- Lengthy-term holders could start accumulating BTC as short-term holders regularly distributed their holdings.

- Miners have seen elevated profitability regardless of the rising issue of mining one BTC.

Bitcoin [BTC] has established a brand new worth degree above $100,000 for the second time this 12 months, hitting an all-time excessive of over $109,000.

This milestone prompt that $100,000 might probably function a brand new psychological assist degree, with bullish market sentiment offering additional momentum for worth will increase.

AMBCrypto evaluation confirmed that the continuing change of BTC between short-term and long-term holders was additional contributing to the optimistic outlook for the cryptocurrency.

Will historical past repeat as BTC modifications hand?

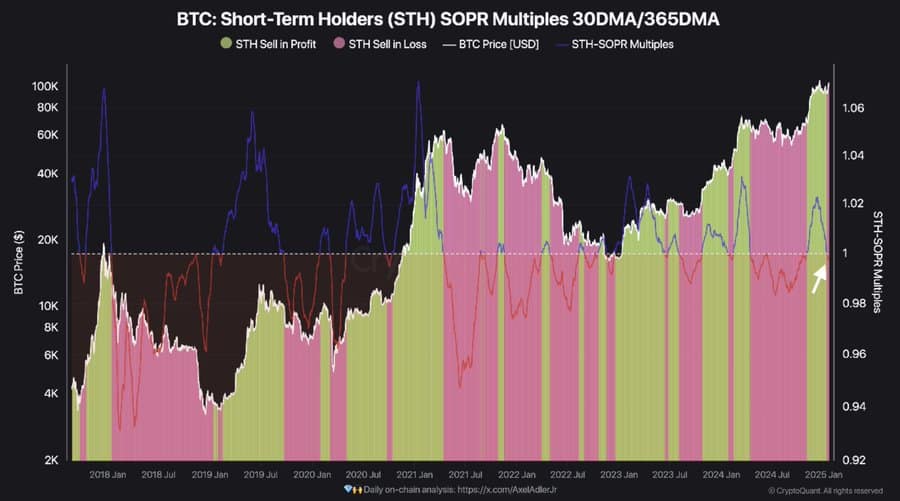

Based on insights from CryptoQuant, short-term Bitcoin holders have began promoting at a loss, as indicated by the Quick-Time period Holder (STH) SOPR a number of.

This metric compares the Quick-Time period Holder Spent Output Revenue Ratio (SOPR) over 30-day and 365-day intervals.

Usually, a worth above 1 signifies STHs are in revenue, whereas a worth beneath 1 alerts losses. Present knowledge reveals that STHs are promoting at a loss.

Traditionally, when the STH SOPR turns unfavorable, it usually attracts long-term holders (LTHs) to build up extra BTC.

LTHs are thought of a extremely bullish cohort available in the market, as they maintain BTC for at the very least 155 days.

This conduct reduces circulating provide, that means accumulation at this degree might positively influence BTC’s worth and drive it greater.

Can miner profitability spark worth pump?

Whereas long-term and short-term BTC holders are actively exchanging positions, miner profitability has reached new highs regardless of rising mining issue.

Mining issue is a mechanism designed to keep up the Bitcoin community’s safety by guaranteeing constant block manufacturing over time.

As issue will increase, it turns into tougher for miners to course of transactions and earn rewards.

Based on Glassnode’s Problem Regression Mannequin, miners are experiencing roughly 3x profitability. The present value to mine 1 BTC is $33,900, whereas BTC’s worth at press time stood at $104,900.

This vital revenue margin might incentivize miners to carry onto their BTC reserves because the asset’s worth developments greater.

This conduct, coupled with accumulation by long-term holders (LTHs), reduces BTC’s circulating provide and will pave the best way for a possible worth surge.

Might BTC be on observe for a 500% surge?

BTC’s present worth efficiency seems to align with historic developments, notably the bull market rally noticed between 2015 and 2018, in line with Glassnode knowledge analyzing BTC’s worth actions because the cycle low.

Based mostly on this metric, BTC has the potential to rally by roughly 562%, or 5.62 instances its present worth of $104,850.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

If this projection holds, BTC might surpass $589,000 by the tip of the present cycle, setting a brand new all-time excessive for the cryptocurrency.

To date, market sentiment stays bullish, reinforcing the opportunity of BTC persevering with its upward trajectory.