Key Notes

- Over $251 million in liquidations occurred in 24 hours, with $200 million from lengthy positions, reflecting robust promoting strain.

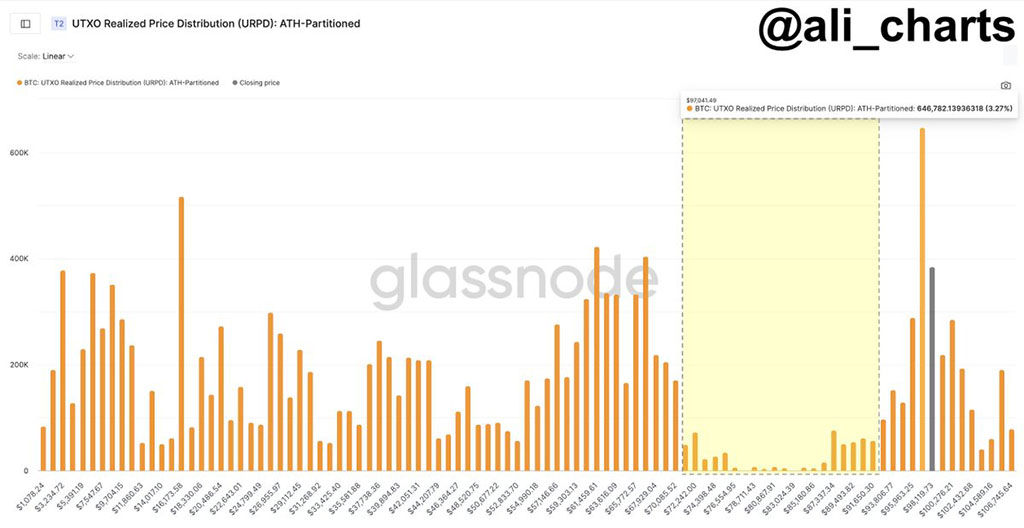

- Realized value distribution (UTXO) highlights $93,806-$97,041 as key demand zones.

- Failure to carry may push Bitcoin towards $70,085.

- Analysts predict potential drops to $70K-$76K, however long-term projections, like $250K by 2025, stay optimistic.

Bitcoin

BTC

$93 525

24h volatility:

1.5%

Market cap:

$1.85 T

Vol. 24h:

$32.68 B

struggling underneath the $100K stage has triggered a pointy pullback, elevating considerations about its means to carry key help ranges. With bearish alerts dominating and liquidation occasions surging, the value now faces important zones.

Whereas short-term dangers level to a drop as little as $70,000, some specialists stay optimistic a few long-term rally by 2025.

Bitcoin Worth Evaluation Hints at $90K Breakdown

With a bullish failure to achieve the $100,000 mark, the upper value rejection from $99,881 resulted in a 3.71% pullback final night time. This creates a bearish engulfing candle and completes a number one share sample.

Undermining the value restoration this week, the BTC value continues in a bearish development. With an intraday pullback of 1.11%, the BTC market value is right down to $94,624.

This creates a second consecutive bearish candle and is testing the closest essential help stage of $94,403. In the meantime, it is usually approaching the 50-day EMA line, priced at $93,170.

Amid the rising bearish affect, the day by day RSI line is down underneath the midway stage and warns of a downtrend continuation. Regardless of offering a number of bouncebacks, the 50-day EMA line stays the ultimate help earlier than the retest of the $90,000 help stage.

Amid the rising bearish affect, the crypto market within the final 24 hours has misplaced $251 million in liquidations, out of which $200 million are liquidated from the long-side buyers. This reveals a market-wide promoting spree, threatening a bearish begin to 2025.

Skilled Opinions on Bitcoin’s Future

Amid the rising possibilities of a bearish comeback to the $90K help stage, a number of market analysts are supporting the bearish narrative. In a current tweet by Ali Martinez, an impartial analyst, a number of spokespersons are highlighting the bearish clouds over Bitcoin.

In a current video, Tone Vays, a former Wall Avenue quant dealer, is highlighting the present situations in Bitcoin as cataclysmic. The analyst believes if Bitcoin begins to commerce under the $95K stage, it will flip very, very unhealthy as a result of it will increase the opportunity of Bitcoin extending the correction section to the $73K stage.

Likewise, a well known technical analyst, Peter Brandt, has stated that Bitcoin is making a broadening triangle sample within the day by day chart. The help stage for this stands on the $90K help stage.

In case BTC value breaks underneath this, a chance of retesting the $70K ranges is feasible. The value chart estimates a drop to $76,614.

Regardless of the technical analysts believing short-term correction, Thomas Lee has strengthened his view on Bitcoin reaching $250K in 2025. Nevertheless, Chartered Market Technician Mark Newton estimates Bitcoin to take a downswing to $60K earlier than the parabolic rise.

And at last, Benjamin Coven, believes the BTC value is prone to flash crash to $60K close to Donald Trump’s inauguration day.

On-Chain Information and Key Ranges

The Bitcoin value, primarily based on the on-chain information, reveals $70,000 as a possible drawdown goal if BTC begins buying and selling under $93,806. In an outdated tweet on December 22, Ali Martinez highlighted a key help zone between $93,806 and $97,041.

That is primarily based on the UTXO Realized Worth Distribution. If this important demand space doesn’t maintain up, the closest vital help is current close to the $70,085 stage.

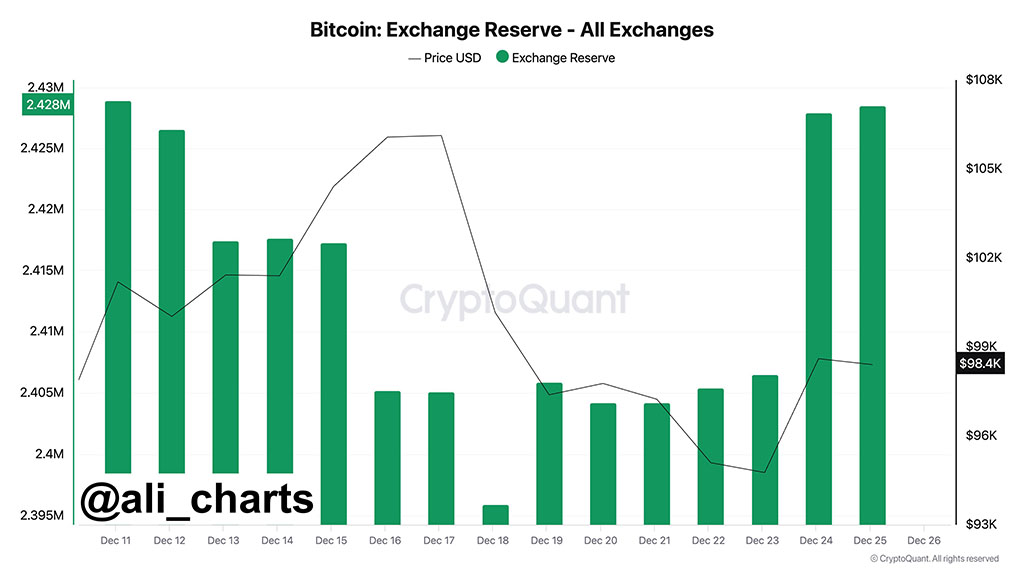

Amid the turning tables within the crypto panorama, some savvy investors have despatched 33,000 BTC to exchanges over the previous week. That is valued at $3.23 billion.

In the meantime, others have additionally began to e-book income when, on December 23 alone, $7.17 billion in BTC income have been realized.

Conclusion

Bitcoin faces important help at $94,403 and the 50-day EMA at $93,170, with a break under probably resulting in a retest of $90K and even $70K, as highlighted by specialists like Tone Vays and Peter Brandt.

Whereas short-term bearish dangers dominate, long-term optimism persists, with projections of a parabolic rise to $250K by 2025 from analysts like Thomas Lee. Merchants ought to watch key ranges carefully to navigate the present uncertainty.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Vishal, a Bachelor of Science graduate, started his journey within the crypto house through the 2021 bull run and has since navigated the next market winter. With a powerful technical background, he’s devoted to delivering insightful articles wealthy in technical particulars, empowering readers to make well-informed choices.