Key Notes

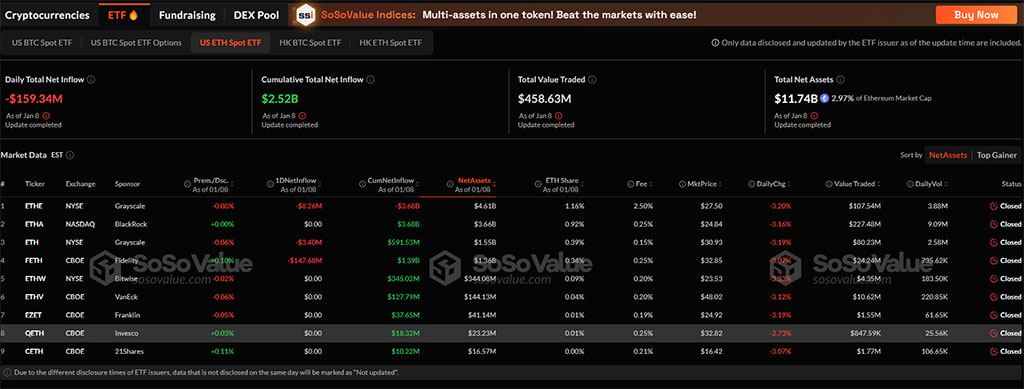

- Ethereum spot ETFs recorded a $159 million outflow on January 8, led by Constancy’s $147.68 million.

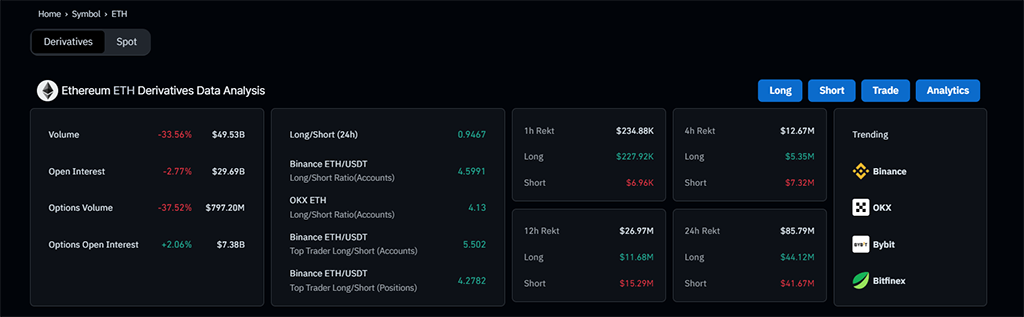

- Ethereum derivatives present open curiosity right down to $29.69 billion, with a 2.77% 24-hour drop.

- Quick-term restoration targets $3,446 primarily based on RSI divergence, whereas failure to carry $3,300 may result in $3,100.

- Analyst Ali Martinez highlights a possible inverted head-and-shoulder sample with a long-term goal of $7,000.

Bitcoin

BTC

$91 829

24h volatility:

3.8%

Market cap:

$1.82 T

Vol. 24h:

$54.27 B

breaking below the $94,000 mark, Ethereum

ETH

$3 215

24h volatility:

4.5%

Market cap:

$387.96 B

Vol. 24h:

$29.41 B

is struggling to carry its bullish vote at $3,300. Presently, Ether is buying and selling at a market value of $3,303 with a minor restoration of 0.44% previously 4 hours.

Ethereum Worth Evaluation Shines Give attention to $3,300

Within the 4-hour chart, Ethereum value motion reveals a bullish failure to maintain above the 61.80% Fibonacci degree at $3,667. Because the bullish failure resulted in a pullback, the broader market crash fueled the correction rally.

The Ethereum value is now right down to $3,300 close to the 23.60% Fibonacci degree. Whereas taking a lateral shift with a number of Doji’s alongside the way in which, the slowdown in bearish momentum is clearly evident within the Ethereum value development.

As the largest altcoin takes a lateral shift, the prevailing downfall has resulted in a dying cross occasion. Nevertheless, the 4-hour RSI line seeks a bullish alternative because it highlights a divergence at play. Moreover, it’s beginning to emerge from the oversold zone, signaling a possible development reversal.

Analyst Finds an Extraordinarily Bullish Sample That Calls for $2,900 Retest

Regardless of the robust probabilities of a pullback in Ethereum, Ali Martinez, an impartial analyst, highlights this as a superb buy-the-dip alternative. Within the 12-hour value chart of Ethereum, Ali highlights a possible inverted head-and-shoulder sample.

A downswing to $2,900 will probably be very bullish for #Ethereum $ETH, because it creates a superb buy-the-dip alternative to focus on $7,000 subsequent!

You do not even must danger your individual capital. Go to @SimpleFXcom through my hyperlink https://t.co/GLjkpQvfTT and declare the $5,000 bonus. pic.twitter.com/9lJp3XXFRa

— Ali (@ali_charts) January 9, 2025

The neckline of this extraordinarily bullish sample coincides with the $4,000 psychological mark. Because the probabilities of a pullback in Ethereum develop, a downswing to $2,900 will enhance the probabilities of a right-shoulder sample. Based mostly on the bullish sample, the worth chart highlights a possible value goal of $7,000.

Nevertheless, for momentum merchants, the breakout of the $4,000 mark will present a greater alternative at a lesser danger if the bullish sample sustains.

Ethereum Derivatives and ETFs Flip Crimson

Regardless of the short-term probabilities of a bullish restoration, the Ethereum derivatives information evaluation reveals a powerful bearish affect. The Ethereum open curiosity is right down to $29.69 billion, registering a 2.77% drop in 24 hours. Moreover, the long-to-short ratio has reached 0.9467, reflecting a powerful promoting sentiment.

Whereas the liquidations within the crypto market have reached $480 million, the Ethereum liquidations stand at $85.79 million previously 24 hours. On a facet word, as Bitcoin spot ETFs within the US document their second-largest outflow ever, the Ethereum spot ETF maintains a bearish method.

On January 8, the Ethereum spot ETFs recorded an outflow of $159 million. Driving the bearish pack, Constancy’s FETH ETF recorded an outflow of $147.68 million, whereas Grayscale Belief and Minitrust recorded an outflow of $11.66 million in complete. The remainder of the ETFs recorded a web zero outflow. And its second-largest outflow ever.

ETH Worth Targets $3,500 Subsequent Week

The short-term value development in Ethereum suggests a possible restoration run to the 50% Fibonacci degree at $3,446 primarily based on the RSI divergence. Nevertheless, the bullish failure to maintain the $3,300 mark amid the broad market crash may retest the $3,100.

Moreover, the long-term value development by Ali highlights the demand for a possible retest to the $2,900-$3,000 psychological mark for an inverted head-and-shoulder sample.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material.

Vishal, a Bachelor of Science graduate, started his journey within the crypto house through the 2021 bull run and has since navigated the next market winter. With a powerful technical background, he’s devoted to delivering insightful articles wealthy in technical particulars, empowering readers to make well-informed selections.

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)