- Crypto markets face heightened volatility as $443M in lengthy positions are liquidated following strong U.S. jobs knowledge.

- A robust labor market alerts fewer charge cuts, pressuring Bitcoin, Ethereum, and risk-on belongings.

The crypto market is down on the ninth of January, as a mix of stronger-than-expected U.S. financial knowledge and vital liquidation occasions weigh closely on investor sentiment.

The downturn has impacted main cryptos like Bitcoin[BTC] and Ethereum[ETH], sparking considerations over the market’s potential to maintain its latest momentum.

Stronger-than-expected U.S. jobs knowledge sends shockwaves

On the eighth of January, the U.S. Bureau of Labor Statistics launched the newest Job Openings and Labor Turnover Survey (JOLTS), revealing 8.096 million job openings for November 2024. This determine far exceeded the consensus estimate of seven.605 million, signaling strong labor market demand.

Stronger job openings knowledge recommend the U.S. economic system stays resilient, regardless of considerations about slowing progress. Whereas that is excellent news for the broader economic system, it has vital implications for financial coverage.

A robust labor market reduces the chance of aggressive charge cuts by the Federal Reserve, a situation that sometimes advantages risk-on belongings like cryptocurrencies.

The anticipation of upper rates of interest for an extended interval has prompted many traders to shift away from speculative belongings, contributing to the present downturn within the crypto market.

Liquidations amplify the downturn

Including to the strain, the crypto market skilled its largest liquidation occasion of the yr.

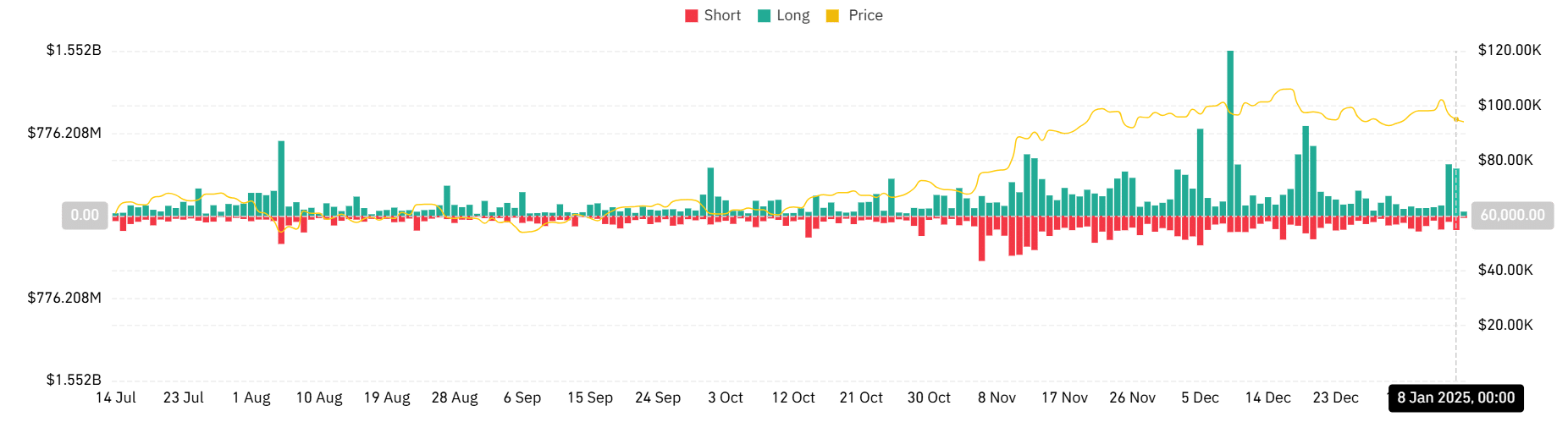

In keeping with the info, lengthy liquidations totaled a staggering $443.023 million, whereas quick liquidations reached $135.539 million during the last 24 hours.

AMBCrypto’s evaluation of the liquidation chart highlights the spikes, with lengthy positions dominating the losses as costs fell sharply. Liquidations of this magnitude point out over-leveraged positions amongst merchants, exacerbating market volatility throughout value declines.

These compelled liquidations have additional fueled downward strain on Bitcoin, Ethereum, and different main cryptos.

The evaluation confirmed that Bitcoin noticed the biggest liquidation, with over $143 million recorded. Ethereum noticed the second-largest liquidation, with over $97 million recorded.

Why the crypto market is down immediately: The broader context

The sell-off comes amid broader financial and geopolitical considerations. A latest decline in tech shares and ongoing uncertainties in international markets have created a difficult surroundings for cryptos.

As central banks preserve a hawkish stance and traders grapple with lowered liquidity, the crypto market stays notably weak to macroeconomic shocks.

Stablecoins have proven relative resilience throughout this era, as evidenced by a slight improve in market share, reflecting a cautious pivot by traders towards safer crypto belongings.

Nonetheless, riskier altcoins have borne the brunt of the downturn, with vital losses throughout the board.

What’s subsequent for crypto markets?

At present’s crypto market decline underscores the sector’s sensitivity to macroeconomic developments.

As traders digest the newest jobs knowledge and its implications for Federal Reserve coverage, consideration will now shift to imminent financial occasions, together with December’s ADP employment report and Friday’s official jobs knowledge.

Market contributors ought to put together for continued volatility because the interaction between macroeconomic knowledge and cryptocurrency dynamics stays dominant.

For now, cautious buying and selling and shut monitoring of worldwide financial circumstances will possible form the market’s subsequent strikes.

- Crypto markets face heightened volatility as $443M in lengthy positions are liquidated following strong U.S. jobs knowledge.

- A robust labor market alerts fewer charge cuts, pressuring Bitcoin, Ethereum, and risk-on belongings.

The crypto market is down on the ninth of January, as a mix of stronger-than-expected U.S. financial knowledge and vital liquidation occasions weigh closely on investor sentiment.

The downturn has impacted main cryptos like Bitcoin[BTC] and Ethereum[ETH], sparking considerations over the market’s potential to maintain its latest momentum.

Stronger-than-expected U.S. jobs knowledge sends shockwaves

On the eighth of January, the U.S. Bureau of Labor Statistics launched the newest Job Openings and Labor Turnover Survey (JOLTS), revealing 8.096 million job openings for November 2024. This determine far exceeded the consensus estimate of seven.605 million, signaling strong labor market demand.

Stronger job openings knowledge recommend the U.S. economic system stays resilient, regardless of considerations about slowing progress. Whereas that is excellent news for the broader economic system, it has vital implications for financial coverage.

A robust labor market reduces the chance of aggressive charge cuts by the Federal Reserve, a situation that sometimes advantages risk-on belongings like cryptocurrencies.

The anticipation of upper rates of interest for an extended interval has prompted many traders to shift away from speculative belongings, contributing to the present downturn within the crypto market.

Liquidations amplify the downturn

Including to the strain, the crypto market skilled its largest liquidation occasion of the yr.

In keeping with the info, lengthy liquidations totaled a staggering $443.023 million, whereas quick liquidations reached $135.539 million during the last 24 hours.

AMBCrypto’s evaluation of the liquidation chart highlights the spikes, with lengthy positions dominating the losses as costs fell sharply. Liquidations of this magnitude point out over-leveraged positions amongst merchants, exacerbating market volatility throughout value declines.

These compelled liquidations have additional fueled downward strain on Bitcoin, Ethereum, and different main cryptos.

The evaluation confirmed that Bitcoin noticed the biggest liquidation, with over $143 million recorded. Ethereum noticed the second-largest liquidation, with over $97 million recorded.

Why the crypto market is down immediately: The broader context

The sell-off comes amid broader financial and geopolitical considerations. A latest decline in tech shares and ongoing uncertainties in international markets have created a difficult surroundings for cryptos.

As central banks preserve a hawkish stance and traders grapple with lowered liquidity, the crypto market stays notably weak to macroeconomic shocks.

Stablecoins have proven relative resilience throughout this era, as evidenced by a slight improve in market share, reflecting a cautious pivot by traders towards safer crypto belongings.

Nonetheless, riskier altcoins have borne the brunt of the downturn, with vital losses throughout the board.

What’s subsequent for crypto markets?

At present’s crypto market decline underscores the sector’s sensitivity to macroeconomic developments.

As traders digest the newest jobs knowledge and its implications for Federal Reserve coverage, consideration will now shift to imminent financial occasions, together with December’s ADP employment report and Friday’s official jobs knowledge.

Market contributors ought to put together for continued volatility because the interaction between macroeconomic knowledge and cryptocurrency dynamics stays dominant.

For now, cautious buying and selling and shut monitoring of worldwide financial circumstances will possible form the market’s subsequent strikes.