Litecoin worth remained on edge in the course of the weekend, mirroring the efficiency of Bitcoin, which remained under $95,000.

Litecoin (LTC), a preferred proof-of-work coin, was caught at $103.03, down by 30% from its highest degree in 2024. This decline aligns with most cryptocurrencies, which have pared again a few of the beneficial properties made final 12 months.

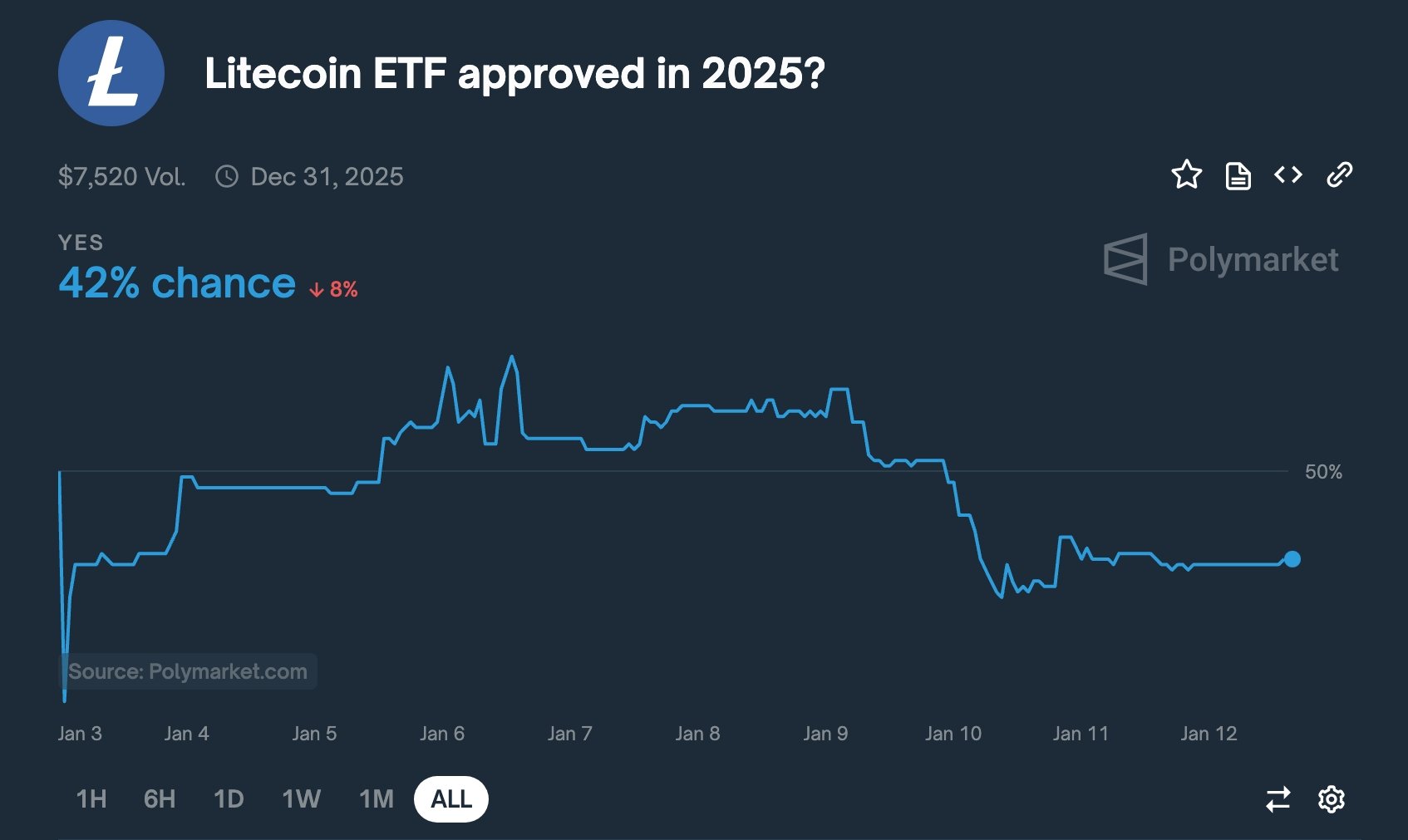

Litecoin’s efficiency was additionally due to the falling odds that the Securities and Alternate Fee will approve a spot LTC ETF in 2025. In response to Polymarket, these odds have dropped to 42% from this 12 months’s excessive of 60%.

Eric Balchunas, a senior ETF analyst at Bloomberg, promoted the view that the SEC would approve a spot LTC ETF. In a December put up, he argued that the company would simply approve a Litecoin fund as a result of it’s a Bitcoin (BTC) laborious fork.

Canary Capital is the one firm that has utilized for a spot Litecoin ETF. Grayscale can also file to transform its Litecoin Belief, which has over $215 million in property, right into a spot ETF because it has accomplished with Bitcoin and Ethereum.

Whereas a spot Litecoin ETF can be factor for the coin, it’s unclear whether or not it should acquire curiosity from institutional traders. instance of that is the efficiency of spot Bitcoin and Ethereum ETFs. Bitcoin funds have over $107 billion in property, 5.7% of the whole market cap. Ethereum funds have $11.6 billion, 2.96% of the market cap, indicating that institutional demand is weak.

Curiosity in Litecoin can be weaker than Ethereum since it’s a smaller crypto mission with a market cap of $7.7 billion. It has additionally misplaced market share within the crypto business as its rating has moved to 22 from being a high ten coin a couple of years in the past.

Polymarket merchants are optimistic that the SEC will approve Solana (SOL) and Ripple (XRP) ETFs this 12 months. The company’s odds of approving a spot XRP ETF are 70%, whereas these of Solana ETFs are 73%. These funds might have an opportunity of success because the two have a market cap of $144 billion and $67 billion, respectively.