Because the digital asset market added over $1.5 trillion to its market cap in 2024, boosted by the rise of an insane memecoin rally the place even essentially the most absurd tasks minted a whole bunch of thousands and thousands of {dollars} (Fartcoin, CumRocket, and Unicorn Fart Mud, to call just some), one of many massive winners was the digital asset ATM sector, a brand new report has revealed.

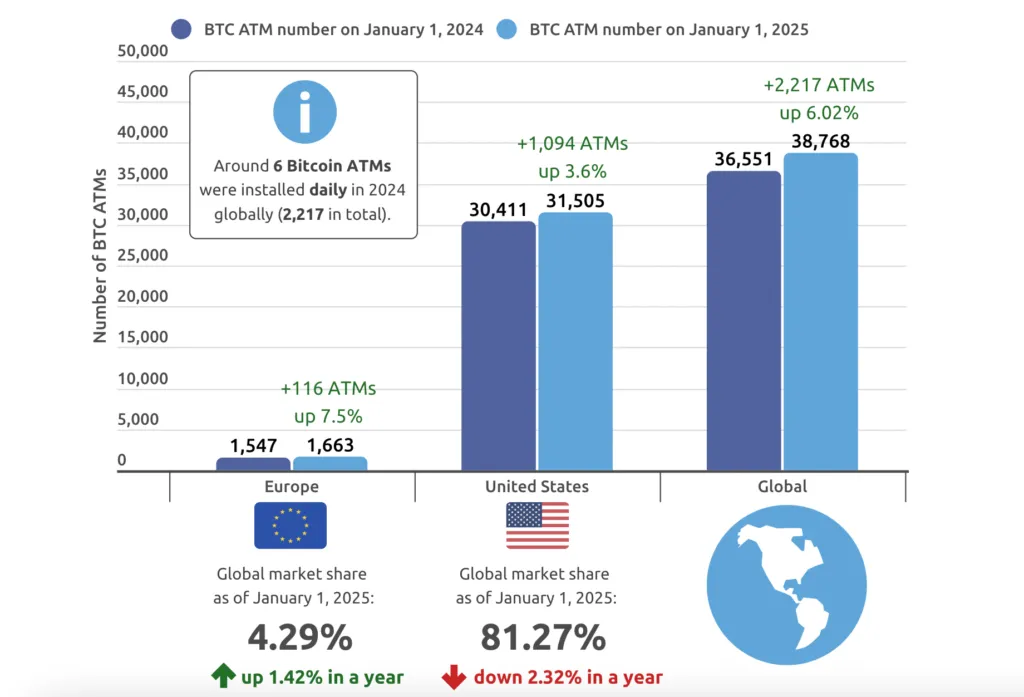

Final yr, 2,217 digital asset ATMs had been put in globally, a 6.02% rise year-on-year, the report by Finbold revealed. This translated to only over six new machines put in every day because the sector capitalized on the bull market to reel thousands and thousands of recent clients globally.

Digital asset ATMs have remained a controversial element of the business. Their proponents have argued that they increase monetary inclusion as they’re straightforward to entry and use, even for novices. They’re additionally favored by these searching for enhanced privateness. Nevertheless, this identical privateness has made them an avenue for criminals, who use them to rip-off victims and launder the proceeds of crime.

Nonetheless, they proceed to proliferate, with the U.S. because the dominant power globally. Final yr, the nation added practically 1,100 new ATMs, half the variety of new machines globally. This introduced the variety of American ATMs to 31,505, accounting for 81.3% of the worldwide complete of 38,768.

The report additionally revealed that Europe stays the one area with constant growth in ATM numbers over time, even throughout the “crypto winter.” Final yr, Europe added 116 new machines, pushing its share to 4.3%.

The rampant progress in digital asset ATMs worries regulators. In Delaware, the Legal professional Normal’s Workplace issued a warning this week, reminding residents to watch out for scammers who’ve focused victims via the machines. In keeping with the U.S. Federal Trade Commission (FTC), People misplaced $111 million to the ATMs in 2023. The precise figures had been a lot increased, FTC added, noting that many of the scams went unreported.

The scammers principally goal victims via social media, phishing campaigns, telephone calls, and different social engineering strategies, with the ATMs used to ship them cash.

“Scammers create some pressing justification so that you can take money out of your financial institution accounts and put it right into a Bitcoin ATM. Usually, the scammers fabricate an funding that guarantees nice returns with restricted threat. If it sounds too good to be true, it’s,” Legal professional Normal Kathy Jennings acknowledged.

Watch: Need to develop on BSV? Right here’s how one can construct with Mandala

title=”YouTube video participant” frameborder=”0″ permit=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>