Key Notes

- Institutional inflows into Bitcoin ETFs hit $1.4 billion this week, signaling renewed confidence in Bitcoin.

- Derivatives market exhibits optimism with open curiosity at $65.93 billion.

- Lengthy-term holders flip grasping as Bitcoin crosses $100,000 because the NUPL indicator reaches euphoria.

- Bullish indicators level to a possible $111,573 worth goal.

With the overall crypto market valuation crossing $3.5 trillion after a 2.42% intraday surge, Bitcoin

BTC

$102 774

24h volatility:

4.0%

Market cap:

$2.04 T

Vol. 24h:

$61.86 B

has damaged above the $102,000 mark with an intraday acquire of two.13%. The bullish development in Bitcoin is gaining momentum.

Will this rising rally create a brand new all-time excessive earlier than Donald Trump’s swearing-in as the brand new US President?

Bitcoin Evaluation Reveals Channel Breakout

Within the 4-hour chart, Bitcoin’s worth motion reveals a bullish breakout of a falling channel sample. BTC worth has elevated by 15% over the previous 4 days, surging from $89,164 to its present market worth of $102,063.

Because the bullish development strengthens, the golden crossover between the 50 and 200 EMA strains indicators a shopping for alternative. Moreover, the 4-hour RSI line has moved into the overbought boundary zone, reinforcing the bullish sentiment.

The BTC worth motion additionally tasks a rounding backside reversal with a neckline at $102,514. Breaking via this stage will probably problem the earlier swing excessive close to the $108,000 mark. Utilizing Fibonacci ranges, the upside worth goal for Bitcoin is $111,573, comparable to the 1.272 Fibonacci stage.

On the draw back, the essential help now lies at $100,874. The breakout rally from the falling channel sample hints at a rounding backside reversal, making the underlying Bitcoin panorama extraordinarily bullish. In consequence, the chance of recent all-time highs is increased than ever.

Institutional Help Drives Bitcoin Momentum

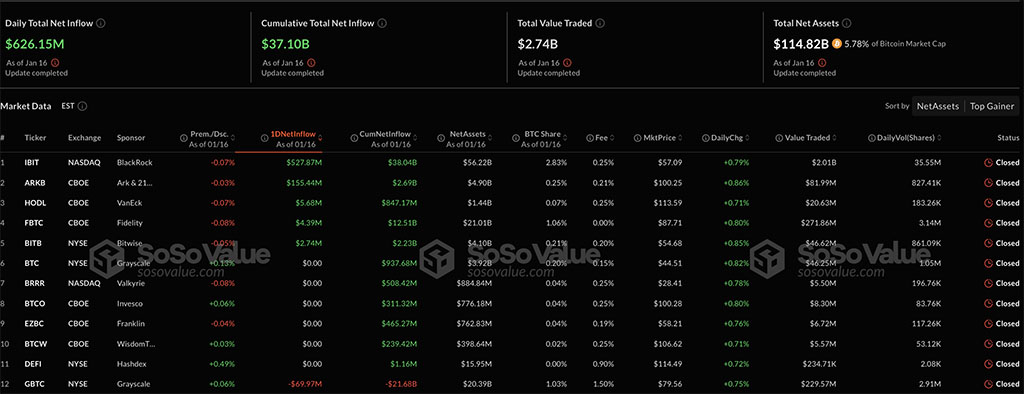

As Bitcoin’s worth continues to develop, institutional help has returned strongly. The each day web influx of US-bought Bitcoin ETFs on January 16 recorded $626.15 million.

BlackRock’s IBIT ETF led the shopping for spree, registering an influx of $527.87 million. ARK and 21Shares adopted because the second-largest purchaser with a mixed influx of $115.44 million.

Whereas most ETFs confirmed optimistic or impartial flows, Grayscale Bitcoin Belief recorded an outflow of $69.97 million. The 2 consecutive inexperienced days for Bitcoin ETFs have propelled inflows to almost $1.4 billion, indicating a clean bullish trajectory.

On-Chain Metrics Sign Optimism

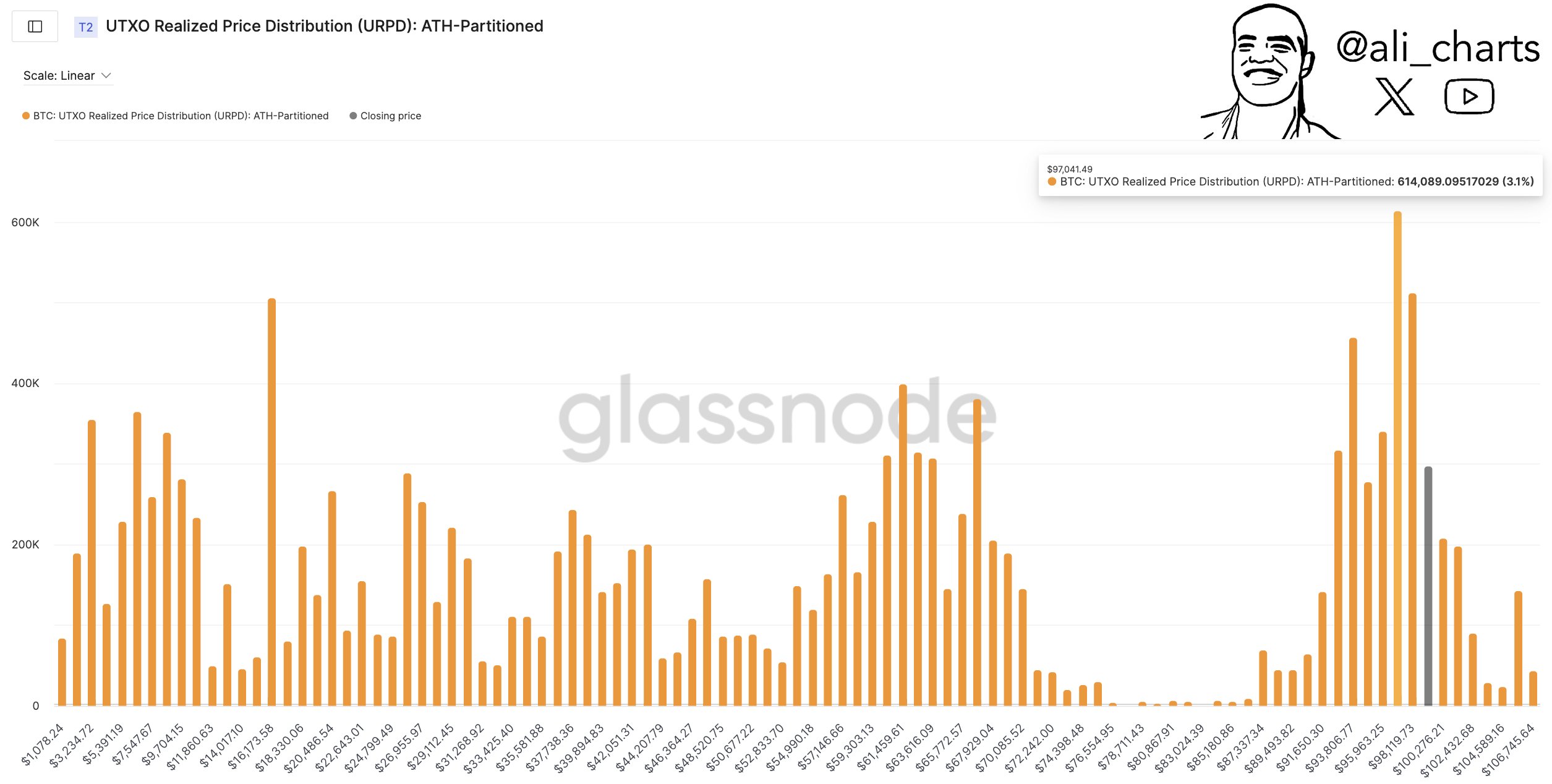

In a current X post, crypto analyst Ali Martinez highlighted the altering dynamics in Bitcoin’s spot market. Lengthy-term holders are turning grasping as Bitcoin crosses the $100,000 mark.

That is evident from the long-term holder NUPL indicator reaching the euphoric stage. Nonetheless, Martinez additionally cautioned about potential corrections in Bitcoin because of market volatility.

The $97,000 stage appearing as a vital help in keeping with the UTXO realized worth distribution indicator. So long as this stage holds, the broader bull run stays intact, regardless of potential short-term corrections.

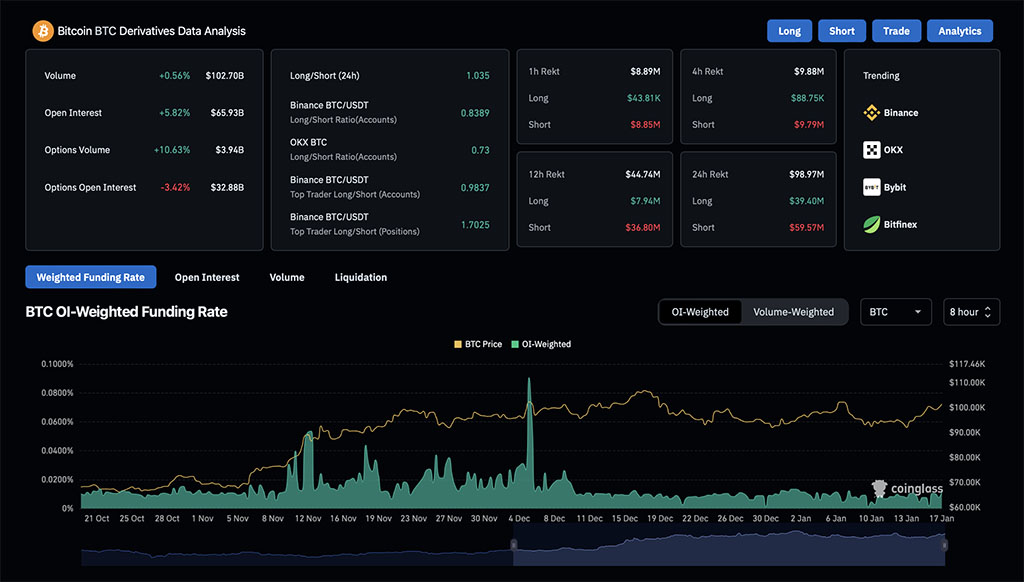

Derivatives Market Displays Bullish Hypothesis

The broader market anticipates a continuation of Bitcoin’s bullish development. A 5.82% improve in Bitcoin open curiosity, reaching $65.93 billion, highlights rising hypothesis. Moreover, choices quantity surged by 10.60% to succeed in $4 billion.

The long-to-short ratio over the previous 24 hours has reached 1.035, reflecting a higher variety of bullish positions. Nonetheless, Binance’s prime dealer accounts present a long-to-short ratio of lower than 1, suggesting fewer accounts holding bullish positions.

When contemplating place dimension, the ratio jumps to 1.7025, demonstrating bullish dominance. The funding fee has spiked to 0.0117, exhibiting merchants’ confidence in holding bullish positions. Thus, derivatives knowledge underscores excessive optimism amongst merchants, supporting the broader bullish narrative for Bitcoin.

In a nutshell, Bitcoin’s bullish momentum and robust institutional help sign potential new highs, with $111,573 as the subsequent goal.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm data by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Vishal, a Bachelor of Science graduate, started his journey within the crypto area through the 2021 bull run and has since navigated the next market winter. With a robust technical background, he’s devoted to delivering insightful articles wealthy in technical particulars, empowering readers to make well-informed selections.