- BTC retested range-lows at $91k, earlier than trying a rebound

- XRP, DOGE, and SOL pullbacks eased at ranges, signaling a possible restoration

Bitcoin [BTC] dropped by practically 10% within the final three days, triggering a market-wide sell-off throughout the altcoin sector. BTC’s dominance additionally soared to 58% as traders unwinded their altcoin positions.

Nevertheless, there was non permanent aid on Friday after BTC stabilized above its $91k range-lows. The depreciation of main belongings like XRP, Dogecoin [DOGE], and Solana [SOL] additionally eased at its December demand ranges. So, what’s subsequent for these high altcoins forward of the U.S jobs report?

XRP value prediction – Is a breakout imminent?

XRP held the sell-off higher than any altcoin, indicating a powerful market construction that might supply an upside shock. It solely dropped by 6% and was above the 50-day EMA (transferring common) at press time. A bullish breakout from the triangle sample may drive bulls to $3.4 – A whopping +40% potential achieve.

On the flipside, short-sellers may carry the day if XRP declines beneath $1.8. At press time, the market may go in both route as key technical indicators have been impartial.

Dogecoin value prediction – Is $0.3 the native backside?

The dog-themed memecoin erased a part of its November beneficial properties, however remained above its key multi-month trendline assist.

The assist stopped earlier pullbacks in October, November, and December. Will it maintain regular once more in January? Likely, primarily based on the latest rebound on the trendline. If the restoration extends itself, $0.35 and $0.30 could be the instant bullish targets.

Nevertheless, a breach beneath the trendline assist would invalidate the optimistic outlook. In such a situation, short-sellers may drag DOGE decrease to its $0.27 and $0.21 ranges.

Solana defends demand ranges in December

Solana dumped the toughest in the course of the latest sell-off. It shed over 17% within the final 4 days and fronted a rebound on Friday. At press time, it was up about 4% after tapping a December demand zone above $175.

For the restoration to increase itself, SOL needed to blast above the trendline resistance. If that’s the case, the March highs of $210 and the provision zone at $220 might be reachable. Nevertheless, optimistic prospects might be dimmed if SOL’s drop prolonged beneath the December demand zone.

Learn Solana [SOL] Price Prediction 2025-2026

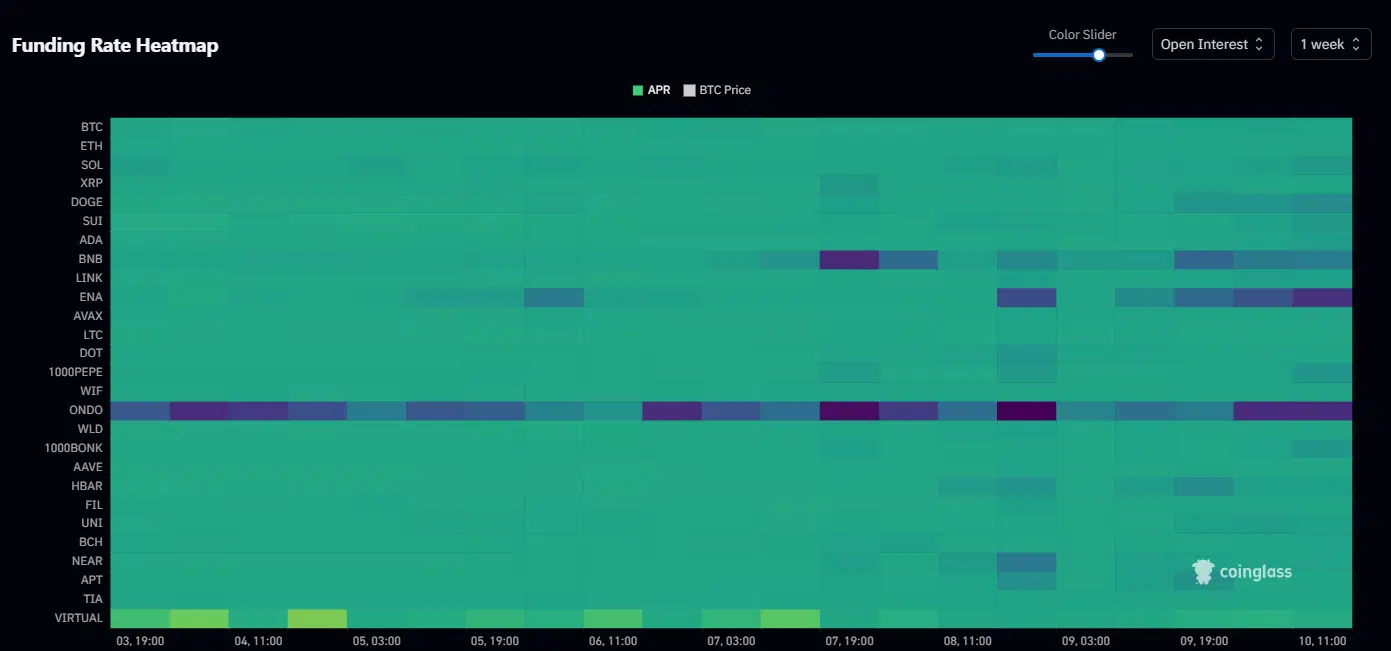

That being mentioned, the sell-off triggered a funding charge reset and a wholesome market situation that might gas the altcoin sector’s rebound. Nevertheless, a sticky BTC dominance may derail the sector’s probabilities of restoration.