- In accordance with Amberdata, Bitcoin’s journey to $120k may very well be delayed.

- Gradual Fed charge minimize expectations and institutional positioning may negatively affect BTC

Choices merchants have been eyeing a $120k value goal for Bitcoin [BTC] by March. Nevertheless, the most recent institutional market positioning and macroeconomic headwinds may delay the projection.

In its weekly replace, Crypto Choices analytics agency Amberdata cited sticky U.S inflation as a short-term danger for BTC and the general market. A part of the report read,

“This upcoming week, we’ll get extra shade on inflation with Tuesday’s PPI and Wednesday’s CPI launch. A powerful financial system and inflation pickup could be the bearish state of affairs for bonds. This could trickle into shares and risk-assets as a secondary impact.”

Final week’s market correction and BTC’s retest of the vary lows had been triggered by rising expectations of fewer Fed charge cuts in 2025. In reality, markets had been pricing a virtually 98% chance that the subsequent Fed charge resolution on 31 January would stay unchanged.

Coinbase analysts lately shared a equally cautious outlook, pushed by macro components and provide from long-term holders. They claimed that BTC’s upside may very well be restricted within the brief time period.

Bitcoin’s $120k goal

Most expectations of a possible BTC rally above $100k are pegged to President-elect Donald Trump’s optimistic coverage bulletins for the house, together with a strategic BTC reserve (SBR).

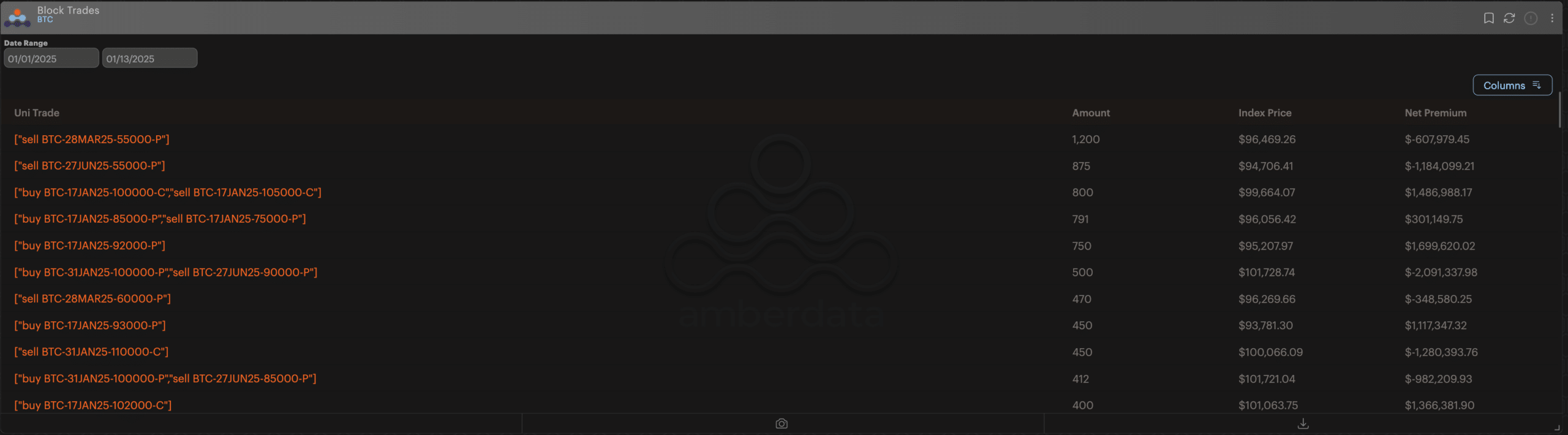

Nevertheless, Amberdata cautioned that coverage updates have probably been priced in. Moreover, the agency famous that institutional merchants have been betting on a possible BTC drop to $55k. This might additional decelerate the $120k goal.

“When high block trades, the institutional merchants are additionally theoretically bullish on Bitcoin costs, however as an alternative of shopping for calls, they’re promoting March $55k Places and June $55k Places (shorting volatility reasonably than shopping for it).”

Places choices are bearish bets sometimes related to massive gamers hedging in opposition to draw back danger.

Amderdata added that promoting places as an alternative of shopping for them may scale back implied volatility (future value swings). This alluded to muted value swings (extra value stability), which may restrict a robust transfer to $120k.

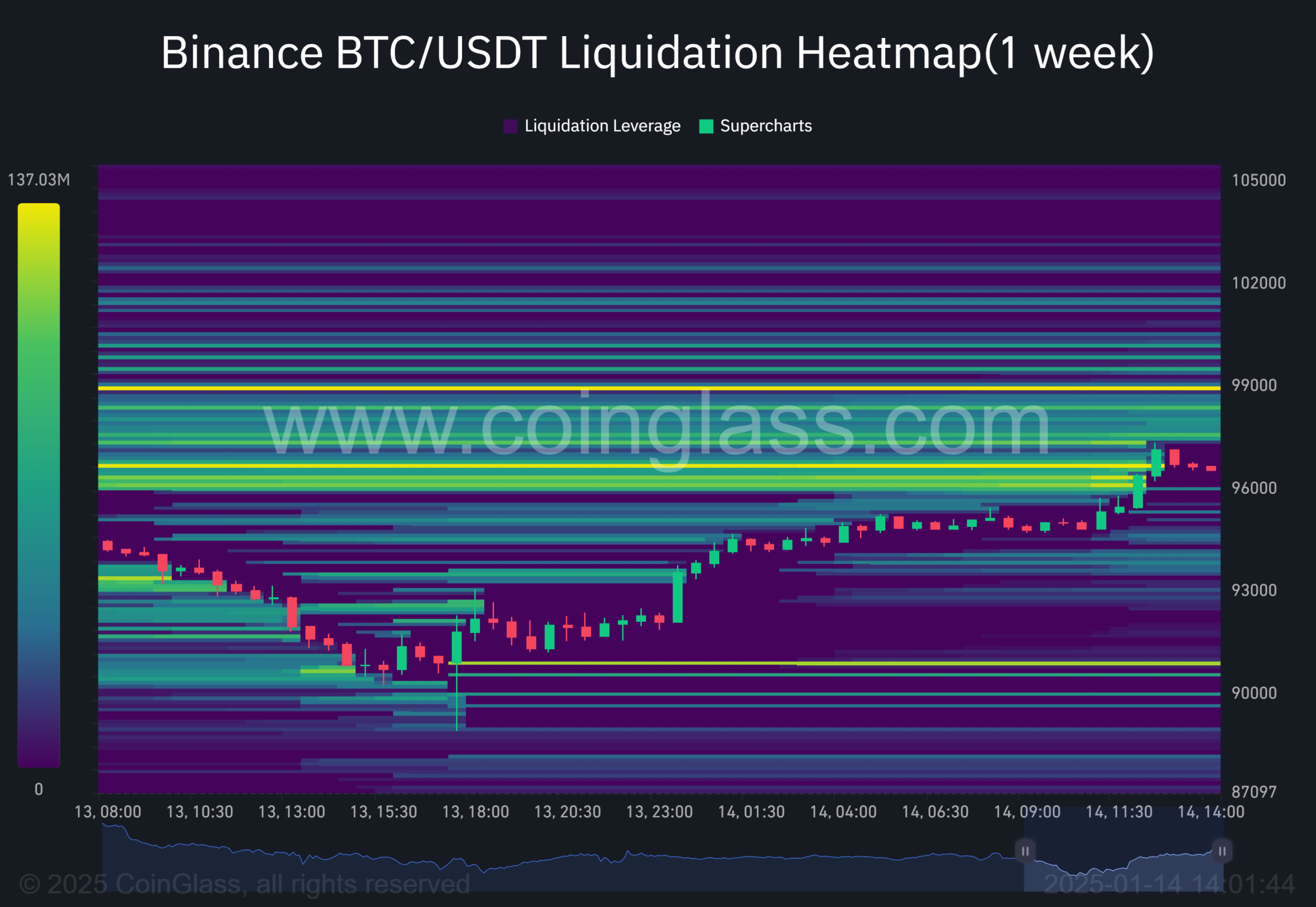

At press time, BTC had soared previous $95k, pushed by a liquidity sweep at $96k (vivid yellow space). Further pockets of liquidity had been positioned at $99k and $90k, which may additional affect value motion.

- In accordance with Amberdata, Bitcoin’s journey to $120k may very well be delayed.

- Gradual Fed charge minimize expectations and institutional positioning may negatively affect BTC

Choices merchants have been eyeing a $120k value goal for Bitcoin [BTC] by March. Nevertheless, the most recent institutional market positioning and macroeconomic headwinds may delay the projection.

In its weekly replace, Crypto Choices analytics agency Amberdata cited sticky U.S inflation as a short-term danger for BTC and the general market. A part of the report read,

“This upcoming week, we’ll get extra shade on inflation with Tuesday’s PPI and Wednesday’s CPI launch. A powerful financial system and inflation pickup could be the bearish state of affairs for bonds. This could trickle into shares and risk-assets as a secondary impact.”

Final week’s market correction and BTC’s retest of the vary lows had been triggered by rising expectations of fewer Fed charge cuts in 2025. In reality, markets had been pricing a virtually 98% chance that the subsequent Fed charge resolution on 31 January would stay unchanged.

Coinbase analysts lately shared a equally cautious outlook, pushed by macro components and provide from long-term holders. They claimed that BTC’s upside may very well be restricted within the brief time period.

Bitcoin’s $120k goal

Most expectations of a possible BTC rally above $100k are pegged to President-elect Donald Trump’s optimistic coverage bulletins for the house, together with a strategic BTC reserve (SBR).

Nevertheless, Amberdata cautioned that coverage updates have probably been priced in. Moreover, the agency famous that institutional merchants have been betting on a possible BTC drop to $55k. This might additional decelerate the $120k goal.

“When high block trades, the institutional merchants are additionally theoretically bullish on Bitcoin costs, however as an alternative of shopping for calls, they’re promoting March $55k Places and June $55k Places (shorting volatility reasonably than shopping for it).”

Places choices are bearish bets sometimes related to massive gamers hedging in opposition to draw back danger.

Amderdata added that promoting places as an alternative of shopping for them may scale back implied volatility (future value swings). This alluded to muted value swings (extra value stability), which may restrict a robust transfer to $120k.

At press time, BTC had soared previous $95k, pushed by a liquidity sweep at $96k (vivid yellow space). Further pockets of liquidity had been positioned at $99k and $90k, which may additional affect value motion.