As tokenization takes root globally, Luxembourg has adopted a brand new legislation that seeks to make the issuance of digital securities simpler, cheaper, and extra environment friendly.

Luxembourg’s parliament not too long ago passed Blockchain Regulation 4, the nation’s newest effort to facilitate blockchain adoption. It’s the fourth in a line of blockchain legal guidelines; the primary was applied again in 2019. The newest framework supplies a simplified regime for “the issuance, recording, and switch of possession of dematerialized debt and fairness securities utilizing DLT (distributed ledger expertise).”

Luxembourg for Finance, the nation’s monetary growth company, says the brand new legislation will cement the nation’s “pioneering position throughout the European Union in the usage of DLT expertise, notably within the area of dematerialized securities issuance.”

Dematerialized securities exist solely electronically and are recorded in a central depository system, resembling shares, bonds and exchange-traded funds (ETFs).

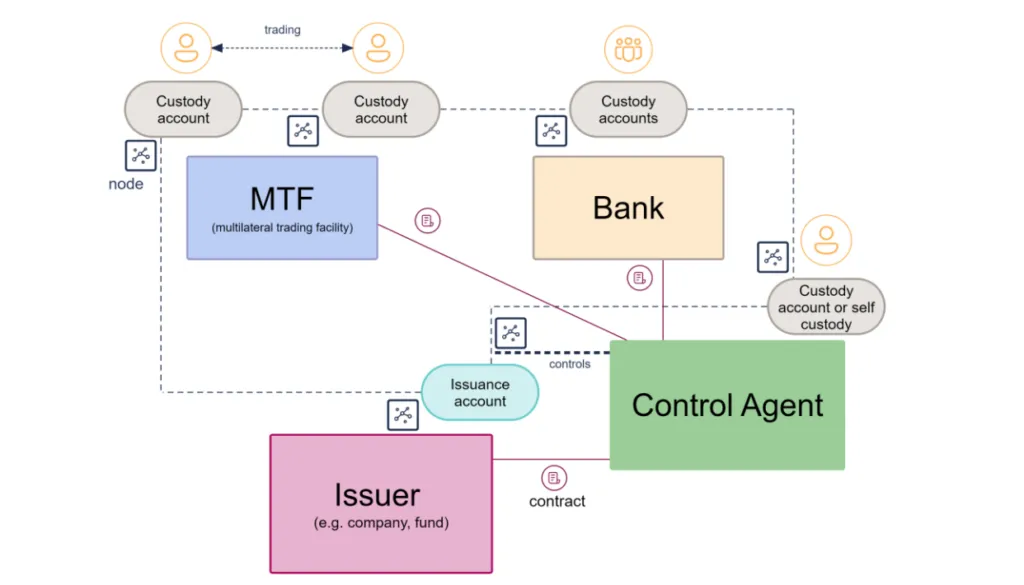

The standout provision of the brand new legislation is the introduction of a management agent whose goal is to cut back inefficiencies and simplify the tokenized debt and securities issuance course of. Beforehand, issuance required a central account keeper (which in different markets could be a central securities depository or CSD), that are extremely regulated monetary entities, making the method costlier and restricted. Then, there could be a separate custodian, making a two-layer system.

Nonetheless, with management brokers, the method can be simpler for contributors as credit score establishments, funding corporations, banks, and settlement organizations can now play this position. Passported European Union corporations licensed in different EU states may play this position, additional widening the scope; this differs from different EU members requiring localized operations.

A control agent will preserve the issuance of tokenized securities, oversee the custody chain of those securities, and guarantee reconciliation between the issuance account on DLT and the securities account. Primarily, quite than having two separate corporations deal with issuance and custody, a management agent can deal with each, eliminating the two-tier system.

The brand new legislation simplifies the necessities for management brokers, making it straightforward for many monetary corporations to use for the position. To qualify, a agency should notify the monetary markets regulator at the least two months prior and meet all of the prudential necessities, resembling governance, safety, organizational construction, and inside controls.

Lately, Luxembourg has quietly superior its monetary legal guidelines to accommodate blockchain. In 2023, it handed Blockchain Law III, which allowed the usage of digital DLT as collateral for monetary devices held on securities accounts.

With tokenization taking root and bold projections of the expertise unlocking as much as $15 trillion in the next decade, Luxembourg is taking strides forward of different superior EU economies, which may make it the largest winner in Europe. Regional frameworks just like the Markets in Crypto-Property (MiCA), which proceed to unify the bloc’s regulatory strategy, imply that corporations can arrange in Luxembourg after which use an EU passport to serve the remainder of the area. Latvia is one other tiny nation that has shortly realized the potential of a post-MiCA world and is busy working with firms utilizing blockchain to arrange within the nation.

Watch: How blockchain tech will help cut back prices for companies

title=”YouTube video participant” frameborder=”0″ enable=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>