- Shiba Inu’s burn price plunged amid value struggles.

- Whale transactions continued to affect SHIB’s value, including each volatility and liquidity considerations.

Shiba Inu [SHIB] has seen fluctuations in its burn price not too long ago, with a dramatic 90.69% drop in burns over the past 24 hours.

Whereas token burns are a deflationary mechanism designed to scale back provide and enhance shortage, the influence on SHIB’s value has been restricted up to now.

With 2025 approaching, many are questioning whether or not the burn efforts, mixed with whale exercise, can generate long-term worth or if broader market circumstances will proceed to overshadow these efforts.

Understanding burn price and SHIB’s current value motion

For context, burn price refers back to the tempo at which tokens are completely faraway from circulation, which reduces the general provide. In principle, this mechanism drives up demand. Nonetheless, current knowledge has triggered considerations.

Over the previous 24 hours, 506,465 SHIB tokens have been burned, reflecting a pointy 90.69% decline from earlier ranges.

This vital drop prompt a sudden slowdown in burn exercise, particularly with the whopping 578% increase a mere 10 hours earlier.

Regardless of this, weekly burns introduced a special story, exhibiting a modest 4.5% enhance with 65.19 million SHIB tokens burned over the previous week.

This indicated that the group’s efforts to scale back the provision stay energetic, although the short-term burn price has decreased.

Worth motion and market sentiment

In the meantime, on the value entrance, SHIB has struggled to take care of its November highs. At press time, the memecoin exchanged arms at $0.00002167.

Regardless of a minor uptick of 1.69% over the previous day, broader market sentiment remained subdued. The token’s declining RSI signaled bearish momentum.

Moreover, the OBV confirmed stagnant demand, whereas decreased buying and selling volumes pointed to waning retail participation.

Shiba Inu whale exercise

Right here, it’s value noting that the whale transactions have been instrumental in shaping Shiba Inu’s market exercise.

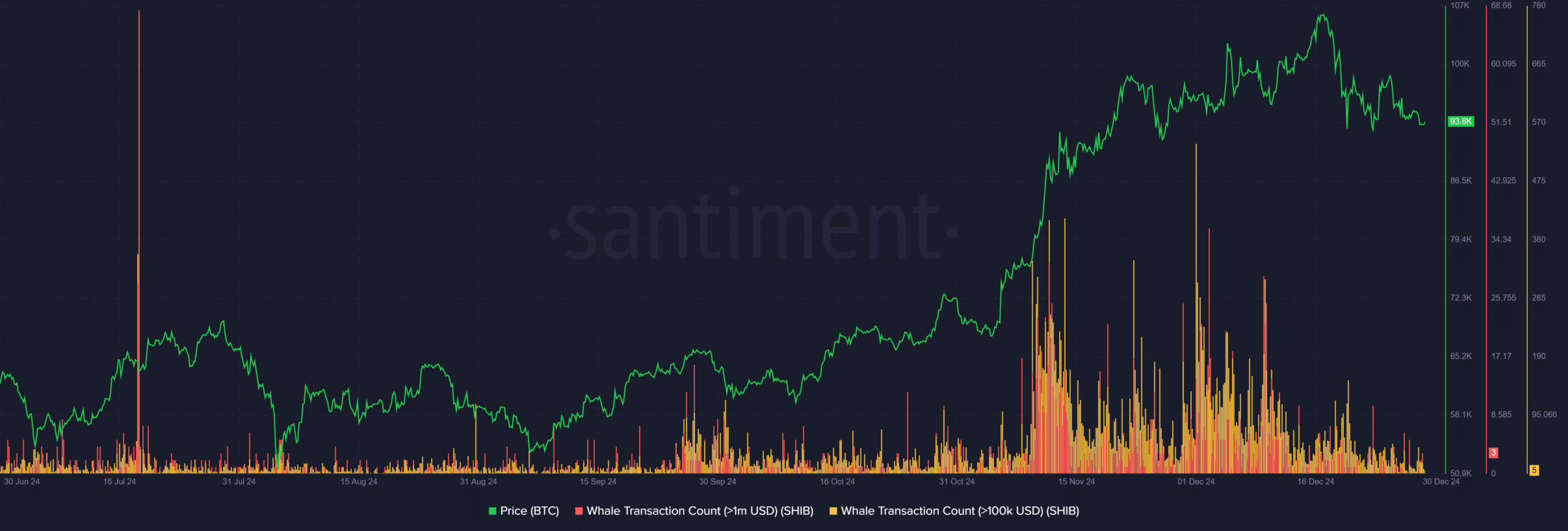

AMBCrypto’s evaluation of Santiment knowledge revealed a noticeable spike in whale exercise throughout key value rallies in October and November 2024. This prompt a direct correlation between large-volume trades and SHIB’s momentum.

Curiously, the most recent knowledge confirmed that whale transactions remained elevated. The counts stabilized at roughly 93.8K for $100K+ transactions, highlighting sustained curiosity from deep-pocketed buyers.

This heightened exercise reinforces liquidity but additionally provides volatility, as vital sell-offs might dampen value restoration efforts.

When mixed with the burn price mechanics, whale exercise capabilities as a double-edged sword—intensifying speculative value surges and exacerbating corrections.

This dynamic stays important for SHIB’s short-term trajectory heading into 2025.

Regardless of this heightened exercise, neither whale transactions nor burn initiatives have triggered substantial value rallies. Why? As a result of macroeconomic uncertainty continues to weigh on investor sentiment.

SHIB’s reliance on burns and whale-driven liquidity, with out the muse of broader utility, constrains its potential upside.

Learn Shiba Inu’s [SHIB] Price Prediction 2025–2026

Shifting into 2025, the token’s trajectory stays influenced by these dynamics.

For SHIB to reverse its downtrend and foster sustainable progress within the upcoming yr, community improvement and elevated adoption shall be pivotal.