- The numerous drop in exercise on the Bitcoin community may exert extra downward strain on the cryptocurrency’s worth.

- A key resistance stage, the place notable promote orders are concentrated, may additional problem Bitcoin’s means to maintain its present worth.

Bitcoin [BTC] has been buying and selling inside a good vary of $93,000 to $94,000 over the previous few days, reflecting an absence of decisive market motion. Whereas this stagnation would possibly point out market resilience, it additionally exhibits uncertainty concerning the subsequent directional transfer.

Previously 24 hours, Bitcoin’s worth has skilled a minor decline of 0.75%. Nonetheless, buying and selling quantity surged by 68.66% to $29.41 billion, suggesting that promoting strain could intensify quickly.

AMBCrypto analyzed broader market sentiment to evaluate whether or not this promoting exercise would possibly enhance.

Drop in community exercise: Will BTC slide decrease?

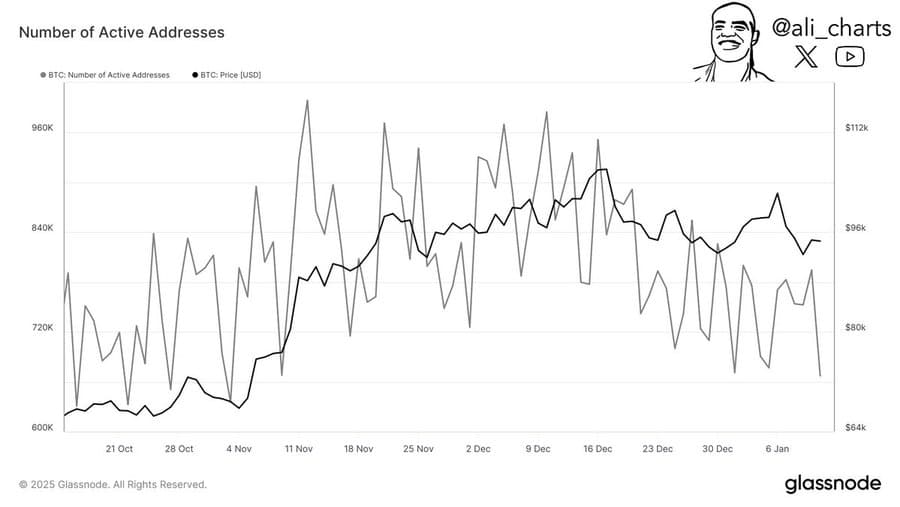

Bitcoin’s community exercise has seen a big decline over the previous month, with the variety of lively addresses steadily reducing.

Presently, the variety of lively addresses has dropped to 667,100—the bottom stage recorded since November 2024.

A decline in lively addresses suggests decreased interplay with the Bitcoin community, probably signaling decrease transaction exercise. This lack of engagement could point out waning curiosity, which may contribute to a worth drop.

Nonetheless, it additionally means that the remaining lively addresses would possibly management a notable portion of the BTC provide. Elevated shopping for exercise from these addresses may probably set off a worth rally.

Impediment to future rally

If lively addresses enhance their shopping for exercise for BTC, the asset may encounter a key provide zone because it traits larger, in accordance with knowledge from IntoTheBlock.

IntoTheBlock’s “In/Out of the Cash Round Value” metric, which identifies provide and demand zones, exhibits that between $95,900 and $98,600, BTC may face promoting strain.

At this stage, roughly 1.46 million addresses maintain potential promote orders for a complete of 1.29 million BTC.

If BTC efficiently crosses this provide zone, it may reclaim the $100,000 area. Nonetheless, failure to interrupt by would probably lead to BTC dropping beneath the $90,000 mark, signaling additional draw back danger.

Elevated provide places BTC rally unsure

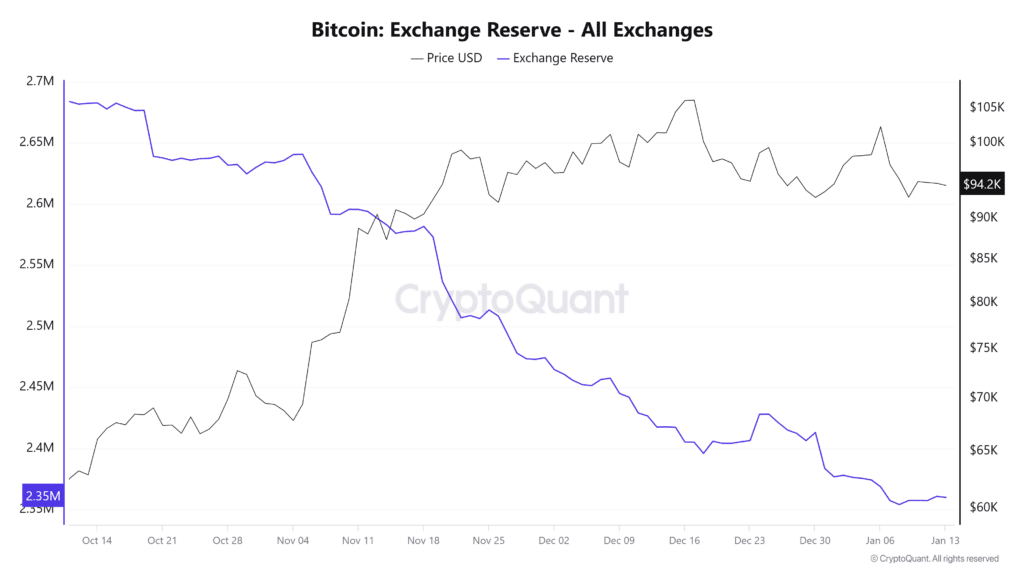

Based on CryptoQuant, BTC change reserves have been step by step growing. This means an increase within the quantity of BTC obtainable on exchanges, resulting in larger provide.

– Learn Bitcoin (BTC) Price Prediction 2025-26

Because the eighth of January, BTC reserves on exchanges have grown from roughly 2,354,000 to 2,360,000. Usually, a rise in change reserves is a warning signal that the asset may face extra downward strain from its present worth stage.

If change reserves proceed to rise, it may hinder BTC’s means to rally from its present ranges.