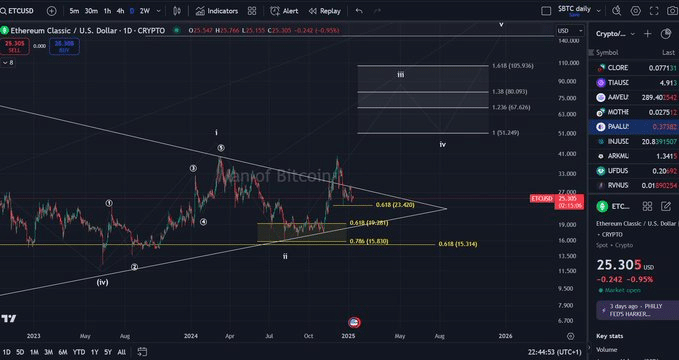

- Fibonacci retracement ranges indicated areas of sturdy assist and resistance, offering insights into future worth actions.

- This declining MVRV ratio aligns with ETC’s worth’s proximity to the 0.618 Fibonacci degree, reinforcing the opportunity of a rebound.

Ethereum Classic [ETC], a broadly adopted cryptocurrency, not too long ago exhibited notable worth actions, sparking curiosity amongst merchants and analysts.

The every day chart reveals a descending triangle sample, a construction usually signaling potential breakout alternatives.

Moreover, essential Fibonacci retracement ranges indicated areas of sturdy assist and resistance, offering insights into future worth actions.

Fibonacci retracement evaluation

Within the Fibonacci retracement ranges, Ethereum Traditional’s worth not too long ago hovered close to the 0.618 retracement degree at $23.46, a zone traditionally thought to be sturdy assist.

This degree usually serves as a turning level, the place bullish momentum might resume if patrons regain confidence.

Nevertheless, a breakdown beneath this degree might ship ETC in direction of the following essential assist on the 0.786 Fibonacci degree, roughly $15.14. This deeper correction would seemingly replicate broader market weak spot or exterior components resembling regulatory pressures.

On the upside, a breakout above the triangle’s higher trendline might permit ETC to focus on the wave iii projections, with $37 to $63 appearing as potential resistance zones.

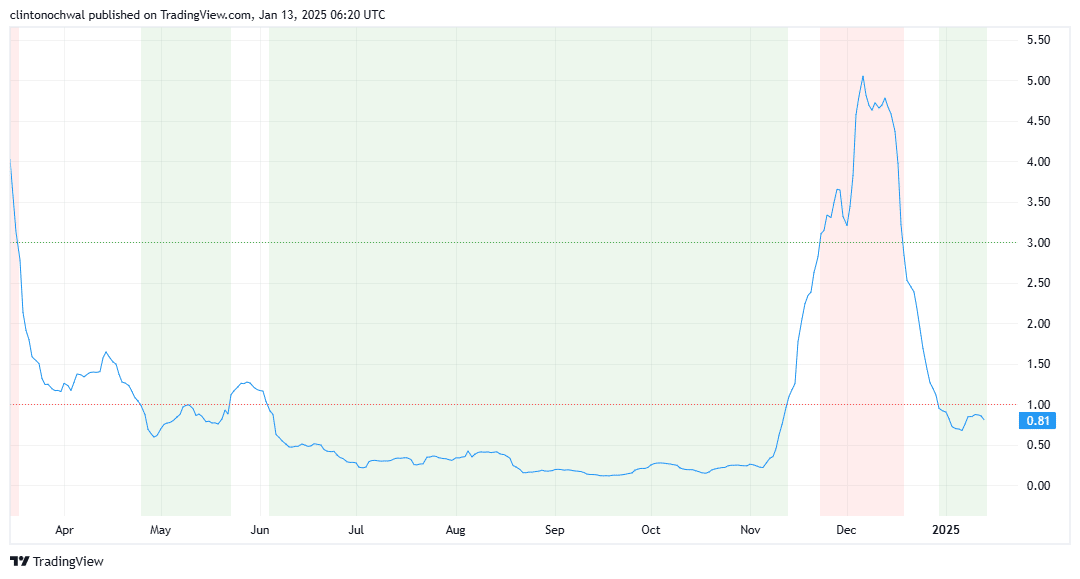

MVRV Ratio evaluation

Presently, Ethereum Traditional’s MVRV ratio suggests the asset is approaching undervaluation. Traditionally, when the MVRV ratio dips beneath 1, it signifies that the majority traders are holding ETC at a loss, which frequently precedes a worth restoration.

The declining MVRV ratio aligns with ETC’s worth nearing the 0.618 Fibonacci degree, reinforcing the opportunity of a rebound.

Lengthy-term traders usually view undervaluation indicators as prime entry factors. Nevertheless, if the ratio continues to drop, it might point out additional worth declines, probably towards the $15.14 degree.

Given the present market construction and historic traits, Ethereum Traditional would possibly consolidate close to its present ranges earlier than trying a restoration. A shift in market sentiment or broader altcoin momentum might speed up a bullish transfer.

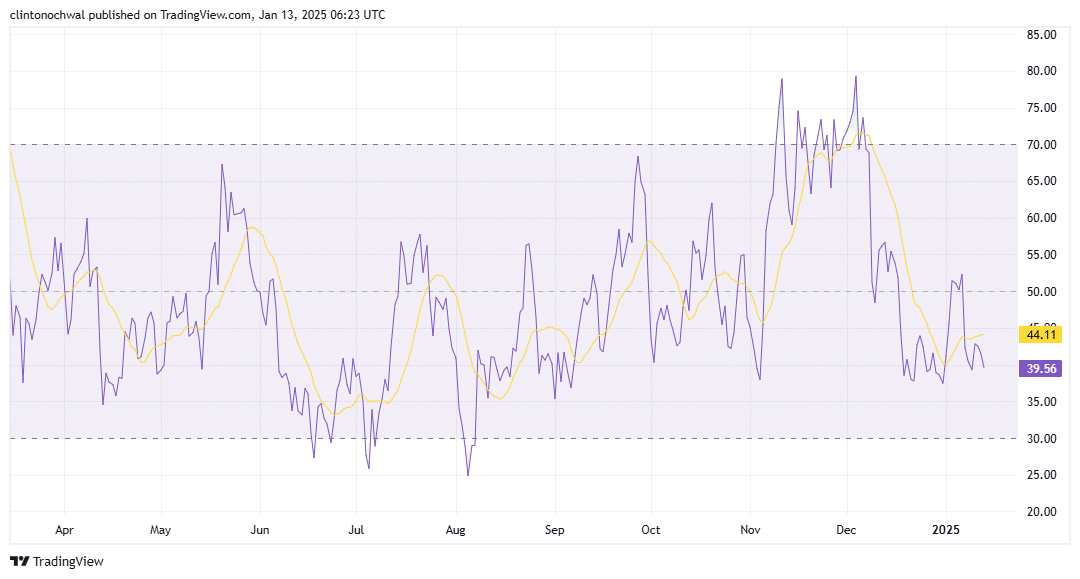

Relative Energy Index of ETC factors to…

The Relative Energy Index (RSI) gives insights into ETC’s momentum and whether or not it’s overbought or oversold.

On the every day timeframe, ETC’s RSI at present hovers within the 40-50 range, suggesting a impartial to barely oversold situation. This aligns with the current worth dip and the testing of the 0.618 Fibonacci degree.

If the RSI drops beneath 30, it will sign an oversold situation, which frequently coincides with reversal factors in worth motion.

This state of affairs will increase the chance of a rebound from $23.46 and even from the decrease $15.14 degree if the decline persists.

Conversely, an increase in RSI above 50 might sign renewed bullish momentum, complementing a possible breakout from the descending triangle sample.

Exterior components impacting Ethereum Traditional’s motion

Whereas technical indicators present precious insights, exterior components have additionally influenced ETC’s current worth motion. The cryptocurrency market, closely affected by Bitcoin’s dominance and macroeconomic circumstances, has created a risky atmosphere for altcoins like Ethereum Traditional.

Regulatory uncertainty, significantly in main markets just like the U.S., has dampened investor confidence, inflicting many altcoins to face sell-offs.

Moreover, Ethereum Traditional’s comparatively stagnant ecosystem improvement in comparison with competing networks has restricted its attraction to institutional traders, exerting extra stress on its worth.

ETC usually mirrors Bitcoin’s worth traits, and Bitcoin’s lack of ability to maintain momentum above key resistance ranges has contributed to ETC’s lack of bullish follow-through.

Nevertheless, renewed curiosity in Bitcoin or optimistic market developments might act as catalysts for ETC to interrupt out of its descending triangle sample.

Remaining ideas

Ethereum Traditional presents a combined outlook for merchants, balancing technical assist ranges, undervaluation indicators, and momentum indicators in opposition to exterior challenges.

– Sensible or not, right here’s ETC market cap in BTC’s phrases

The 0.618 Fibonacci degree at $23.46 stays a key space to observe, supported by a comparatively impartial RSI and an MVRV ratio suggesting undervaluation.

Ethereum Traditional’s skill to keep up present assist ranges and capitalize on potential market shifts might set the stage for a breakout. This makes it a cryptocurrency to observe for each short-term and long-term traders.