Key Notes

- Whale addresses holding over $10M ETH decreased by 2%, signaling market weak point.

- A dormant ICO-era whale moved $2.5M in ETH after 9.5 years, sparking bearish issues.

- Ethereum RSI reveals rising shopping for stress, hinting at potential $3,600 breakout.

Within the final 24 hours, Ethereum

ETH

$3 423

24h volatility:

1.0%

Market cap:

$411.88 B

Vol. 24h:

$16.76 B

value has elevated by 1.62%. This restoration run places the 7-day value development at 4.40%, with a market value of $3,427.

Because the short-term restoration heads a market cap of $412 billion, the rising complexities within the institutional assist and whales are signaling large value fluctuations. Will the Ethereum bulls come out victorious within the upcoming value swing for an uptrend in 2025? Let’s discover out.

Ethereum Value at Crossroads

Within the 4-hour chart, the ETH value did not maintain above the 38.20% Fibonacci degree at $3,477. This resulted in a fast pullback to the 23.60% Fibonacci degree at $3,333.

Picture: TradingView

This accounted for a 4.67% drop, making a bearish engulfing candle within the every day chart. The ETH value development continues to consolidate between two key Fibonacci ranges within the 4-hour chart.

At present, the ETH value development kinds a large bullish engulfing candle, accounting for a 3.20% surge. Breaking above the 20 EMA line, the Ethereum rally is re-challenging the dynamic resistance common line 50 EMA.

Moreover, the RSI line has witnessed a major uptick crossing above the 14-day common line and the 50% degree. Thus, the momentum indicator displays a increase in shopping for stress.

ETH Value Targets

With the bullish engulfing candle, the Ethereum value showcases elevated probabilities of a 38.20% Fibonacci degree breakout. This bullish rally will doubtless problem the important resistance degree of $3,600.

Nevertheless, closing beneath the $3,300 degree will check the bullish dominance at $3,100. The elevated stress amid market fluctuation might lead to a fall to $3,000.

Whale Tackle Quantity on a Decline

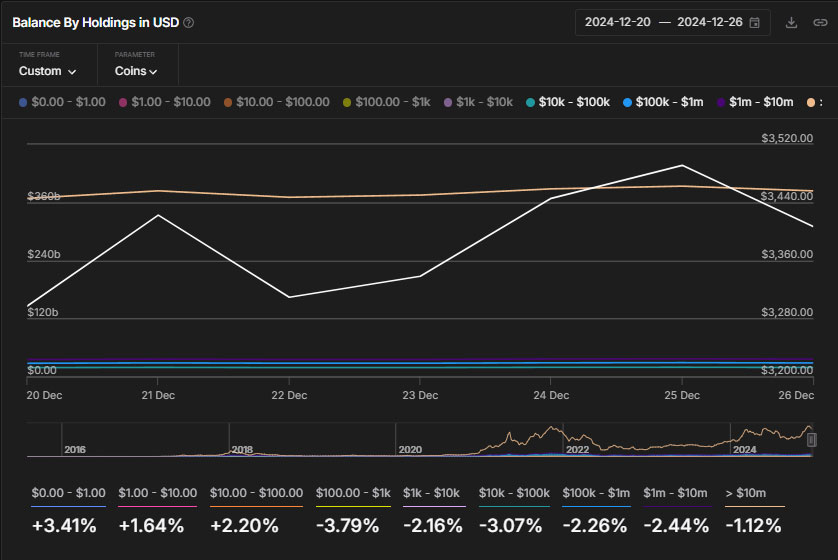

During the last 7 days, the whale holding of Ethereum from addresses holding $10,000 value of Ethereum to greater than $10 million has fluctuated from 805.57k addresses to 788.3k addresses. This marks a large shift within the whale addresses over the correction section.

Diving deep into the categorization, addresses holding greater than $10 million value of Ethereum modified from 2.52k to 2.47k. Moreover, the addresses holding $1,000,000 to $10,000,000 value of Ethereum reached 13.14k from 13.37k.

The huge shift within the whale addresses reveals the reflection of underlying weak point within the Ethereum whale neighborhood.

Ethereum ICO Whale Returns to Offload

Amid the technical and on-chain indicators turning crimson for Ethereum, a whale from the Ethereum ICO period has woke up. After a dominant sleep of 9.5 years, the whale has deposited 742.11 Ethereum tokens over the previous 5 hours.

That is value almost $2.5 million on two totally different wallets. One among these wallets has despatched 431.11 Ethereum to Coinbase.

The dealer had invested almost $600 within the ICO to obtain 1,940 ETH on the Genesis block. At present, the whale continues to carry its 1,198 ETH tokens value $4.01 million.

Because the information of a number of ICO-era whales awakening to dump, the short-term fluctuations are prone to expertise elevated bearish affect.

Briefly, Ethereum’s value reveals bullish momentum, aiming for $3,600, however declining whale exercise and the awakening of dormant wallets trace at potential short-term volatility.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Vishal, a Bachelor of Science graduate, started his journey within the crypto house in the course of the 2021 bull run and has since navigated the following market winter. With a powerful technical background, he’s devoted to delivering insightful articles wealthy in technical particulars, empowering readers to make well-informed selections.

![Devcon: Hacia Colombia en 2022 [Redux]](https://atomicwallet.download/wp-content/uploads/2025/01/upload_2b32fe55f8984608f37d72635a3f8721-350x250.jpg)