally.

Amid steady promoting stress, Bitcoin worth

BTC

$94 708

24h volatility:

0.7%

Market cap:

$1.88 T

Vol. 24h:

$18.72 B

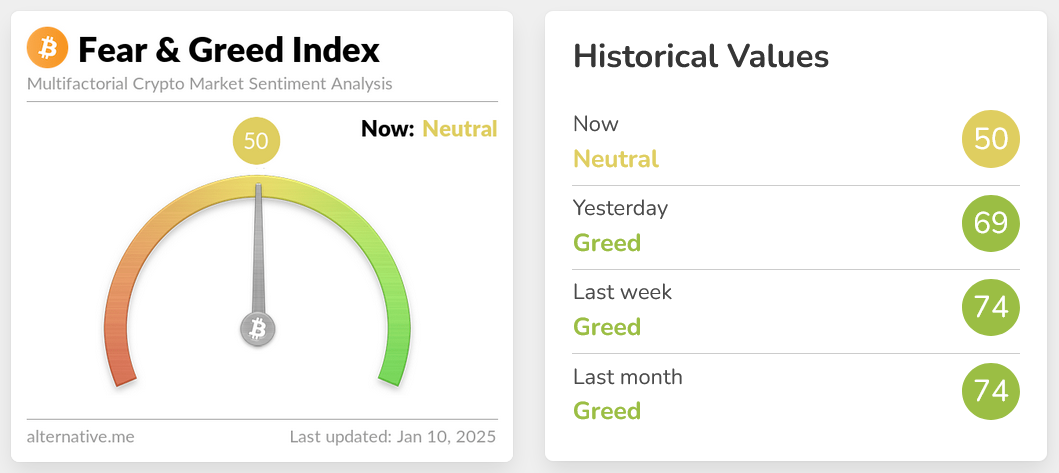

has corrected additional hitting a low of $91,380 ranges earlier right now. Consequently, the Crypto Concern and Greed Index, which measures the general market sentiment, dropped by a large 19 factors in a day swinging in direction of the worry finish, thereby hitting its lowest stage since October 14.

The index’s sharp drop to a rating of fifty out of 100 marks one in every of its most important day by day declines in recent times. Thus, the market sentiment has slipped into the “Impartial” zone after three months of lingering within the “Excessive Greed” and “Greed” zones.

-

Supply: Different.me

The Crypto Concern and Greed Index touched a excessive of 94 out of 100 on November 22, amid robust market optimism following Republican Donald Trump‘s presidential election victory. moreover, there’s robust hypothesis of a possible US Bitcoin reserve technique in 2025

The promoting stress on Bitcoin continues as studies urged that the US government sold over 69,000 Bitcoins value $6.7 billion. Nevertheless, some market analysts consider that macro headwinds will proceed to play a job within the BTC worth volatility shifting forward.

Analysts level to expectations of tighter financial coverage from the US Federal Reserve in 2025 as a key issue behind the decline. Moreover, rising Treasury yields and a strengthening US greenback have contributed to Bitcoin remaining largely under the $100,000 mark in latest weeks.

Later right now on Friday, the Bureau of Labor Statistics (BLS) will launch the Nonfarm Payrolls (NFP) information of the USA for the final month of December 2024. Traders are intently monitoring the December jobs report for brand spanking new insights into the state of the US labor market, amid ongoing considerations about inflation and the financial coverage trajectory underneath Trump’s presidency.

Bitcoin and Altcoins Collectively Will Go Up

Regardless of the present turbulence within the crypto market, veteran Wall Road investor and macro analyst Raoul Pal stays optimistic for Bitcoin and the general altcoin house shifting forward.

Actual Imaginative and prescient co-founder and CEO Raoul Pal acknowledged that the crypto market has entered the “Banana Zone” signaling the section of a powerful rally. Pal predicts this might result in a “Banana Singularity,” a interval characterised by widespread market surges the place “every thing goes up.”

Sure, we’re nonetheless within the Banana Zone… 🍌🍌🍌

Banana Zone Part 1 was the escape final yr, now the consolidation (just like the 2016/17 consolidation after section 1). This would possibly not final lengthy..

Subsequent up Banana Zone Part 2 – The “Banana Singularity” (Alts szn) when every thing goes up…

— Raoul Pal (@RaoulGMI) January 10, 2025

The macro investor added that the primary section of the bull market began with a breakout in November 2024 after Donald Trump’s election victory. This was later adopted by the present section of consolidation just like that witnessed in 2016/17. Under are the three Banana Zones predicted by Raoul Pal explaining why the Bitcoin worth and the general crypto market will go up.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Bhushan is a FinTech fanatic and holds a very good aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary expertise.