As we step into 2025, it’s time to take a measured and analytical method to what the yr may maintain for Bitcoin. Making an allowance for on-chain, market cycle, macroeconomic information, and extra for confluence, we will transcend pure hypothesis to color a data-driven image for the approaching months.

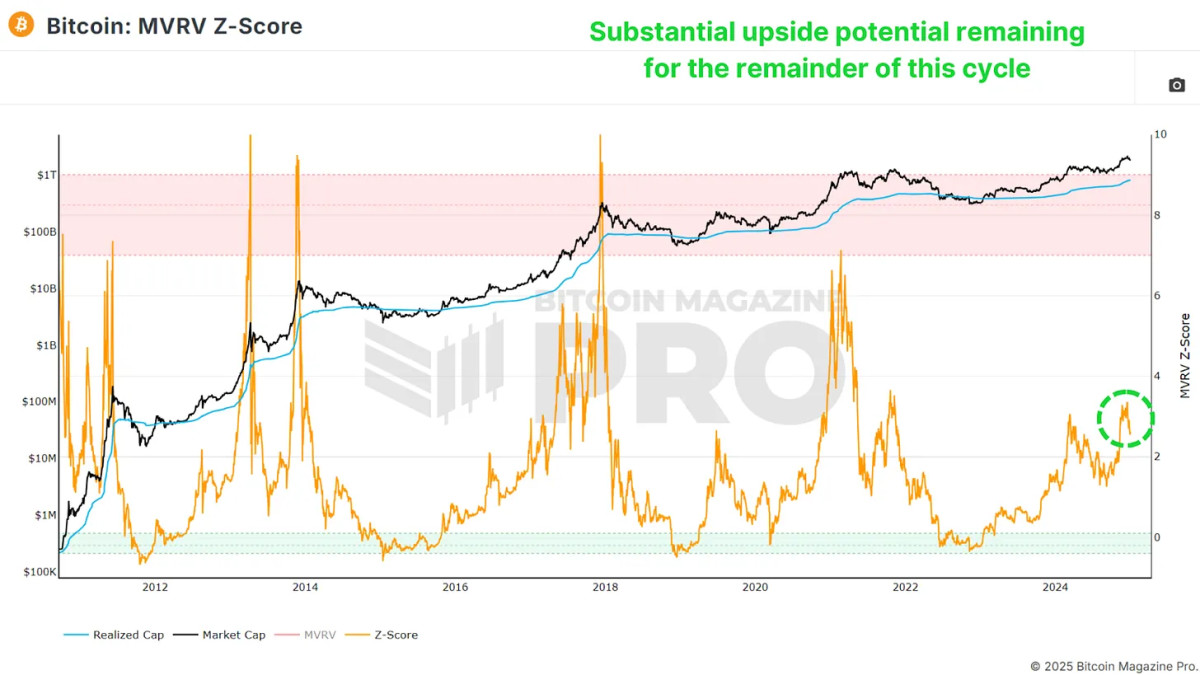

MVRV Z-Rating: Loads of Upside Potential

The MVRV Z-Score measures the ratio between Bitcoin’s realized worth (the common acquisition worth of all BTC on the community) and its market cap. Standardizing this ratio for volatility offers us the Z-Rating, which traditionally gives a transparent image of market cycles.

At the moment, the MVRV Z-Rating suggests we nonetheless have important upside potential. Whereas earlier cycles have seen the Z-Rating attain values above 7, I consider something above 6 signifies overextension, prompting a more in-depth have a look at different metrics to establish a market peak. Presently, we’re hovering at ranges corresponding to Might 2017—when Bitcoin was valued at just a few thousand {dollars}. Given the historic context, there’s room for a number of a whole lot of p.c in potential features from present ranges.

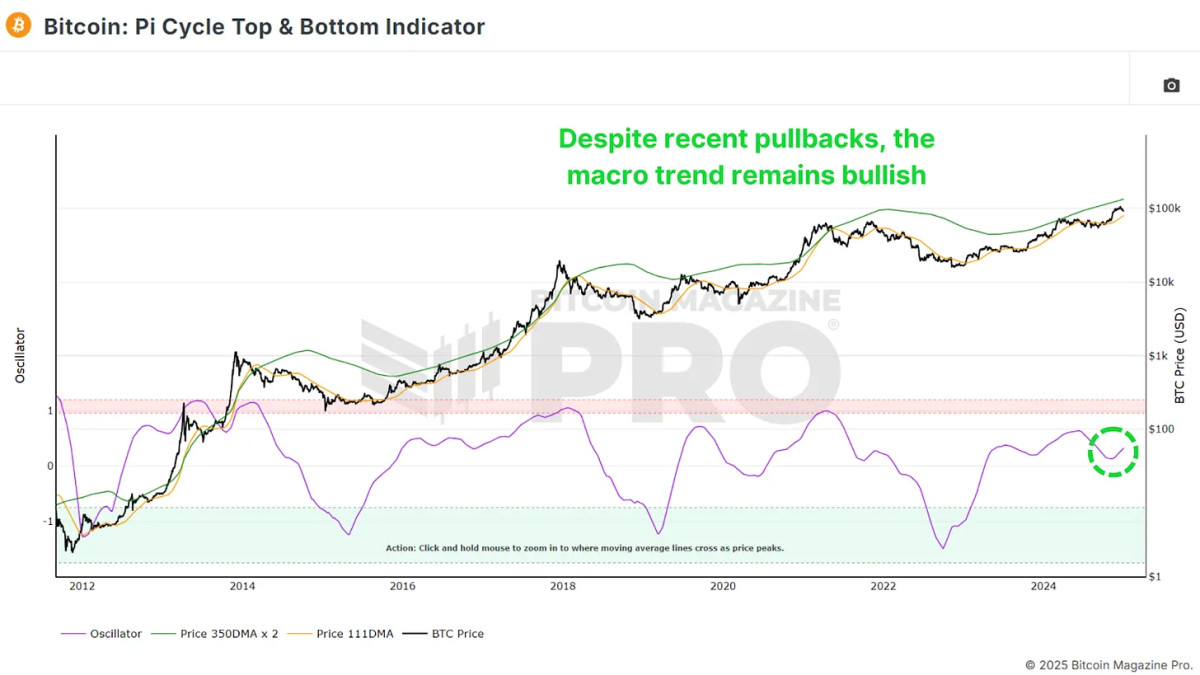

The Pi Cycle Oscillator: Bullish Momentum Resumes

One other important metric is the Pi Cycle Top and Bottom indicator, which tracks the 111-day and 350-day shifting averages (the latter multiplied by 2). Traditionally, when these averages cross, it usually alerts a Bitcoin worth peak inside days.

The space between these two shifting averages has began to pattern upward once more, suggesting renewed bullish momentum. Whereas 2024 noticed intervals of sideways consolidation, the breakout we’re seeing now signifies that Bitcoin is coming into a stronger progress part, doubtlessly lasting a number of months.

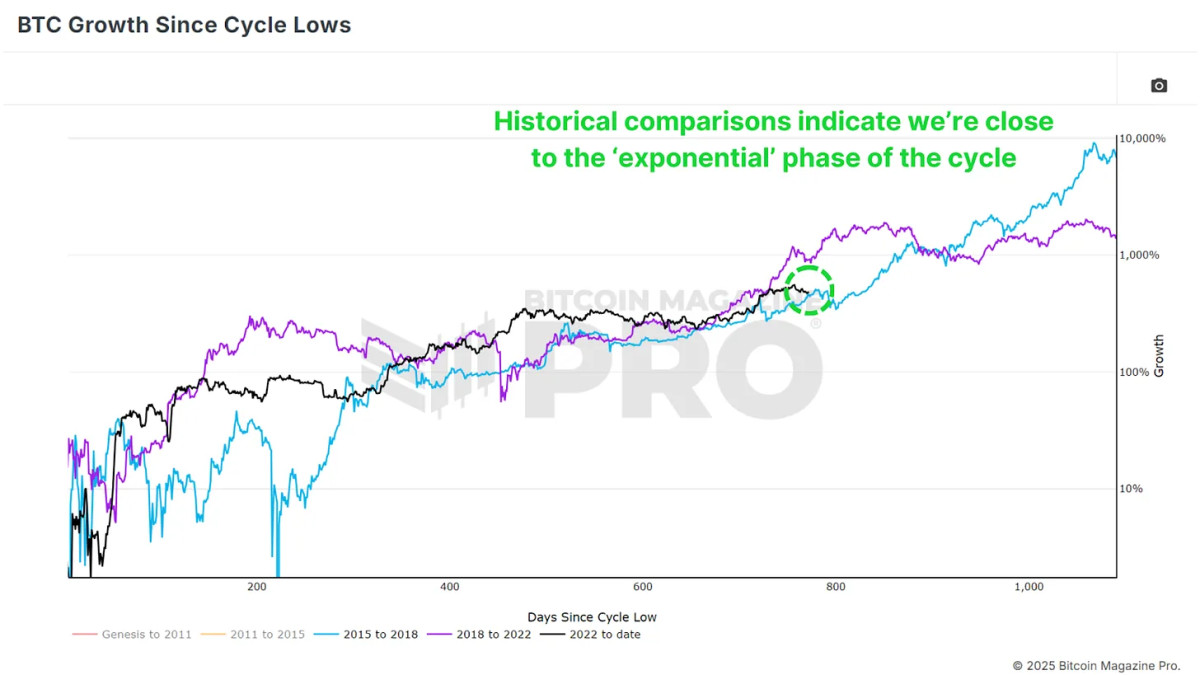

The Exponential Part of the Cycle

Bitcoin’s historic worth motion, cycles usually function a “post-halving cooldown” lasting 6–12 months earlier than coming into an exponential progress part. Based on previous cycles, we’re nearing this breakout level. Whereas diminishing returns are anticipated in comparison with earlier cycles, we may nonetheless see substantial features.

For context, breaking the earlier all-time excessive of $20,000 within the 2020 cycle led to a peak close to $70,000—a 3.5x improve. If we see even a conservative 2x or 3x from the final peak of $70,000, Bitcoin may realistically attain $140,000–$210,000 on this cycle.

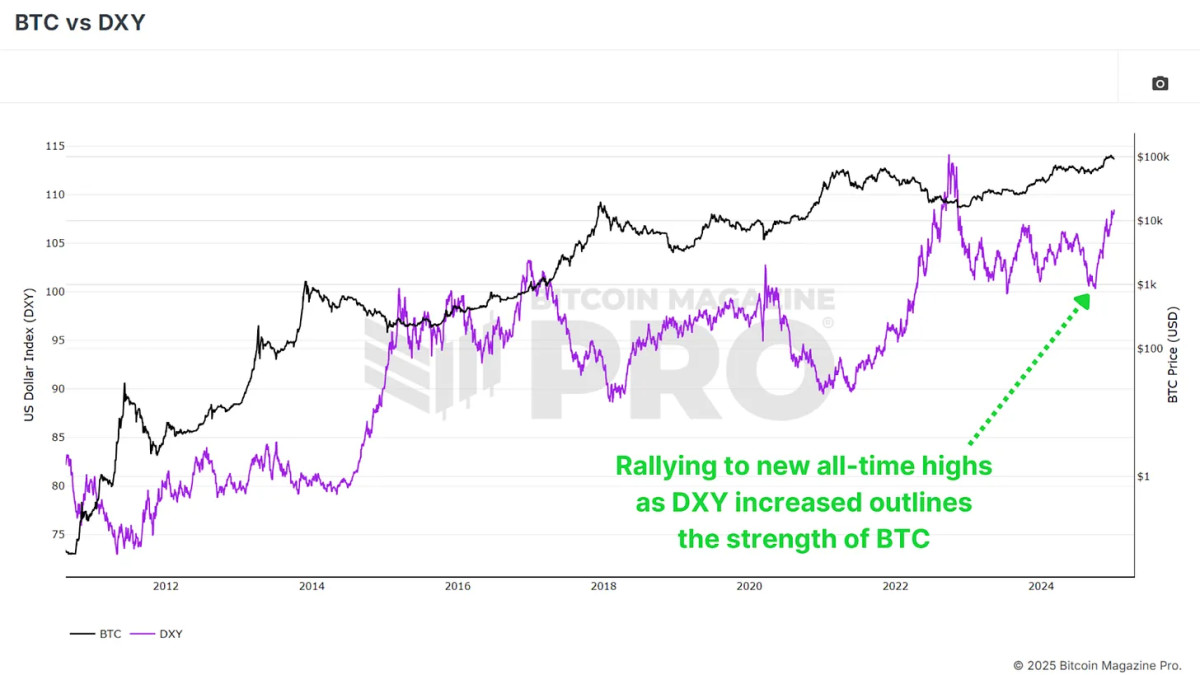

Macro Components Supporting BTC in 2025

Regardless of headwinds in 2024, Bitcoin carried out strongly, even within the face of a strengthening U.S. Dollar Index (DXY). Traditionally, Bitcoin and the DXY transfer inversely, so any reversal within the DXY’s power may additional gasoline Bitcoin’s upside.

Different macroeconomic indicators, comparable to high-yield credit score cycles and the worldwide M2 cash provide, counsel bettering situations for Bitcoin. The contraction within the cash provide seen in 2024 is anticipated to reverse in 2025, setting the stage for an much more favorable atmosphere.

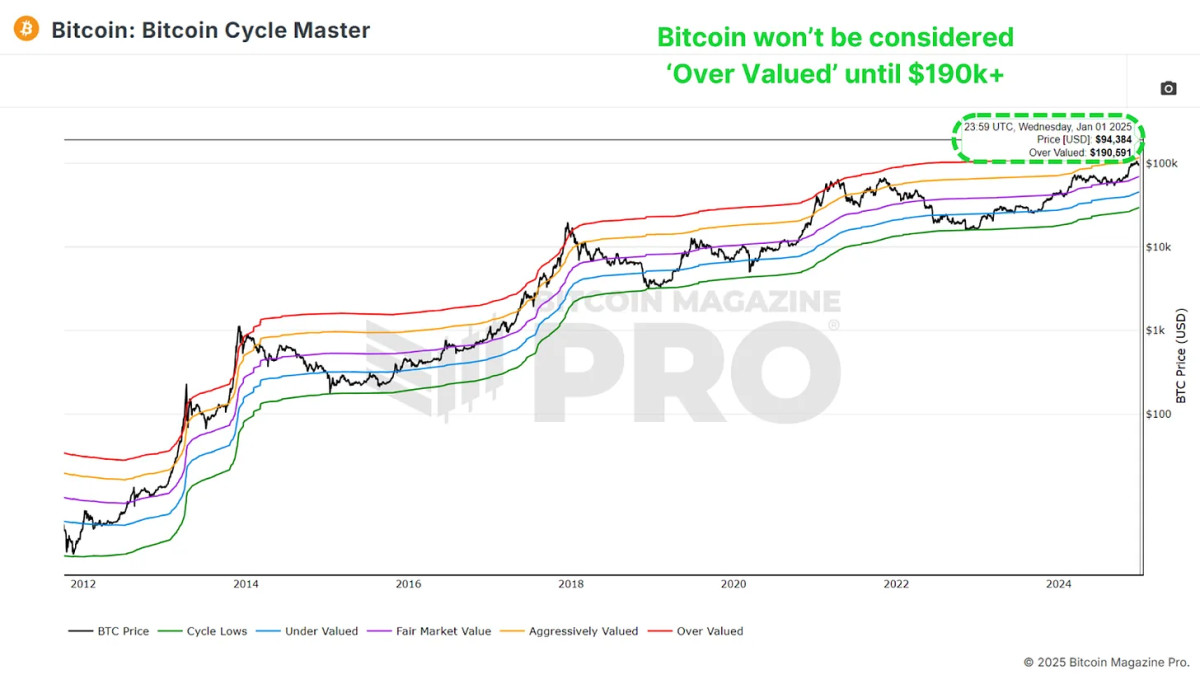

Cycle Grasp Chart: A Lengthy Option to Go

The Bitcoin Cycle Master Chart, which aggregates a number of on-chain valuation metrics, exhibits that Bitcoin nonetheless has appreciable room to develop earlier than reaching overvaluation. The higher boundary, at present round $190,000, continues to rise, reinforcing the outlook for sustained upward momentum.

Conclusion

At the moment, nearly all information factors are aligned for a bullish 2025. As at all times, previous efficiency doesn’t assure future outcomes, nonetheless the information strongly means that Bitcoin’s finest days should still lie forward, even after an extremely constructive 2024.

For a extra in-depth look into this subject, take a look at a latest YouTube video right here: Bitcoin 2025 – A Data Driven Outlook

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, personalised indicator alerts, and in-depth business reviews, take a look at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.