Bitcoin (BTC) stays the middle of traders’ consideration and concern particularly following the latest nonfarm payrolls data from the US Bureau Of Labor Statistics (BLS). Whereas the overall market sentiment stays bullish, latest developments within the US economic system point out that macroeconomic components could also be in opposition to the premier cryptocurrency in 2025.

At present, Bitcoin trades above $94,000 following one other turbulent worth efficiency which produced a lack of 3.45% prior to now seven days.

Fed’s Pivot To Charge Cuts Is Lifeless – Analysts

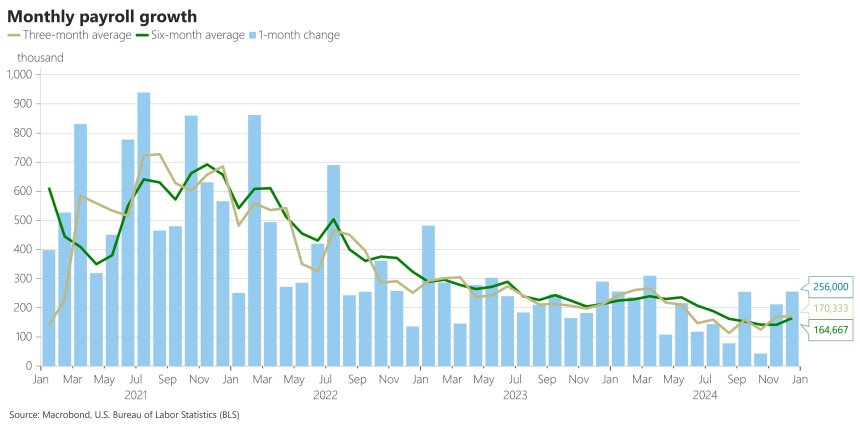

In an X post on December 10, market consultants at world capital market evaluation agency The Kobeissi Letter dissected the employment scenario abstract for December 2024. Based on the BLS, nonfarm payrolls employment rose by 256,000 jobs on this month, indicating an extra 100,000 jobs to the broadly predicted figures.

Following this report, The Kobeissi Letter analysts spotlight that the US economic system has gained a median of 165,000 jobs since July representing the very best 6-month common since July 2024.

Contemplating the US Federal Reserve started implementing rate of interest cuts from September 2024 citing then a discount in jobs progress and inflation, the analysts at The Kobeissi Letter said the Apex Financial institution’s strategy could have been misguided in gentle of the latest developments.

Subsequently, the Fed is predicted to halt rate of interest cuts to battle an anticipated heightened inflation resulting from a robust jobs information, with the potential of even adopting charge hikes.

Typically, an absence of charge cuts or introduction of charge hikes is adverse for Bitcoin as decrease Rates of interest afford traders the capability to deal In dangerous property akin to cryptocurrencies. Following the Fed’s earlier announcement of potential decreased charge cuts in 2025, Bitcoin skilled a flash crash of over 9% mid-December as traders moved to shut their unstable positions in all monetary markets.

At present, The Kobeissi Letter forecasts that the Fed’s pivot to charge cuts is probably going over, with a 44% likelihood that there might be no charge cuts by means of June 2025.

Bitcoin Worth Overview

On the time of writing, Bitcoin trades at $94,028 reflecting a 0.22% achieve prior to now 24 hours. In the meantime, the premier cryptocurrency is down by 3.72% and 6.35% prior to now seven and thirty days respectively.

Regardless of the potential of decreased charge cuts in 2025, Bitcoin traders are more likely to retain bullish sentiments resulting from different components together with historic worth efficiency in a bull cycle, an anticipated pro-crypto US authorities and steady institutional investments through the spot ETFs.

With a market cap of $1.84 trillion, Bitcoin continues to rank as the most important cryptocurrency and world’s eight largest asset.

Featured picture from Investopedia, chart from Tradingview