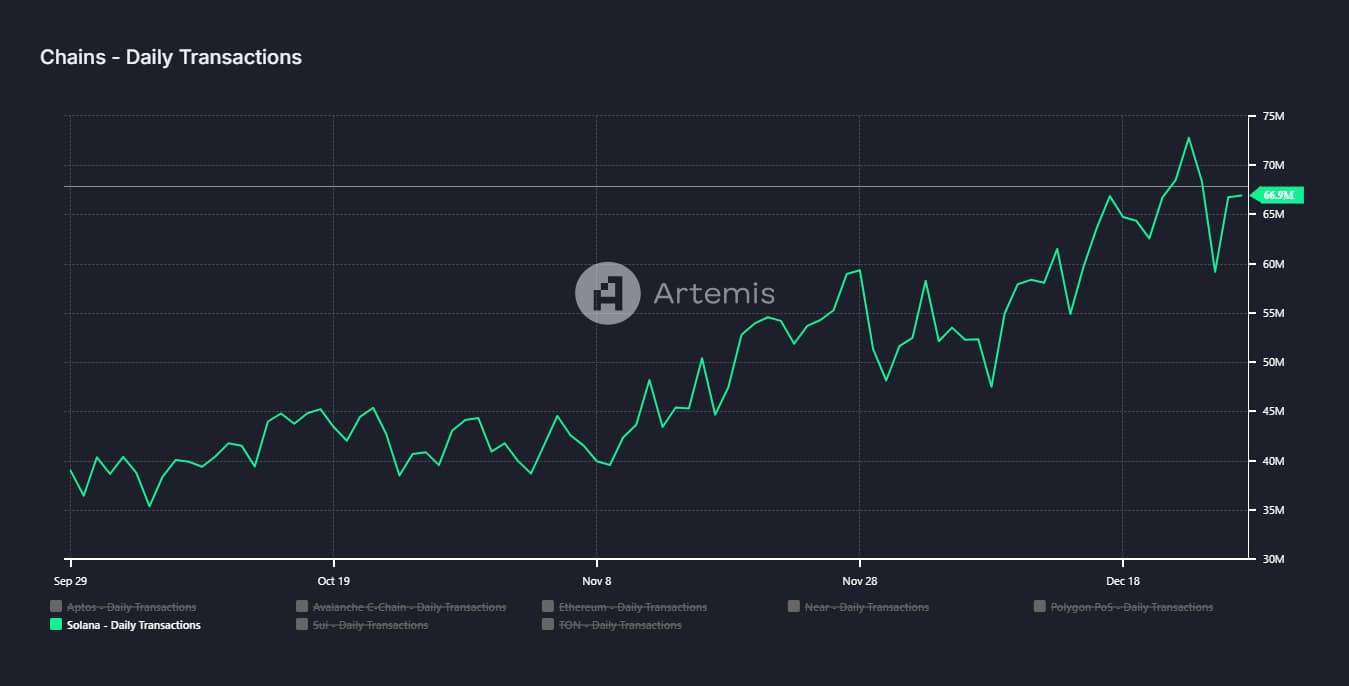

- Solana’s transaction depend has elevated not too long ago, however market exercise prompt that sellers dominated.

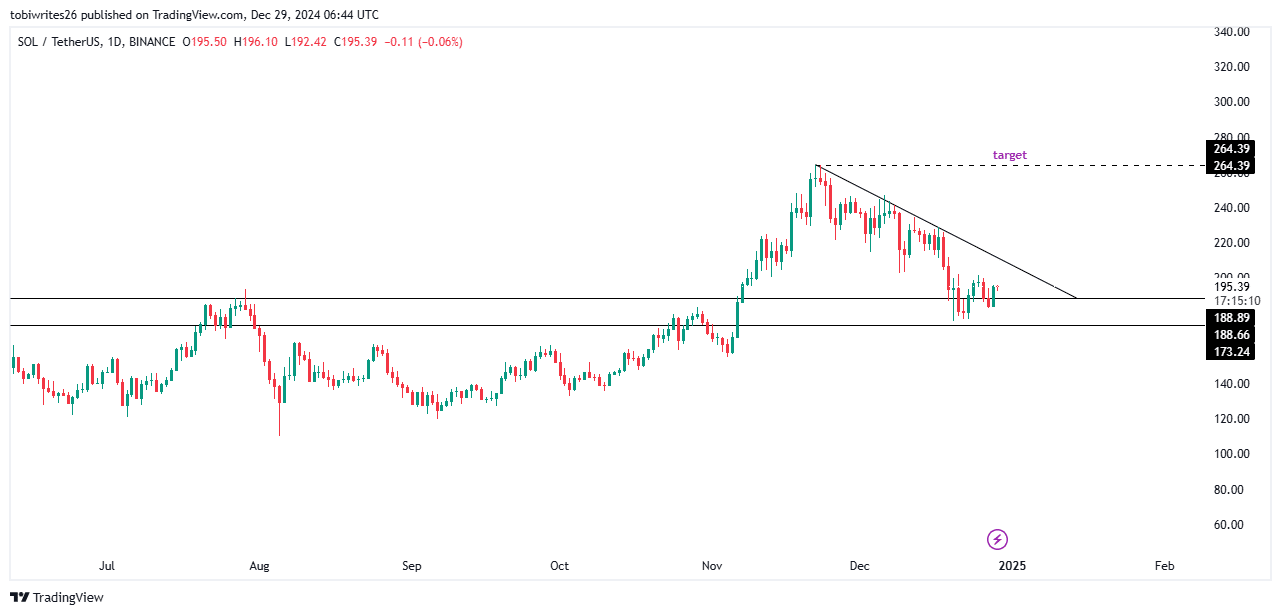

- On the chart, SOL remained inside a bullish sample that would propel it again to its earlier all-time excessive.

After attaining a brand new all-time excessive in December, Solana [SOL] has retraced, shedding 18.18% over the previous month.

Nonetheless, the narrative seems to be shifting because the asset has gained 7.09% previously week and 5.42% within the final 24 hours.

Regardless of the obvious bullish momentum, uncertainty persists. The general construction leans bullish, however latest promoting stress raises questions in regards to the sustainability of the development.

Transaction counts surge, however sellers dominate

Solana’s community has recorded a surge in transaction exercise, with 66.9 million transactions executed previously 24 hours. This comes because the asset steadily recovers from its latest downturn.

A spike in transaction counts can sign both bullish or bearish sentiment, relying on whether or not market individuals are shopping for or promoting. To discern the development, AMBCrypto analyzed Solana’s Change Netflow.

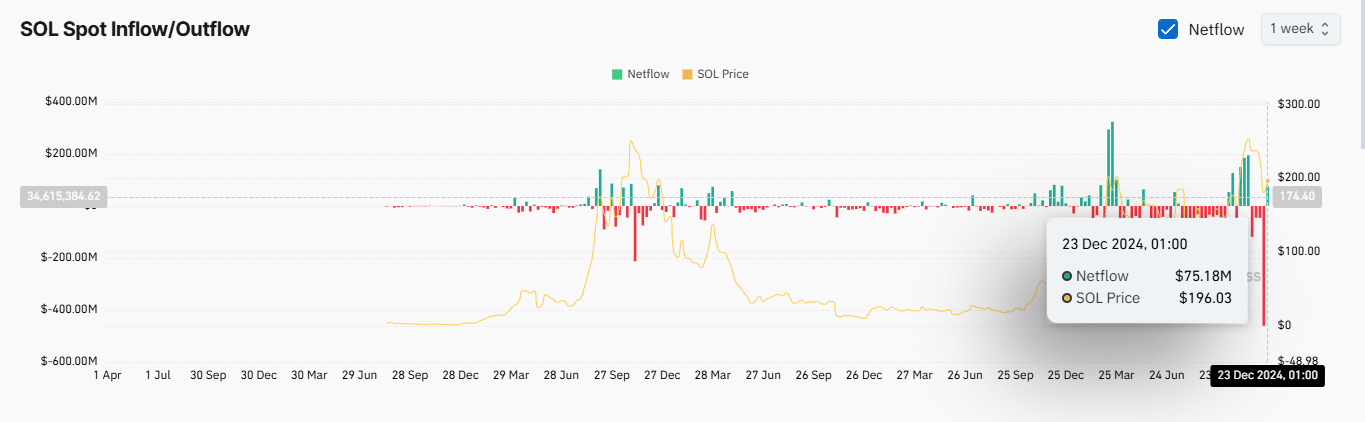

Change Netflow measures the distinction between the inflows and outflows of an asset on exchanges. A constructive netflow signifies extra promoting exercise, whereas a unfavourable netflow suggests shopping for stress dominates.

As of now, Solana’s Change Netflow is unfavourable on each day by day and weekly timeframes, suggesting that purchasing exercise has outpaced promoting.

Previously 24 hours, $6.15 million price of SOL has been bought, and $75.18 million previously seven days.

Regardless of the noticed shopping for stress, SOL’s value surge of 5.42% over the past 24 hours appeared fragile.

A better evaluation of buying and selling quantity revealed a 25% decline, indicating that the latest rally could lack adequate market momentum to maintain itself.

Sometimes, when a value surge is accompanied by a drop in quantity, it alerts a short lived rally with out substantial market help.

Until Solana sees a corresponding improve in buying and selling quantity to again its value motion, the asset stays vulnerable to a deeper pullback.

SOL maintains bullish potential regardless of stress

SOL has entered a key help zone on the chart, buying and selling inside a bullish triangle construction.

This help degree ranges between $188.89 and $173.24, an space traditionally related to important shopping for stress, although such exercise has but to materialize presently.

Learn Solana’s [SOL] Price Prediction 2025–2026

If SOL breaches this help zone, it’s prone to re-enter the consolidation part it not too long ago exited.

Conversely, if the help degree serves as a catalyst for a rally, the asset might expertise a big upside. This might propel SOL towards its earlier all-time excessive and probably past.