Key Notes

- Right now’s Shopper Value Index (CPI) launch and the Federal Reserve’s January rate of interest determination might considerably affect Bitcoin value.

- Cooler-than-expected inflation information might set off a rally, whereas hawkish Fed insurance policies have delayed the primary 2025 fee cuts to June.

- Forward of Donald Trump’s January 20 inauguration, Bitcoin faces resistance at $100K and will stay range-bound till mid-March.

Within the final 24 hours, Bitcoin value

BTC

$96 847

24h volatility:

0.3%

Market cap:

$1.92 T

Vol. 24h:

$44.92 B

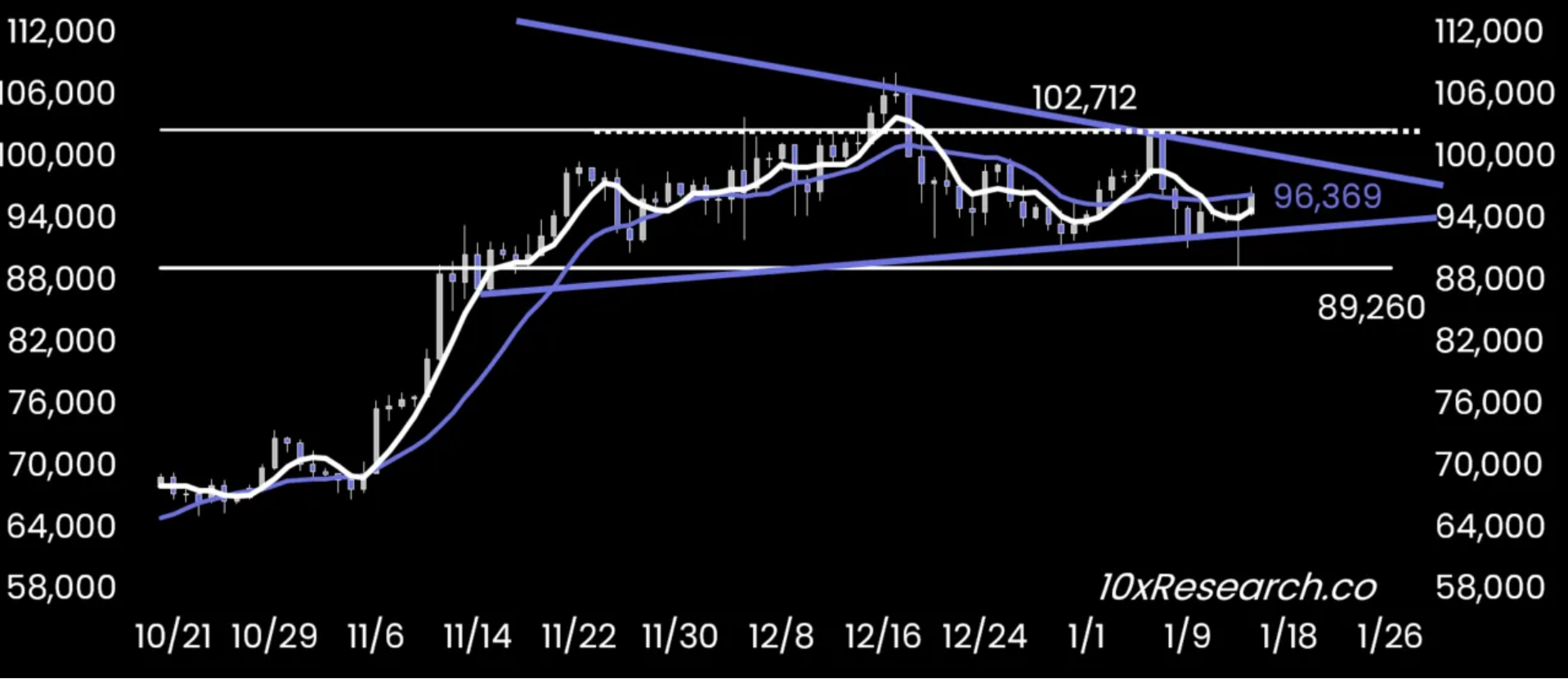

has staged a powerful restoration leaping 2.45% and shifting previous $97,300 ranges as of press time. As per 10x Analysis head of analysis Markus Thielen, the BTC value motion is shaping up for a significant breakout forward of the Federal Open Market Committee (FOMC) assembly scheduled for January 29.

In his January 14 markets report, Thielen wrote:

“Bitcoin trades inside a narrowing triangle, signaling a breakout is imminent — possible no later than the January 29 FOMC assembly”.

-

Supply: 10x Analysis

Thielen added that for merchants, the most effective method will probably be to observe the breakout no matter which course it occurs. One of many main catalysts for a Bitcoin value rally can be the Shopper Value Index (CPI) information launch right now.

There have been rising expectations of a better CPI, which signifies that if inflation comes cooler than the anticipated worth, it might set off a Bitcoin value rally forward. On the January FOMC, the US Federal Reserve will make the primary rate of interest determination for this yr 2025.

Contemplating the hawkish tone of Fed’s Jerome Powell final month, buyers will probably be carefully watching any additional commentary. Moreover, the robust jobs information and strong US financial system have already delayed the primary Fed fee cuts for 2025, to June this yr.

Bitfinex highlighted information from the CME FedWatch Software, which signifies that merchants within the Fed Funds futures market see a 38.3% chance that the Federal Reserve will chorus from making any fee cuts throughout the first half of 2025.

Bitcoin Value Volatility and Trump Inauguration

Forward of Donald Trump‘s inauguration subsequent week on January 20, crypto market analysts are sustaining a cautious stand as Bitcoin value faces rejections at $100K ranges. In his analysis report, Thielen acknowledged that Bitcoin may consolidate for some extra time and almost for the following two months. He wrote:

“As a consequence of weak market drivers, Bitcoin will possible stay range-bound till mid-March.”

Crypto analyst Lark Davis famous in a January 14 submit on X that “Bitcoin is displaying value actions much like these seen over the last presidential election and inauguration”.

Davis shared a value chart displaying that forward of President Biden’s 2021 inauguration, Bitcoin dipped to round $30,000 earlier than rallying to $55,000 shortly after the occasion. “Historical past might not repeat itself, but it surely usually rhymes,” Davis added.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material.

Bhushan is a FinTech fanatic and holds a superb aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s constantly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and generally discover his culinary expertise.