- Bitcoin’s Binary CDD and HODL Waves indicated that long-term holders have been accumulating, easing market sell-side strain.

- New triggers may drive its subsequent main worth motion.

Bitcoin’s [BTC] on-chain metrics paint a compelling image of lowered sell-side strain, with long-term holders (LTHs) displaying indicators of accumulation fairly than distribution.

Key indicators equivalent to Binary Coin Days Destroyed (CDD), HODL Waves, and Alternate Netflow present a stabilizing market, however new catalysts could also be wanted to unlock the subsequent development section.

LTHs take a backseat

The Bitcoin Binary CDD indicator, which measures long-term holders’ depth of coin motion, has not too long ago proven values persistently beneath 0.3.

This means that LTHs should not actively spending or promoting their cash, a development usually related to lowered sell-side strain.

Traditionally, intervals of low Binary CDD have preceded bullish phases, as long-term holders have a tendency to carry onto their cash throughout market uncertainty.

With Bitcoin’s worth hovering round $102,000, this metric signifies that LTHs are probably ready for stronger alerts earlier than making important strikes.

A rising desire for accumulation

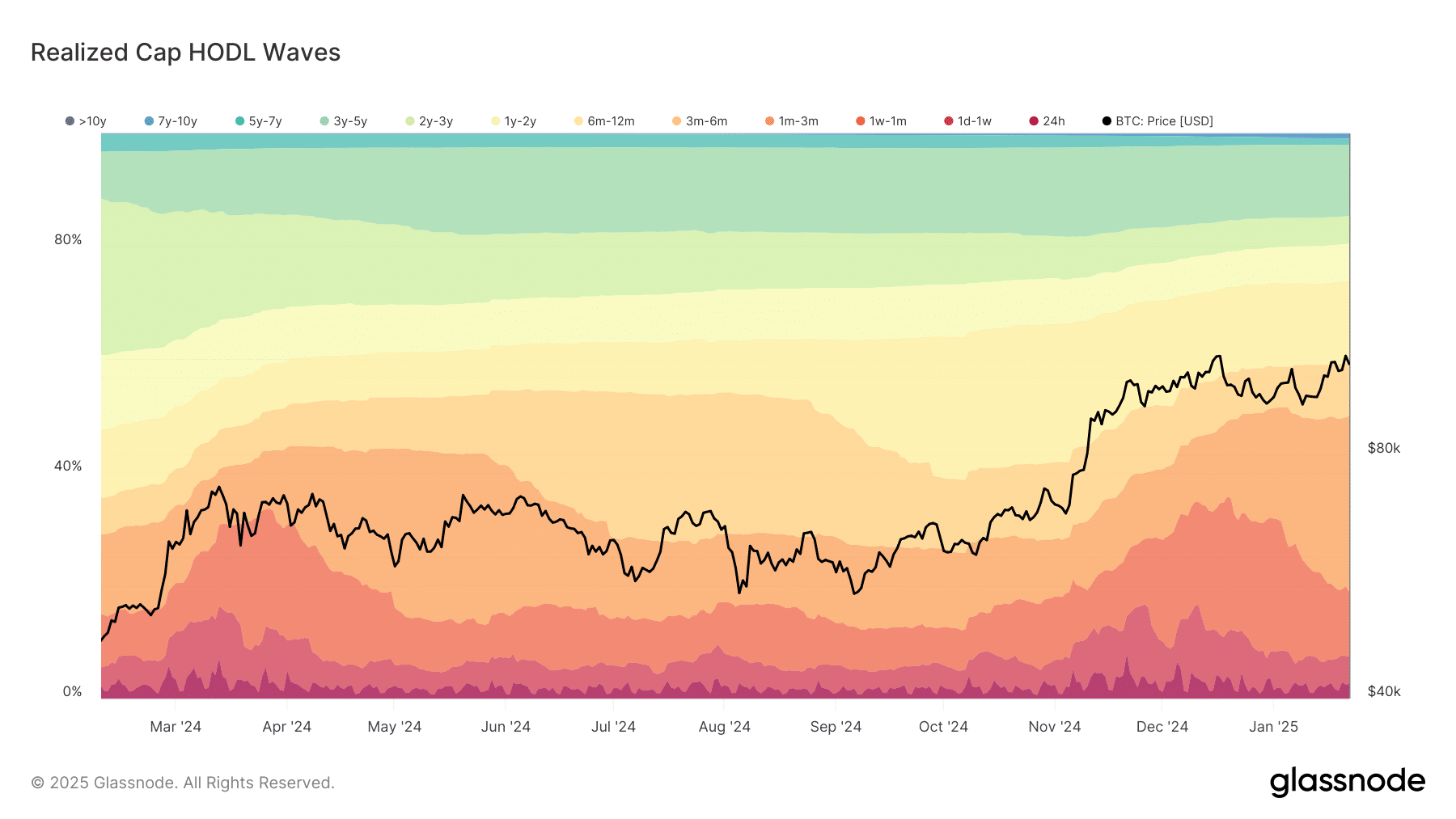

The Realized Cap HODL Waves chart from Glassnode additional proves this development.

The info reveals that a good portion of Bitcoin’s provide is held by long-term holders, with cash aged 1–2 years and a couple of–3 years displaying notable will increase.

Cash held for 1–2 years have grown steadily, indicating that traders who purchased throughout the 2022 bear market are holding robust.

Equally, cash held for two–3 years have additionally expanded. It displays confidence amongst those that gathered throughout the 2020-2021 bull run.

These HODL Waves recommend that long-term holders should not solely refraining from promoting however are additionally accumulating extra Bitcoin, additional decreasing obtainable provide available on the market.

Bitcoin exhibits unfavorable stream

The Bitcoin Alternate Netflow metric, which tracks the motion of cash to and from exchanges, has proven a constant unfavorable development over the previous few months.

This implies extra Bitcoin is being withdrawn from exchanges than deposited. This development is a robust indicator of accumulation.

Current information exhibits the netflow has been predominantly unfavorable, with outflows spiking throughout key worth actions. As of this writing, the netflow was unfavorable, with over 258 BTC recorded.

For instance, throughout Bitcoin’s latest surge, trade netflow dipped considerably, suggesting traders moved their cash to chilly storage.

Unfavorable netflow reduces quick sell-side strain, as fewer cash can be found on exchanges for buying and selling. This development aligns with the conduct of long-term holders preferring to carry fairly than commerce.

What’s subsequent for Bitcoin?

Whereas the present on-chain metrics level to a stabilizing market, Bitcoin’s worth motion could require new catalysts to interrupt by key resistance ranges.

The latest chart evaluation gives extra insights into Bitcoin’s potential trajectory.

The chart exhibits Bitcoin’s worth hovering round $102,587.51. It had a each day excessive of $103,779.99 and a low of $101,512.88.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

The 50-day and 200-day shifting averages are at 98,599.97 and $75,750.86, respectively, indicating a bullish crossover. This means that regardless of short-term volatility, the long-term development stays upward.

Bitcoin’s on-chain metrics present that long-term holders maintain robust and sell-side strain is easing. Whereas this creates a basis for market stability, the subsequent main worth motion will probably rely upon exterior catalysts.