- AAVE whales have been accumulating within the final two weeks.

- A recap of spot and derivatives demand because the bears cool off.

Aave [AAVE] is off to an thrilling week characterised by a resurgence of bullish demand. However much more fascinating is that whales have been displaying curiosity in AAVE, which may increase its potential restoration.

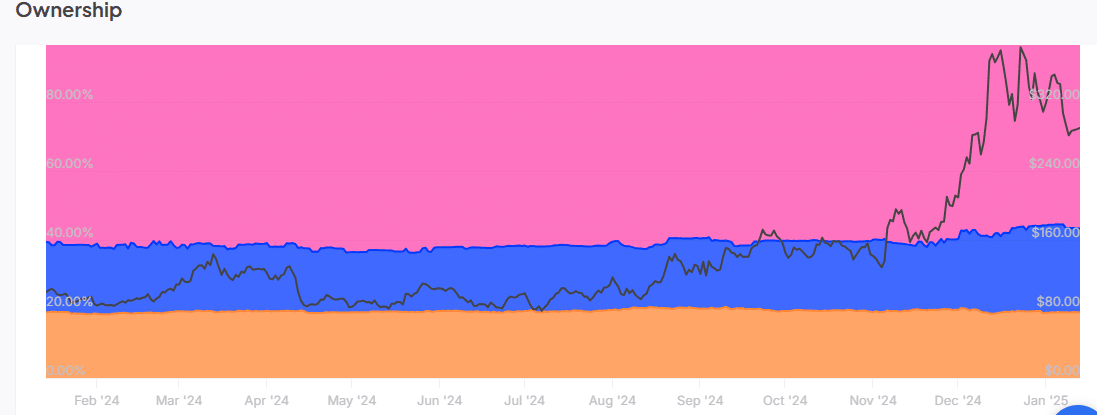

In accordance with historic focus information, whales have been accumulating the coin for the reason that begin of January.

Whales held 8.92 million AAVE tokens as of the first of January, which was equal to 55.75% of the full provide. That determine has since grown to 9.07 million tokens or 56.69% of the full provide.

Whales presently represent the very best cohort of AAVE holders, thus having the largest affect on worth. This investor class has trimmed their balances from 4.05 million tokens to three.88 million tokens throughout the identical interval.

In the meantime, retail holders have additionally been shopping for the dip, growing their balances from 3.03 million to three.05 million AAVE.

May whale demand assist AAVE restoration?

Whale accumulation is a wholesome signal for AAVE bulls. It suggests the worth may doubtlessly rally after its newest dip. AAVE bears appear to have run out of steam over the weekend, adopted by a requirement build-up.

AAVE bought for $290.75 after bouncing again by roughly 13% from its lowest worth on the thirteenth of January. Its cash movement indicator has been on an uptrend for the reason that eighth of January, indicating that liquidity is flowing again into the token.

The weekend pivot and bullish momentum within the final two days may point out that the coin is on the verge of extra upside. Nevertheless, sustained demand is critical for this to occur.

The newest on-chain stats reveal sturdy curiosity after the newest wave of promote strain bottomed out.

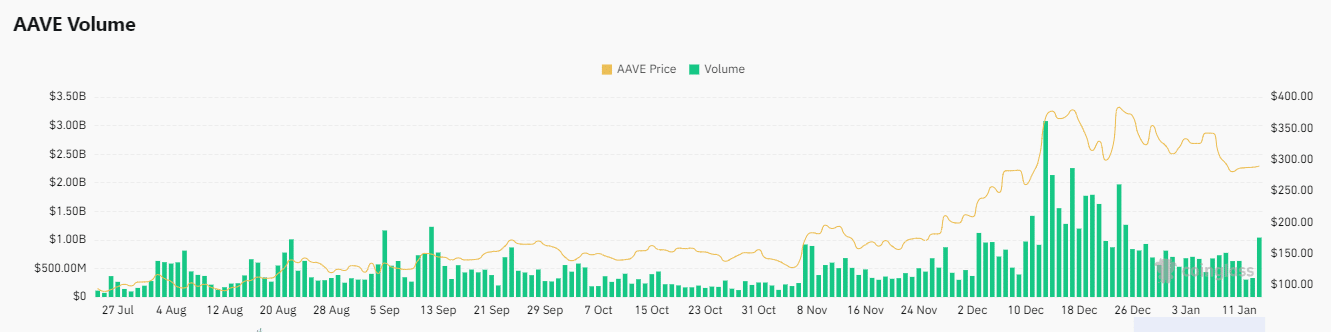

For instance, AAVE derivatives quantity peaked at $1.04 billion after a 61.05% uptick within the final 24 hours. This was the very best every day quantity determine achieved to this point this month.

The spike in volumes highlights the extent of exercise behind the token and its potential restoration. Open Curiosity peaked at $310.50 million after rallying by 6.95%.

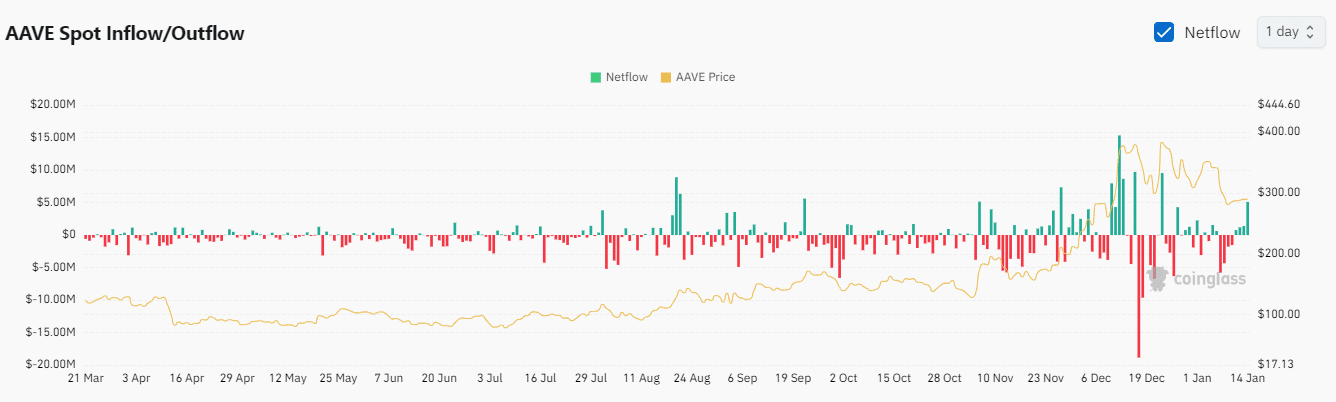

Demand additionally elevated within the spot section. As famous earlier, the MFI surged for the reason that seventh of January, and spot demand shifted throughout the identical timeline.

Spot outflows declined and turned constructive on the eleventh of January.

Learn Aave’s [AAVE] Price Prediction 2025–2026

The coin’s Spot Inflows peaked at $5.09 million on the time of statement, the very best within the final two weeks.

This confirmed a requirement resurgence for AAVE throughout this era. The true query is whether or not this demand can proceed for extra upside within the coming days.