After weeks of consolidation, Ethereum (ETH) seems to be breaking out to the upside from its $3,200 to $3,500 buying and selling vary. Bullish technical indicators on the ETH chart, coupled with strengthening fundamentals, recommend important upside potential for the second-largest cryptocurrency by market cap.

Is Ethereum Eyeing $4,000 Goal?

Final month, Ethereum tried to breach the essential $4,000 resistance stage twice however failed on each events. Between December 16 and December 19, ETH skilled a steep decline, falling from $4,000 to as little as $3,100 – a drop of greater than 20% inside three days.

Since December 19, ETH has remained range-bound, fluctuating between $3,200 and $3,500, sparking issues a few potential decline under the $3,000 stage. Nonetheless, ETH is displaying indicators of resurgence at this time, breaking out of a symmetrical triangle sample, with $4,000 rising as the primary main resistance stage to beat.

Crypto dealer and analyst Chilly Blooded Shiller noted that Ethereum’s weekly Relative Energy Index (RSI) has reset, which may present the momentum essential to push ETH past $4,000. The analyst added that if ETH surpasses $3,500, they plan to extend their spot holdings.

For the uninitiated, a weekly RSI reset happens when the RSI, a momentum indicator, strikes again from overbought or oversold ranges towards its impartial zone, usually indicating {that a} potential development reversal or consolidation is underway. In Ethereum’s context, this reset may sign diminished promoting stress and a chance for a rebound.

Seasoned crypto dealer TraderSZ echoed comparable sentiments. In a put up on X, the analyst shared weekly and month-to-month Ethereum charts, suggesting that an upside breakout could also be imminent.

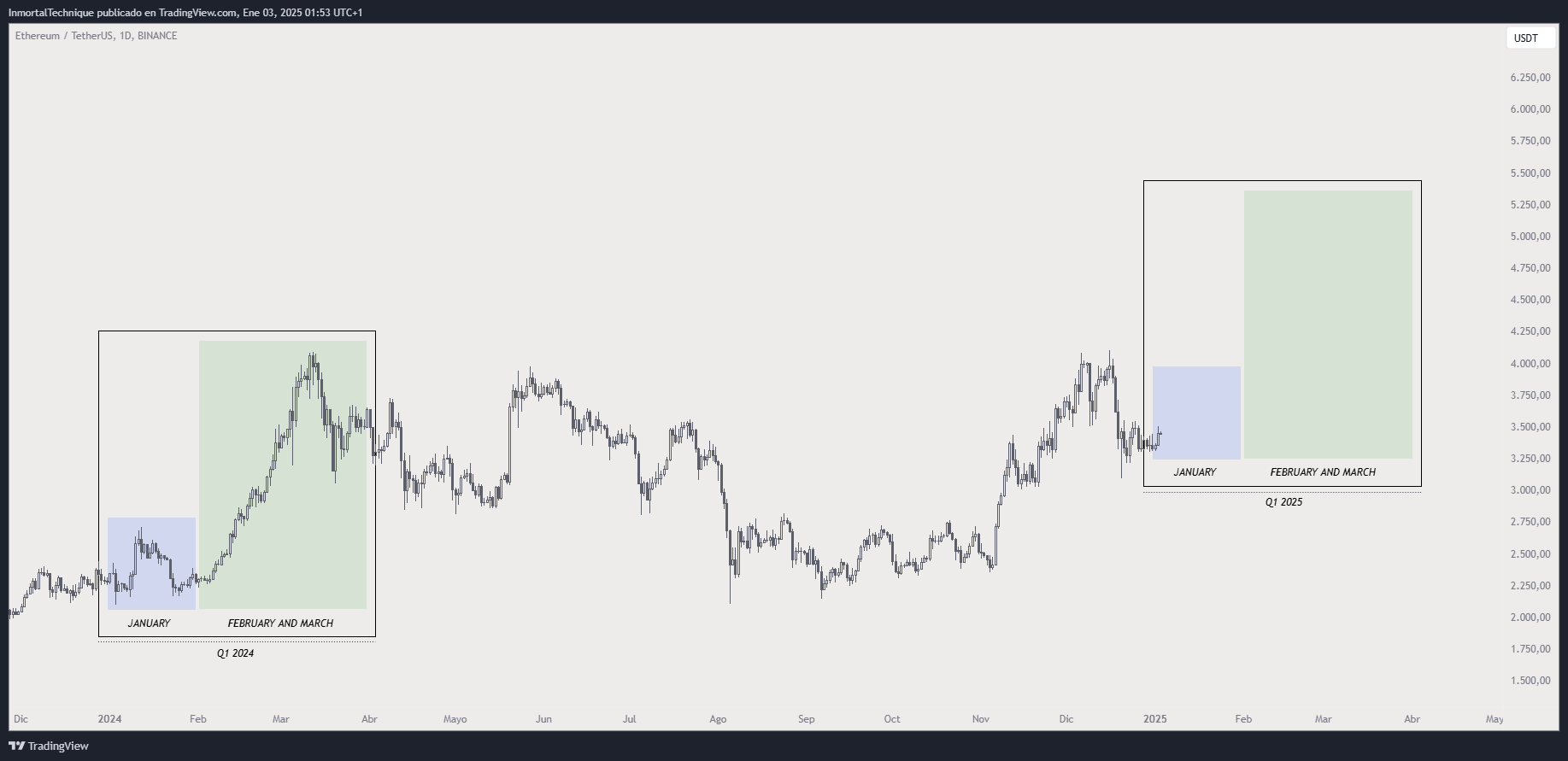

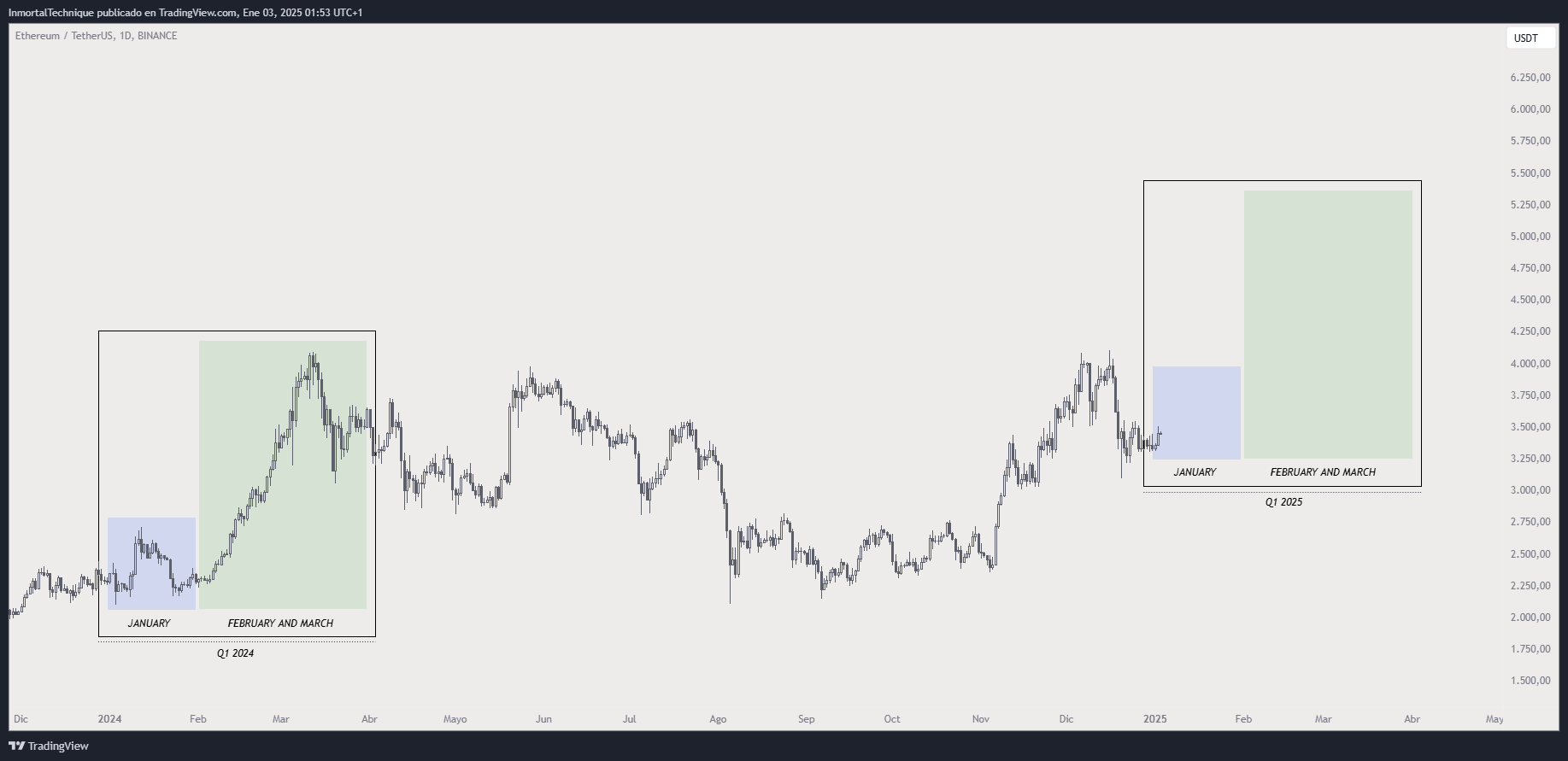

One other outstanding cryptocurrency analyst, often called Inmortal, weighed in on Ethereum’s potential value trajectory. Of their evaluation, Inmortal in contrast the present ETH value motion to Q1 2024, highlighting similarities between the 2 durations.

In keeping with the next chart, January typically serves as an accumulation part, whereas February and March are likely to expertise parabolic value actions. If ETH follows an identical sample in 2025, it may goal $5,300.

Will Ethereum’s Rise Set off An Altseason?

Whereas Bitcoin (BTC) witnessed unprecedented value surges in 2024 – briefly touching six-figure territory – Ethereum has not but skilled comparable explosive development. ETH’s present all-time excessive (ATH) dates again to November 2021, underscoring that ETH has lagged behind BTC throughout this cycle.

Nonetheless, latest market traits point out that ETH might finally be gaining floor towards BTC, as evidenced by the steadily growing ETH/BTC ratio. Moreover, Bitcoin dominance seems poised for a decline after forming a decrease excessive on the weekly chart.

This shift may pave the way in which for the much-anticipated altseason, offering a lift for ETH and different altcoins. At press time, ETH trades at $3,576, up 3.2% prior to now 24 hours.

Featured Picture from Unsplash.com, Charts from X and TradingView.com

After weeks of consolidation, Ethereum (ETH) seems to be breaking out to the upside from its $3,200 to $3,500 buying and selling vary. Bullish technical indicators on the ETH chart, coupled with strengthening fundamentals, recommend important upside potential for the second-largest cryptocurrency by market cap.

Is Ethereum Eyeing $4,000 Goal?

Final month, Ethereum tried to breach the essential $4,000 resistance stage twice however failed on each events. Between December 16 and December 19, ETH skilled a steep decline, falling from $4,000 to as little as $3,100 – a drop of greater than 20% inside three days.

Since December 19, ETH has remained range-bound, fluctuating between $3,200 and $3,500, sparking issues a few potential decline under the $3,000 stage. Nonetheless, ETH is displaying indicators of resurgence at this time, breaking out of a symmetrical triangle sample, with $4,000 rising as the primary main resistance stage to beat.

Crypto dealer and analyst Chilly Blooded Shiller noted that Ethereum’s weekly Relative Energy Index (RSI) has reset, which may present the momentum essential to push ETH past $4,000. The analyst added that if ETH surpasses $3,500, they plan to extend their spot holdings.

For the uninitiated, a weekly RSI reset happens when the RSI, a momentum indicator, strikes again from overbought or oversold ranges towards its impartial zone, usually indicating {that a} potential development reversal or consolidation is underway. In Ethereum’s context, this reset may sign diminished promoting stress and a chance for a rebound.

Seasoned crypto dealer TraderSZ echoed comparable sentiments. In a put up on X, the analyst shared weekly and month-to-month Ethereum charts, suggesting that an upside breakout could also be imminent.

One other outstanding cryptocurrency analyst, often called Inmortal, weighed in on Ethereum’s potential value trajectory. Of their evaluation, Inmortal in contrast the present ETH value motion to Q1 2024, highlighting similarities between the 2 durations.

In keeping with the next chart, January typically serves as an accumulation part, whereas February and March are likely to expertise parabolic value actions. If ETH follows an identical sample in 2025, it may goal $5,300.

Will Ethereum’s Rise Set off An Altseason?

Whereas Bitcoin (BTC) witnessed unprecedented value surges in 2024 – briefly touching six-figure territory – Ethereum has not but skilled comparable explosive development. ETH’s present all-time excessive (ATH) dates again to November 2021, underscoring that ETH has lagged behind BTC throughout this cycle.

Nonetheless, latest market traits point out that ETH might finally be gaining floor towards BTC, as evidenced by the steadily growing ETH/BTC ratio. Moreover, Bitcoin dominance seems poised for a decline after forming a decrease excessive on the weekly chart.

This shift may pave the way in which for the much-anticipated altseason, offering a lift for ETH and different altcoins. At press time, ETH trades at $3,576, up 3.2% prior to now 24 hours.

Featured Picture from Unsplash.com, Charts from X and TradingView.com

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)