- The Fed injected $400B liquidity into the U.S. market on the first of January.

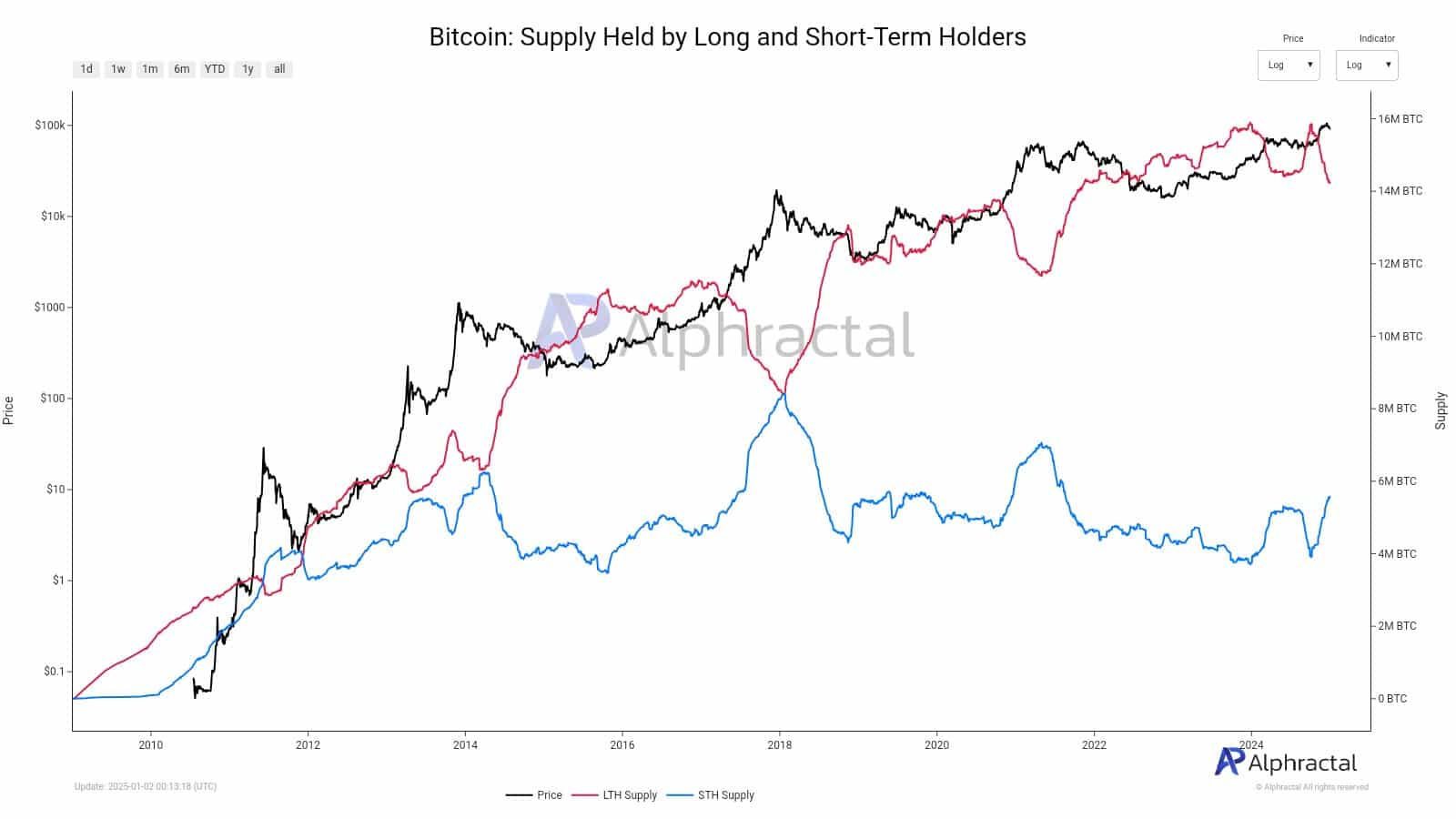

- However long-term holders’ relentless sell-off has been absorbed by STH (short-term holders).

The U.S. Federal Reserve (Fed) could also be pivoting away from quantitative tightening (QT), a transfer that might inject extra liquidity into the market and gasoline risk-on belongings like Bitcoin [BTC].

On the first of January, one of many elements used to gauge the Fed’s QT, Reverse Repo Facility, printed $400B. This meant that $400B was injected into the US financial system, boosting market liquidity.

Will U.S. liquidity injection pump BTC?

Traditionally, a pointy uptick within the Repo Facility correlated with a robust BTC uptrend in 2021. So, BTC might anticipate upside momentum if the development repeats and the Fed liquidity injection continues.

Pseudonymous macro and crypto analyst, Rooster Genius, had beforehand said that the Fed’s QT would finish in Q1 2025. He said,

“Prediction: Quantitative tightening (QT) ends this quarter.”

Lengthy-term holders dump Bitcoin

Regardless of the optimistic replace from the macro entrance, BTC long-term holders [LTH] have been selling relentlessly.

Since mid-September 2024, LTH provide has shrunk from 14.2M to just about 13.1M in early January 2025. In brief, they’ve offered over 1M BTC cash in three months.

Nevertheless, the short-term holders have absorbed practically all of the LTH sell-offs. Over the identical interval, the STH provide soared from 2.5M to three.8M BTC.

Learn Bitcoin [BTC] Price Prediction 2025-2026

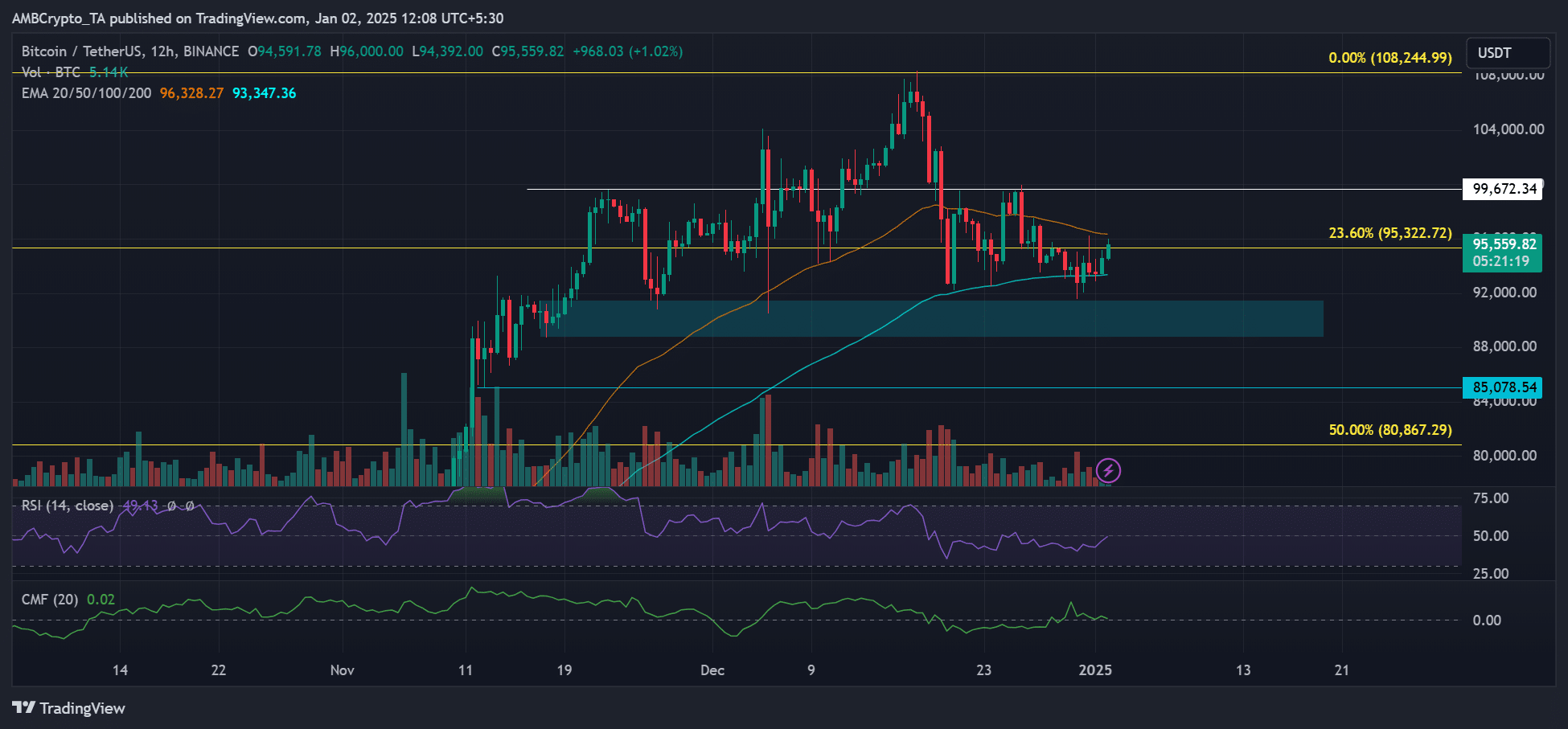

That stated, the cryptocurrency tried to reclaim $95K at press time. The upper timeframe market construction may very well be flipped bullish if it decisively closed above $97K and key transferring averages.

Nevertheless, one other value rejection at $97K might drag it decrease to the 100-day EMA of $93K or the demand assist at $90K (cyan).