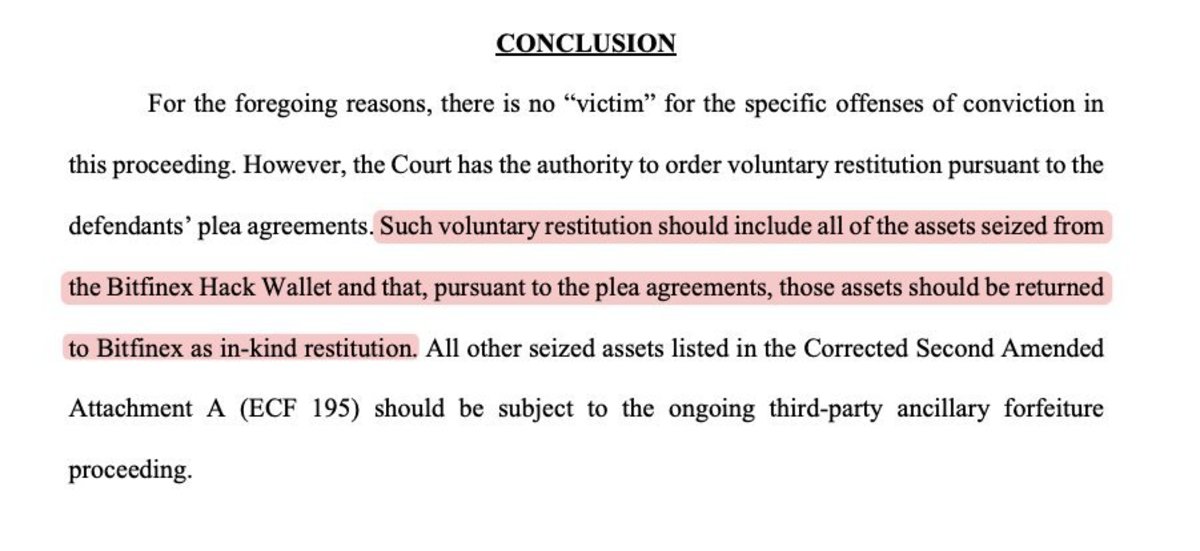

Earlier this morning, the U.S. authorities introduced through a court docket doc that stolen bitcoin from the Bitfinex hack in 2016 must be returned to the change in-kind. This bitcoin, as seen publicly on the blockchain through Arkham Intelligence, totals 94,643 BTC at the moment price $9.4 billion on the time of writing.

Simply 5 days earlier than pro-Bitcoin Donald Trump is sworn into workplace for a second time period, the U.S. authorities appears to be on the verge of sending a big chunk of U.S. held bitcoin again to Bitfinex. Final summer time, at The Bitcoin 2024 Convention in Nashville, Donald Trump pledged to create a nationwide strategic bitcoin stockpile utilizing the bitcoin already held by the federal government obtained from hacks, seizures, and so forth. In line with Arkham Intelligence data, the U.S. at the moment holds 198,109 bitcoin price over $20.1 billion. If these cash are to be despatched again to Bitfinex — that will reduce Trump’s promised strategic reserve by 47.77% right down to 103,466 BTC.

BREAKING: 🇺🇸 DONALD TRUMP PLEDGES TO NEVER SELL #BITCOIN AND HOLD IT AS A STRATEGIC RESERVE ASSET IF ELECTED PRESIDENT pic.twitter.com/bbPRxlZfGZ

— Bitcoin Journal (@BitcoinMagazine) July 27, 2024

It makes me bullish that if the federal government goes to be buying mass quantities of bitcoin within the close to future and over the long run, then I’d need them to begin from as near 0 as doable, as a result of that will require them to market purchase extra and push the value greater. The bitcoin must be returned in-kind, the court docket doc said, which means these cash is not going to have to be bought for {dollars}, relieving any downward stress on bitcoin’s worth from that will be sale. Plus bitcoin getting returned to its rightful proprietor feels like the fitting factor to do, and I’m positive Bitfinex will probably be thrilled to get their cash again.

Nonetheless, if the U.S. authorities goes to be mass shopping for bitcoin for a strategic reserve, then Wyoming Senator Cynthia Lummis’ proposed laws for that will have to be signed into legislation. Because it stands from simply Trump’s promise, he would simply initially preserve the seized bitcoin held on the federal government steadiness sheet because the strategic reserve, with the potential of buying extra BTC by different strategies, however made no laborious promise on that. Senator Lummis’ proposed invoice would see america purchase 200,000 bitcoin per yr, for five years, till it has amassed a complete of 1,000,000 bitcoin.

JUST IN: US Senator Cynthia Lummis outlines Strategic #Bitcoin Reserve plan: "buy 200k BTC per yr for 5 years. 1m BTC whole." 🇺🇸 pic.twitter.com/57ofJhc8X0

— Bitcoin Journal (@BitcoinMagazine) November 21, 2024

Nonetheless this all performs out, the strategic bitcoin reserve will probably be bullish for the nation and for Bitcoin typically. Clearly, Senator Lummis’ invoice could be the much more bullish of the potential outcomes, as a result of it will market purchase again all of the bitcoin it plans to provide again to Bitfinex, after which 905,357 BTC extra. That quantity of sheer shopping for demand would probably ship the value of bitcoin skyrocketing, particularly as different governments around the globe begin shopping for as nicely to maintain up with our authorities’s purchases.

Even when Lummis’ invoice doesn’t come to fruition, and we solely get the reserve that Trump promised, I imagine that’s nonetheless sufficient to make different governments FOMO into creating their very own reserve as nicely.

There’s solely about 450 new bitcoin getting mined each day, and with institutional bitcoin purchases already outpacing the brand new provide of BTC mined this yr, issues might get actually loopy, actually quick. Buckle up.

JUST IN: Company demand for #Bitcoin is already outpacing new bitcoin provide this yr 👀

Bullish 🚀 pic.twitter.com/PyKk9Aci93— Bitcoin Journal (@BitcoinMagazine) January 13, 2025

This text is a Take. Opinions expressed are solely the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.