Matthew Sigel, Head of Digital Property Analysis at VanEck, has not too long ago made feedback relating to the potential of Bitcoin to change into a world financial normal, just like gold, which have sparked controversy. This viewpoint is gathering momentum, significantly as the controversy relating to a US Strategic Bitcoin Reserve intensifies.

Associated Studying

The Future Of Finance: The Position Of Bitcoin

Sigel acknowledged that Bitcoin has the potential to considerably affect the way forward for international finance. He asserts that the institution of a crypto strategic reserve by the USA authorities, with an estimated amount of 1 million BTC, may set up the main crypto asset as a brand new type of foreign money.

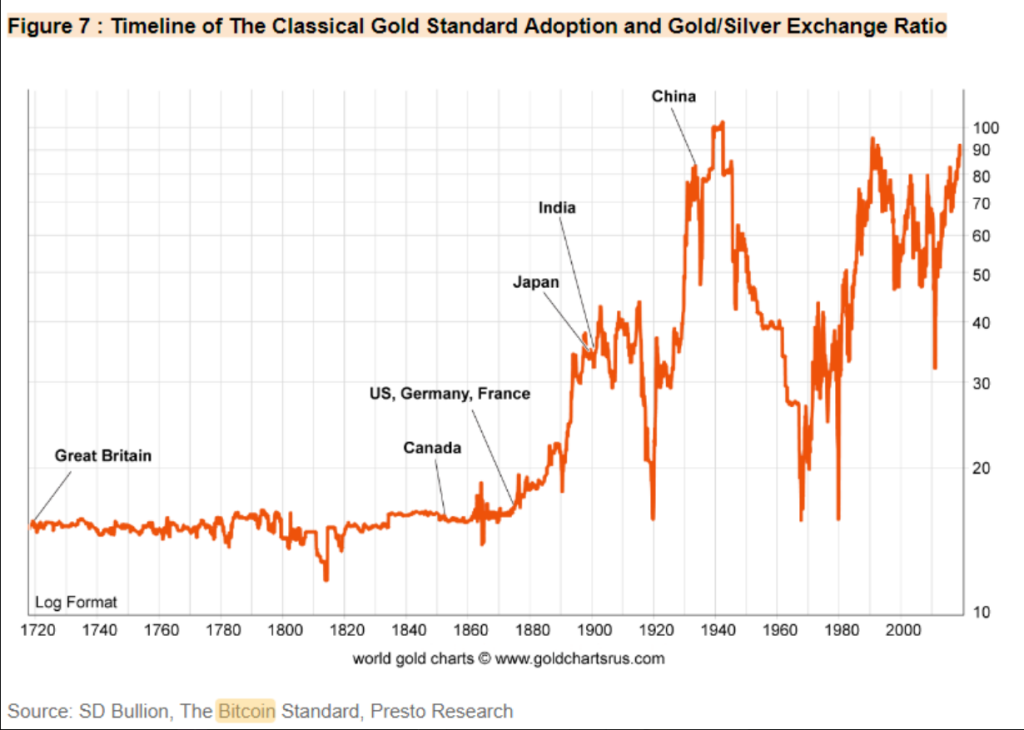

This idea is paying homage to historic intervals wherein nations accrued gold to be able to fortify their financial capabilities. Sigel posits that this might catapult the US to change into the flag-bearer of the brand new period of finance.

The gold normal as soon as outlined reserve property.

Now, Bitcoin presents the chance to converge on a ‘Digital Normal’ for cash.

It may very properly echo gold’s position in reshaping international finance. pic.twitter.com/e1ogPe947R— matthew sigel, recovering CFA (@matthew_sigel) January 10, 2025

Gold Vs. Bitcoin: Classes From Historical past

The comparability of crypto to gold will not be new, nevertheless it has gained traction not too long ago as extra governments experiment with digital currencies.

Gold is commonly seen as a protected haven and a dependable retailer of wealth, however Bitcoin affords distinctive advantages that no different commodity does. It’s primarily a digital asset, thus in contrast to gold, transfers are quick and significantly extra transportable. This digital nature makes it much less weak to bodily theft and facilitates cross-border transactions.

Whereas mining helps to provide gold, Bitcoin is intrinsically uncommon since its provide is proscribed at 21 million cash. For these attempting to offset financial uncertainty and inflation, this deliberate shortage may make BTC a tempting substitute.

World Views & Reactions

There’s a rising international buzz concerning the potential of Bitcoin. On account of latest political shifts within the US, nations like El Salvador have made Bitcoin authorized tender, and leaders in different nations try to place comparable insurance policies into place. Nonetheless, given the erratic character of Bitcoin and the regular buying energy of gold, some economists consider that this motion ought to be rejected.

Associated Studying

Though Bitcoin affords modern advantages like decentralization and immunity to governmental intervention, its worth volatility, in line with critics, could also be a barrier to its widespread adoption as a medium of trade. In consequence, the 2 property differ within the essential components that buyers and decision-makers must have in mind.

Sigel’s phrases replicate a brand new curiosity in how Bitcoin may reconfigure monetary techniques around the globe. As conversations proceed about whether or not it’s going to finally change into a world normal, standing alongside gold, each proponents and detractors shall be watching how this story develops over the approaching years. Maybe the way forward for cash is determined by how these two property evolve and work together in an more and more digital financial system.

Featured picture from Pexels, chart from TradingView