Key Notes

- The crypto derivatives market has seen a big liquidity drop through the holidays, with buying and selling volumes and general volatility reducing.

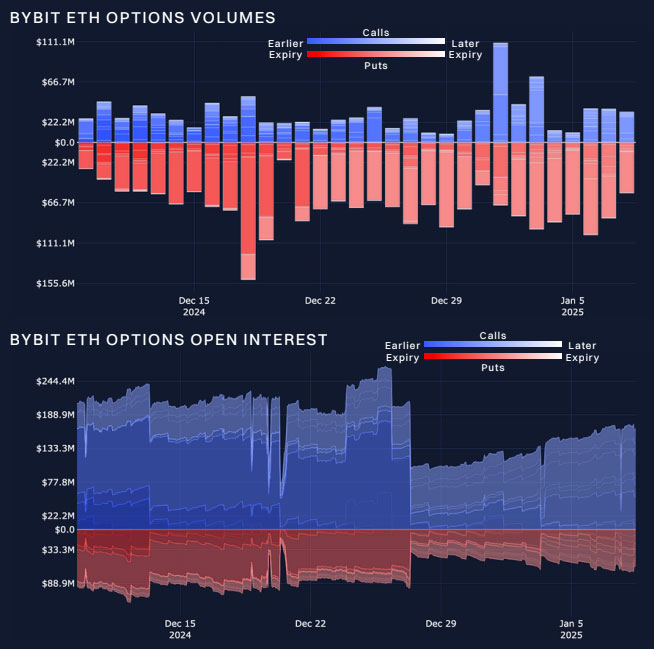

- The choices markets for Ethereum (ETH) and Bitcoin (BTC) are displaying diverging tendencies.

- ETH is seeing elevated name possibility exercise, whereas each markets are displaying a big hole between implied and realized volatility.

Bybit, the world’s second-largest crypto alternate by buying and selling volumes, printed a report displaying how macro components are weighing over the turbulence within the crypto market as Bitcoin value continues to face robust rejection at $100K ranges. The inauguration of “crypto president” Donald Trump can be essential to figuring out the longer term trajectory and boosting investor sentiment.

Over the previous week, there’s been heightened uncertainty within the crypto derivatives market as buyers are trying ahead to a important political transition with Donald Trump’s inauguration. The crypto trade has excessive hopes for Trump, who promised the make America the crypto capital of the world throughout his election marketing campaign.

Nevertheless, the Bybit analysis report reveals that the perpetual swap market witnessed a powerful liquidity drop through the holidays. Because the buying and selling volumes tanked through the previous month, the general volatility throughout the crypto market additionally dropped.

Bitcoin and Ethereum Choices Markets Present Diverging Tendencies

Open curiosity remained steady in comparison with the interval earlier than the main choices contract expiration in December 2024. This displays a cautious method and restricted hedging exercise within the perpetual swap markets.

The choices markets for Ethereum

ETH

$3 233

24h volatility:

0.5%

Market cap:

$389.87 B

Vol. 24h:

$30.39 B

and Bitcoin

BTC

$93 438

24h volatility:

0.7%

Market cap:

$1.85 T

Vol. 24h:

$63.93 B

are signaling notable adjustments heading into the brand new yr, with a transparent divergence between implied and realized volatility. Following the expiration in December, Bitcoin’s open curiosity is rebalancing following the expiration of choices contracts.

Alternatively, ETH’s choices market has proven a marked choice for name choices. The disparity between the 30-day implied volatility and the 7-day realized volatility for each cryptocurrencies has reached its largest hole for the reason that US elections.

This reveals that choices merchants are pricing in excessive ranges of danger and volatility, regardless of the comparatively calm market circumstances on the floor.

ETH Name Choices on the Rise

The Bybit Analysis report reveals a serious reshuffling in Ethereum (ETH) open curiosity, with name choices gaining traction since December, although put choices nonetheless dominate in general quantity.

Nevertheless, the realized volatility in 2025 to this point has tempered the optimism surrounding ETH choices, thereby forcing possibility merchants to reassess their positions. The volatility time period construction has steepened, with short-term volatility (measured over 30 days) remaining greater than 15 factors above its realized counterpart. This hole is the widest seen for the reason that pre-election interval of 2024 when geopolitical uncertainty contributed to volatility premiums.

Whereas the market stabilizes, buyers are exercising warning, reflecting underlying uncertainty that will affect the crypto market within the coming months.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material.

Bhushan is a FinTech fanatic and holds an excellent aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s constantly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary expertise.

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)