A US-based growth and enterprise intelligence firm will push via with its plan to construct up its Bitcoin holdings, implementing its technique of acquiring vital cryptocurrency investments.

Regardless of amassing an enormous quantity of Bitcoin, MicroStrategy plans to extend its BTC holdings utilizing the estimated $2 billion it’ll generate from its most popular inventory providing.

The 21/21 Plan

MicroStrategy announced in a press assertion that it plans to promote a few of its shares via a most popular inventory providing. The corporate goals to lift funds to finance extra Bitcoin as a part of its audacious “21/21” plan.

“MicroStrategy targets as much as $2 billion capital elevate via public choices of perpetual most popular inventory within the first quarter of 2025,” MicroStrategy co-founder Michael Saylor stated in a put up.

The corporate acknowledged it will elevate $2 billion from “a number of public underwritten choices” of perpetual most popular inventory on MicroStrategy’s class A common stock.

“The perpetual most popular inventory could embody options akin to (i) convertibility to our class A typical inventory, (ii) fee of money dividends, and (iii) provisions permitting for redemptions of shares, amongst different options,” MicroStrategy defined.

Different Methods To Finance Crypto Purchases

MicroStrategy stated that it’s discovering different choices to meet its plan which goals to lift $21 billion in fairness and $21 billion in fixed-income devices, a transfer that’s a part of the corporate’s technique to purchase extra Bitcoins.

The enterprise intelligence agency has been implementing this plan akin to getting funds from senior convertible notes and debt, permitting the corporate to constantly purchase extra digital belongings. The providing is predicted to happen, if in any respect, within the first quarter of 2025, the corporate stated.

MicroStrategy defined that the deliberate providing will “strengthen its stability sheet and purchase extra bitcoin.”

Nevertheless, MicroStrategy famous that it might select to proceed or to not proceed with the providing.

“The choice whether or not to proceed with and consummate the Providing is in MicroStrategy’s sole discretion and is topic to market and different circumstances,” the corporate acknowledged.

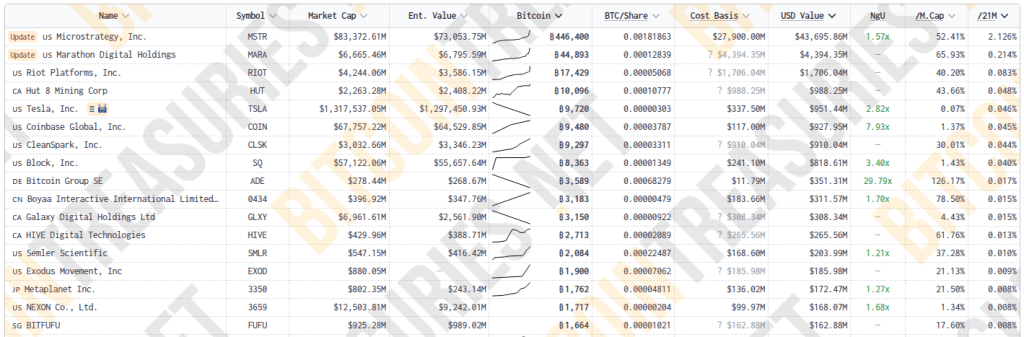

Supply: Bitcoin Treasuries

Largest Bitcoin Holder

Information confirmed that MicroStrategy is already the world’s largest company holder of Bitcoin, and but regardless of this milestone, the corporate stays dedicated to acquiring extra cryptos.

Saylor, who can be the corporate’s govt chairman, is the brains behind MicroStrategy’s Bitcoin funding technique.

Thus far, MicroStrategy owns 446,400 Bitcoins with an estimated worth of $43.9 billion.

Featured picture from MicroStrategy, chart from TradingView

A US-based growth and enterprise intelligence firm will push via with its plan to construct up its Bitcoin holdings, implementing its technique of acquiring vital cryptocurrency investments.

Regardless of amassing an enormous quantity of Bitcoin, MicroStrategy plans to extend its BTC holdings utilizing the estimated $2 billion it’ll generate from its most popular inventory providing.

The 21/21 Plan

MicroStrategy announced in a press assertion that it plans to promote a few of its shares via a most popular inventory providing. The corporate goals to lift funds to finance extra Bitcoin as a part of its audacious “21/21” plan.

“MicroStrategy targets as much as $2 billion capital elevate via public choices of perpetual most popular inventory within the first quarter of 2025,” MicroStrategy co-founder Michael Saylor stated in a put up.

The corporate acknowledged it will elevate $2 billion from “a number of public underwritten choices” of perpetual most popular inventory on MicroStrategy’s class A common stock.

“The perpetual most popular inventory could embody options akin to (i) convertibility to our class A typical inventory, (ii) fee of money dividends, and (iii) provisions permitting for redemptions of shares, amongst different options,” MicroStrategy defined.

Different Methods To Finance Crypto Purchases

MicroStrategy stated that it’s discovering different choices to meet its plan which goals to lift $21 billion in fairness and $21 billion in fixed-income devices, a transfer that’s a part of the corporate’s technique to purchase extra Bitcoins.

The enterprise intelligence agency has been implementing this plan akin to getting funds from senior convertible notes and debt, permitting the corporate to constantly purchase extra digital belongings. The providing is predicted to happen, if in any respect, within the first quarter of 2025, the corporate stated.

MicroStrategy defined that the deliberate providing will “strengthen its stability sheet and purchase extra bitcoin.”

Nevertheless, MicroStrategy famous that it might select to proceed or to not proceed with the providing.

“The choice whether or not to proceed with and consummate the Providing is in MicroStrategy’s sole discretion and is topic to market and different circumstances,” the corporate acknowledged.

Supply: Bitcoin Treasuries

Largest Bitcoin Holder

Information confirmed that MicroStrategy is already the world’s largest company holder of Bitcoin, and but regardless of this milestone, the corporate stays dedicated to acquiring extra cryptos.

Saylor, who can be the corporate’s govt chairman, is the brains behind MicroStrategy’s Bitcoin funding technique.

Thus far, MicroStrategy owns 446,400 Bitcoins with an estimated worth of $43.9 billion.

Featured picture from MicroStrategy, chart from TradingView