- Bitcoin’s LTHs are distributing slower, signaling a possible shift in market sentiment

- Historic traits recommend decreased LTH promoting stress typically results in upward value momentum

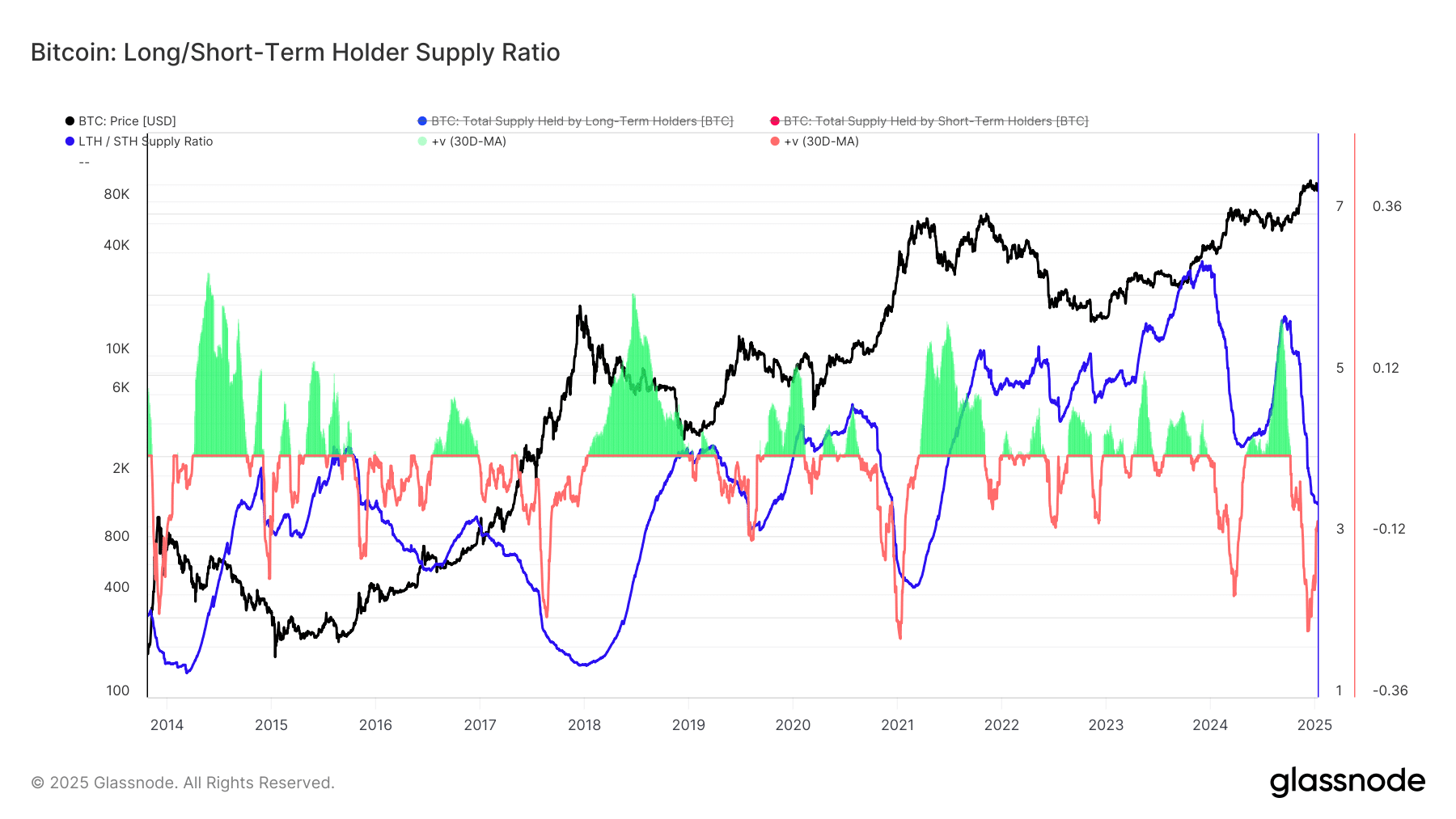

Bitcoin’s [BTC] value appeared to be hovering round 12% beneath its all-time excessive at press time, leaving many to marvel in regards to the future path of the market. Regardless of this dip, nevertheless, LTHs proceed to distribute their Bitcoin holdings, albeit at a slower tempo.

Actually, on-chain information revealed a key shift – Whereas LTHs are nonetheless promoting, the speed of distribution has begun to gradual. Extra importantly, the 30-day p.c change in LTH provide steered that this distribution cycle might have hit its peak, signaling that the promoting stress may quickly ease.

LTH distribution traits

Latest information revealed that LTHs have continued to distribute their Bitcoin, even with the value simply 12% beneath its all-time excessive. This ongoing promoting conduct signifies that these long-term holders are cautious, probably pushed by macroeconomic components or a technique of taking income throughout unsure market circumstances. Regardless of this continued distribution, the tempo of promoting has began to gradual.

There’s a declining 30-day change in LTH provide, suggesting that the height of LTH promoting stress might have handed. This shift could be attributed to enhancing market sentiment and the stabilization of exterior pressures, which can have eased among the issues that prompted earlier promoting.

30-Day p.c change in LTH provide

The 30-day p.c change in LTH supply measures the web accumulation or distribution of Bitcoin by LTHs over a rolling month-to-month interval. When this metric rises, it typically indicators accumulation, whereas a decline sometimes signifies lively distribution.

The information revealed a plateau in LTH distribution, suggesting the promoting section could also be ending. Traditionally, such slowdowns precede durations of decreased promoting stress. As LTHs scale back distribution, downward stress on Bitcoin may ease, permitting for consolidation or a possible bullish reversal.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

Comparability to earlier cycles and potential implications

When evaluating the present development to earlier cycles, it’s clear that comparable distribution slowdowns have marked the top of bear markets or the beginning of bull markets. In 2015, 2019, and 2020, LTH distribution slowdowns had been adopted by decreased market volatility, setting the stage for upward traits. Throughout these occasions, Bitcoin noticed larger stability, greater confidence, and contemporary inflows from new traders – All contributing to cost hikes.

If this development follows previous cycles, Bitcoin might stabilize at its press time value earlier than transferring upwards. The shift in LTH conduct and decreased promoting stress may sign the beginning of a value rally. This might result in bullish momentum or prolonged consolidation, relying on market circumstances.

As historical past has proven, such moments of decreased promoting stress typically set the stage for Bitcoin to attain new highs. Nonetheless, whether or not the market follows this sample once more stays to be seen.