Key Notes

- Historic value sample emerges with longest consecutive inexperienced hourly candles in seven years, signaling potential development reversal forward.

- Market indicators present blended indicators as RSI suggests vendor dominance at 46.73, whereas whale accumulation hints at bullish momentum.

- Large liquidations totaling $389.50M rock the crypto market, with BTC shorts accounting for $82.70M in current value motion.

Trade-leading cryptocurrency Bitcoin

BTC

$94 346

24h volatility:

0.4%

Market cap:

$1.87 T

Vol. 24h:

$57.93 B

printed a large 14 hourly candles consecutively on Friday, the longest streak since 2017, and it appears that evidently whales are actively shopping for the present dip, suggesting a rise in shopping for strain. As Inauguration Day for the pro-crypto administration nears, the digital asset market individuals have their eyes set on BTC’s subsequent transfer.

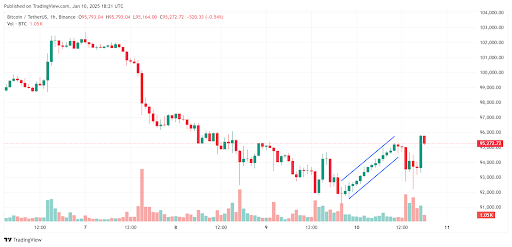

As clear from the chart under supplied by TradingView, the 14 hours had been printed between Jan. 9 at 9 PM GMT and Jan. 10 at 11 AM GMT. This value trajectory of Bitcoin has confused merchants on social media platform X (previously Twitter) as a result of the market-leading cryptocurrency turned bearish in the previous few days, dropping to a low of $91,771 after which rebounding to a each day excessive of $95,770.

A senior analyst at K33 Analysis, Vetle Lunde, talked about this unusual value motion of BTC in an X submit, confirming that that is the longest streak of inexperienced hourly candles that the market chief has printed since January 1, 2017, when it made 11 candles. The crypto group speculated on the opportunity of an institutional purchaser opening a brand new place for BTC.

A Deeper Dive into Bitcoin Worth Motion

In response to CoinMarketCap data, Bitcoin is buying and selling at $95,078 on the time of writing, up 2.52% previously 24 hours. Up to now week, the cryptocurrency has crashed 3.28% whereas plummeting 5.28% within the final 30 days. The digital asset is down 11.74% from its all-time excessive of $108,268 witnessed over 27 days in the past.

The Relative Power Index (RSI) for the Bitcoin value trajectory on the chart under reads a worth of 46.73, which implies that the sellers are dominating. Nonetheless, the gradient of the road means that consumers are giving a pushback and goal to take management. A retest of $100,000 appears probably.

The MACD indicator confirmed a bearish divergence on the each day timeframe for Bitcoin, because the sign line (pink) rose above the MACD line (blue). The MACD histogram has additionally turned pink, however because the traces are very shut, both aspect might achieve a bonus.

Lastly, the data supplied by Coinglass confirms {that a} large $389.50 million was liquidated from the crypto market as Bitcoin unexpectedly broke above the $95,000 value stage, turning the broader market bullish as effectively. Up to now 4 hours, over $128.23 million was liquidated, which incorporates $82.70 million in BTC shorts.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.